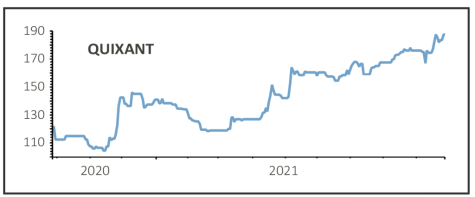

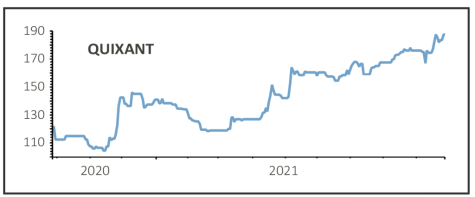

Quixant (QXT:AIM) 190p

Gain to date: 9.2%

Original entry point: Buy at 174p, 19 August 2021

Gambling tech firm Quixant (QXT:AIM) provided continued evidence of its recovery from the pandemic as casinos and slot machines began to be used more widely again.

The developer of logic boxes which control pay-to-play digital gaming machines saw pre-tax profit for the six months to 30 June of $800,000, compared to losses a year earlier of $3 million.

Revenue rose 31% to $36.5 million and included a 55% improvement in the company’s gaming division.

‘Component shortages and price inflation remain a challenge and we do not anticipate significant improvement in the short term,’ says chief executive Jon Jayal.

‘While our customers have been accepting of essential price rises, nonetheless we expect a period of continued margin volatility. However, our strong cash position and good relationship with suppliers, built up over many years, help to mitigate the impact.’

FinnCap analyst Lorne Daniel comments: ‘We feel these results signpost the end of a difficult two years for the group.

‘We now look forward to a return to sustained growth and profitability for a very high-quality, well managed business.’

SHARES SAYS: More to come. Keep buying.

‹ Previous2021-09-30Next ›

magazine

magazine