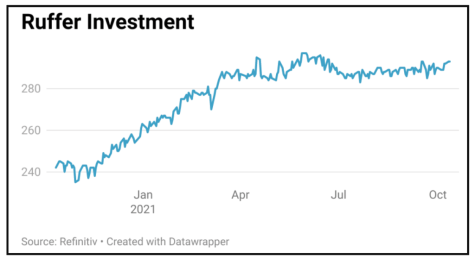

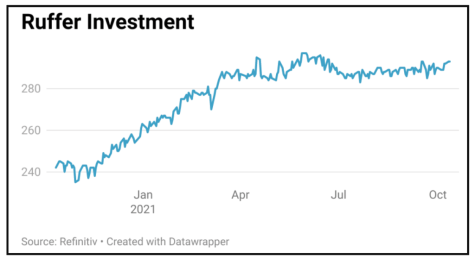

RUFFER INVESTMENT COMPANY (RICA) 293p

Gain to date: 2%

Original entry point: Buy at 287.25p, 8 July 2021

Our bullish call on capital preservation trust Ruffer (RICA) is modestly in the money. Yet with inflationary pressures escalating, we’re more convinced than ever this is the right time to hold this multi-asset portfolio built to protect against inflation and financial repression, where saving rates are much lower than inflation.

Ruffer focuses on preserving and growing real – i.e. inflation adjusted – capital, regardless of financial market conditions and has a proven track record of making money in up and down markets.

A portfolio of assets spanning shares, inflation-linked bonds, gold and credit protection leaves Ruffer well-equipped to deal with the increasing inflation and economic and market volatility ahead.

During September, Ruffer’s share price rose by 0.2% and NAV edged ahead by 0.9%, which compared with a 1% decline for the FTSE All-Share index. Holdings in inflation-linked bonds and other less conventional protections did their job, enabling Ruffer to deliver a robust performance in the face of falling bond and equity markets.

SHARES SAYS: Keep buying Ruffer to protect against inflation and for rising dividends.

‹ Previous2021-10-14Next ›

magazine

magazine