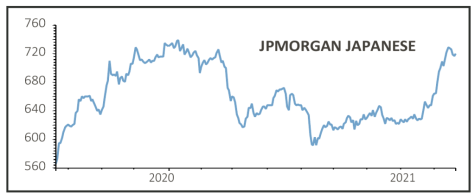

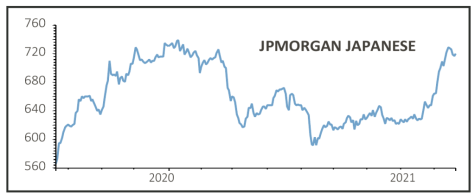

JPMorgan Japanese (JFJ) 723p

Gain to date: 32%

Original entry point: Buy at 547.92p, 2 July 2020

After a patchy start to 2021, this Japanese-focused investment trust is now comfortably in the money as Tokyo shares received a boost from prime minister Yoshihide Suga announcing plans to step down.

Suga’s reputation had been buffeted thanks

to his handling of the pandemic and his decision not to stand in a November general election should increase the chances of his Liberal Democratic party remaining in power, preserving political stability, and of a renewed bout of financial stimulus.

Japanese stocks also benefited from a strong corporate earnings season. In recent commentary from the trust, it noted the longer-term theme

Japanese stocks also benefited from a strong corporate earnings season. In recent commentary from the trust, it noted the longer-term theme

of Japanese businesses becoming more shareholder friendly.

‘The corporate governance story continues to develop, and this increasingly looks structural in nature. It is important to note that over 50% of Japanese companies have net cash positions. This is a significantly higher percentage than companies in Europe and the US,’ it added.

SHARES SAYS: Even after their recent rally the shares still trade at an 8.1% discount to net asset value, providing an attractive way for investors to play Japan. Keep buying the shares.

‹ Previous2021-09-23Next ›

magazine

magazine Japanese stocks also benefited from a strong corporate earnings season. In recent commentary from the trust, it noted the longer-term theme

Japanese stocks also benefited from a strong corporate earnings season. In recent commentary from the trust, it noted the longer-term theme