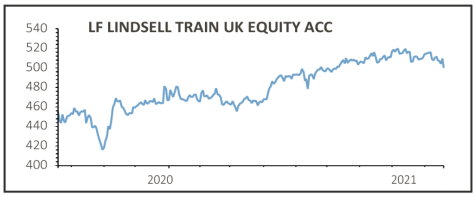

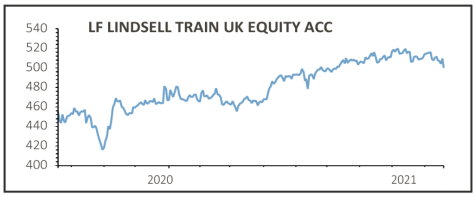

Lindsell Train UK Equity FUND

(B18B9X7) 507.7p

Gain to date: 9.6%

Original entry point: Buy at 463.1p, 4 March 2021

A tilt back towards quality stocks earlier this year as the vaccine-led value rally ran out of steam has supported a recovery for Lindsell Train UK Equity (B18B9X7). However, exposure to a brewing Chinese crisis could make life more difficult for the fund in the coming months.

Longer term we believe the Nick Train-steered collective’s emphasis on quality will pay off for holders of the fund. However, in the short term, big positions in luxury brand Burberry (BRBY) and French spirits group Remy Cointreau could come under pressure given their exposure to China, where sentiment is weakening.

In his latest commentary on the fund Nick Train observed: ‘An important reason for our holdings in Burberry and Remy is that the premium/luxury nature of their products not only allows them to participate in global growth (as they have all this century), but also protects shareholders against the effects of inflation.

‘The brands confer pricing power. Certainly, both companies, particularly Remy, have been able to increase prices in 2021.’

SHARES SAYS: Investors should note the risks associated with China-related exposure and growing market concerns that Chinese consumer spending could disappoint in the near-term. That said, the fund is still a long-term buy for patient individuals.

‹ Previous2021-09-23Next ›

magazine

magazine