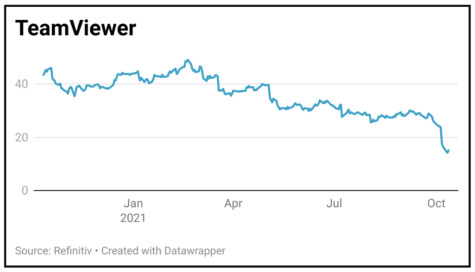

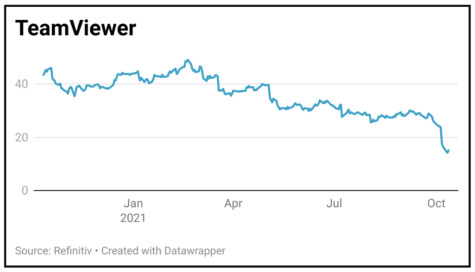

Teamviewer (TMV:XETRA) €15.20

Loss to date: 59.3%

Original entry point: Buy at €37.38, 8 April 2021

After a hugely successful 2019 listing in Germany and months of bullish growth projections, the TeamViewer reality check arrived last week.

In what the company admitted were ‘very bad’ and ‘very disappointing’ results, management cut this year’s sales and profit guidance and scaled back ambitious medium-term financial goals, warning various headwinds were likely to be ‘persistent rather than temporary’.

The share price plunged, losing 40% in just a few days and extending a 2021 decline to 69% since this year’s February €49.13 peak.

TeamViewer saw a huge increase in demand for its remote connectivity software through 2020 as many corporate clients were forced to ask their staff to work from home. Unfortunately, fewer than expected customers have renewed their contracts.

Investors might well wonder if management had their priorities right, announcing high profile sponsorship deals with Manchester United and the Mercedes Formula 1 and Formula E racing units while financial performance was under-shooting promises so badly.

SHARES SAYS: Very disappointing results full of bad news. It’s hard to always win with investing and this is an example where we didn’t get it right. Cut your losses and walk away.

‹ Previous2021-10-14Next ›

magazine

magazine