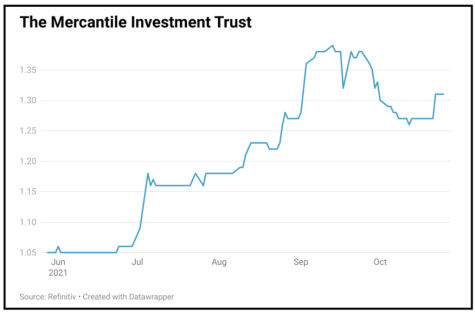

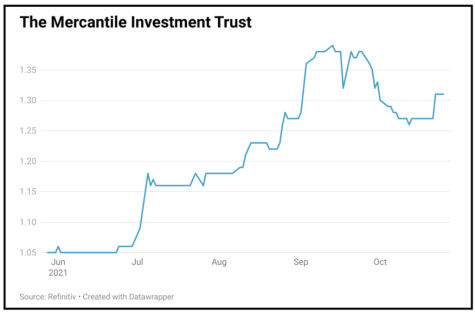

THE MERCANTILE INVESTMENT TRUST (MRC) 261.5p

Gain to date: 44.4%

Original entry point: Buy at 181.1p, 17 September 2020

Our buy call on investment trust Mercantile (MRC) is 44.4% in the money and we are pleased to note a benchmark-beating first half performance (15 Oct) from the small and mid cap-focused fund.

Focused on finding ‘tomorrow’s UK market leaders’, Mercantile’s tried-and-tested strategy paid off in the six months to July 2021, with the trust generating a net asset value total return of 25.3%.

That was comfortably ahead of the 18.1% produced by the benchmark FTSE All-Share (ex FTSE 100, ex Inv Companies) index, thanks to stellar share price performances from the likes of luxury watch retailer Watches of Switzerland (WOSG) and media group Future (FUTR).

The positive outlook of fund managers Guy Anderson and Anthony Lynch is reflected in the trust’s 10% gearing, with portfolio companies for the most part either continuing to perform strongly or recovering well from the Covid crisis.

Mercantile also said it plans to at least maintain the full year dividend at 6.7p by dipping into its revenue reserves, ‘but to a lesser extent than required for 2021’, with investee companies beginning to increase and restore pay-outs.

SHARES SAYS: Keep buying at 261.5p.

‹ Previous2021-10-28Next ›

magazine

magazine