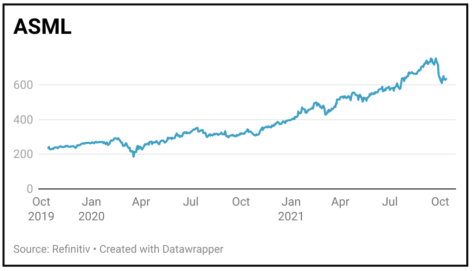

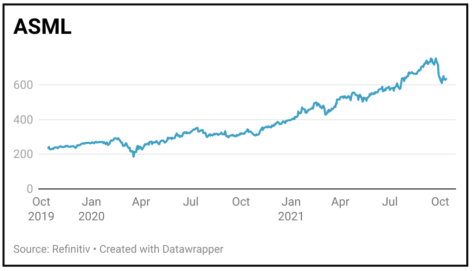

ASML (ASML:AMS) €634.90

Gain to date: 139.9%

Original entry point: Buy at €264.60, 23 April 2020

Regulators might not like them but investors love a monopoly and Dutch microchip tech firm ASML remains the only company in the world with the extreme ultraviolet lithography machines that chip giants like TSMC, Intel and Samsung need to make the smallest and most sophisticated microprocessors.

In the 18 months since we said to buy the stock has more than doubled. Experts believe substantially more value will be created for investors over the next year or two.

Last month the €262 billion business raised forecasts and said it can see revenue growth of around 11% annually through to 2030 amid booming demand for its products.

That would imply nearly €30 billion of sales, having done €14 billion revenue last year. Gross margins will climb from 46% to 55% this decade, the company believes.

According to Morningstar data, a £10,000 investment five years ago would today be worth close to £65,000. That shows the exceptional value-creation capability of the stock and why we firmly see ASML as a core holding for investors.

SHARES SAYS: ASML remains a great long-run value creator. Keep buying the shares.

‹ Previous2021-10-14Next ›

magazine

magazine