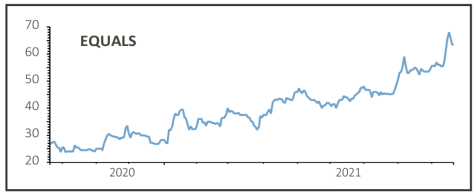

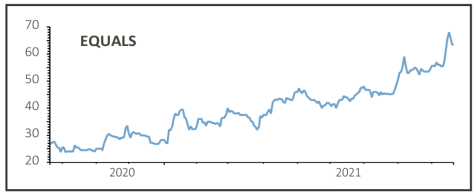

Equals (EQLS:AIM) 63.99p

Gain to date: 48.8%

Original entry point: Buy at 43p, 29 April 2021

Payments group Equals (EQLS:AIM) reported half year numbers that were ahead of analysts’ expectations. Group revenue increased by 23% to £16.9 million. Adjusted EBITDA (earnings before interest, tax, depreciation and amortisation), increased by 128% to £1.6 million.

Third quarter revenue to 10 September was £9.2 million, equating to a 58% increase year-on-year. A key factor behind this outperformance is Equals Solutions, a new multi-currency product aimed at larger corporates. Although the platform was only launched in June it has attracted new customers and has secured a strong pipeline of orders. In Q3, it generated £1.2 million of revenue, 13% of the group total.

Third quarter revenue to 10 September was £9.2 million, equating to a 58% increase year-on-year. A key factor behind this outperformance is Equals Solutions, a new multi-currency product aimed at larger corporates. Although the platform was only launched in June it has attracted new customers and has secured a strong pipeline of orders. In Q3, it generated £1.2 million of revenue, 13% of the group total.

The outlook is robust and will be driven by the confluence of two factors. First, the business-to-business revenue continues to grow as the group’s investment in technology in previous years is now bearing fruit. Second, the easing of travel restrictions will boost the consumer business.

Following the update, Canaccord Genuity says it now expects 2021 revenue to be 6% higher than its previous forecast and 2022 to be 5% higher. ‘Positive operational gearing implies that our earnings per share forecasts are upgraded by 8% in each year,’ it adds.

SHARES SAYS: Keep buying.

‹ Previous2021-09-23Next ›

magazine

magazine Third quarter revenue to 10 September was £9.2 million, equating to a 58% increase year-on-year. A key factor behind this outperformance is Equals Solutions, a new multi-currency product aimed at larger corporates. Although the platform was only launched in June it has attracted new customers and has secured a strong pipeline of orders. In Q3, it generated £1.2 million of revenue, 13% of the group total.

Third quarter revenue to 10 September was £9.2 million, equating to a 58% increase year-on-year. A key factor behind this outperformance is Equals Solutions, a new multi-currency product aimed at larger corporates. Although the platform was only launched in June it has attracted new customers and has secured a strong pipeline of orders. In Q3, it generated £1.2 million of revenue, 13% of the group total.