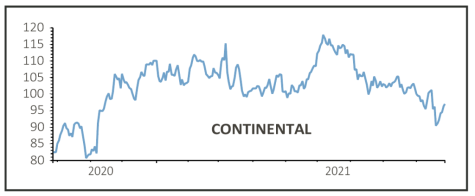

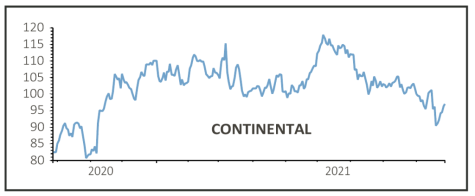

Continental €96.40

Loss to date: 17% (adjusted for Vitesco spin off)

Original entry point: Buy at €130, 10 June 2021

At first glance our call on Continental looks to have been a shocker as the shares are trading below €100 against an entry price of €130.

However, that fails to take account of the spin-off of the Vitesco power train unit earlier this month. Shareholders in Continental received one Vitesco share per five shares in the parent company.

With Vitesco shares trading at €56.80, the effective position for Continental investors is actually €107.80 (96.4+(56.8 x 0.2)) or a loss of 17% since early June.

This is due to well-documented challenges for car parts makers such as supply chain bottlenecks and a global shortage of computer chips.

However, Continental shares actually gained 2% on the day that French rival Faurecia lowered its earnings forecast for this year, suggesting investors are ready to put the current disruption in the rear view mirror and focus instead on the bright future for electric vehicles, where the company is a leading global player.

The firm recently reported its autonomous driving order pipeline had risen to €70 billion from 2022 to 2024. The company also said carmakers were increasingly demanding integrated software and services on top of their component needs, helping to drive up profit margins.

SHARES SAYS: We remain buyers.

CORRECTION: The original version of this story contained an error, saying shareholders received one share in Vitesco for each Continental share held. The ratio should have read 1:5.

‹ Previous2021-09-30Next ›

magazine

magazine