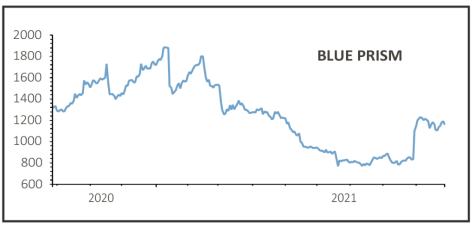

Blue Prism (PRSM:AIM) £11.70

Gain to date: 50.3%

Original entry point: Buy at 778.5p, 15 July 2021

Investors may be disappointed by the takeover terms for robotic process automation firm Blue Prism (PRSM:AIM).

The £1.1 billion deal agreed with Vista Equity Partners fell short hoped for levels and saw the shares dip on the news.

While the £11.25 per share offer was pitched at a 35% premium to the price before Blue Prism revealed it had entered into talks with Vista and its rival bidder TPG Capital in August, the market was clearly expecting in a higher offer.

The company appears to be trying to win investors over to the merits of the deal by painting a reasonably bleak picture of its immediate prospects.

Blue Prism cited several operational and organisational headwinds and the difficulty in searching for a new chief executive as it responds to shareholder pressure to split the combined chairman and CEO hat currently worn by Jason Kingdon.

Based on the pattern of other recent takeover situations it would not be a surprise to see a higher bid surface, as the business has attractive growth prospects despite some near-term challenges.

SHARES SAYS: Anyone owning the shares should sit tight for now and see how the situation plays out.

‹ Previous2021-09-30Next ›

magazine

magazine