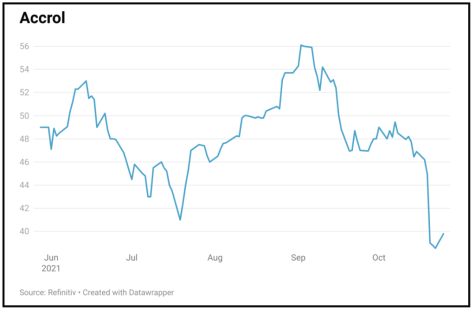

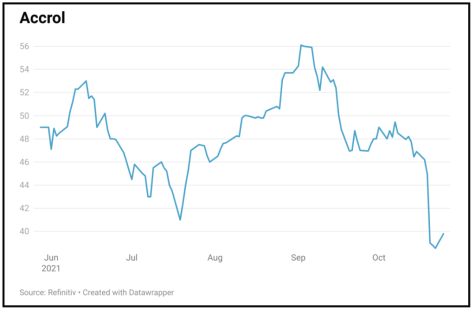

Loss to date: 25.6%

Original entry point: Buy at 50.8p, 26 August 2021

Our buy call on Accrol (ACRL:AIM) is 25.6% underwater following a profit warning (20 Oct 2021) from the toilet roll, tissue and kitchen roll maker.

Yet we’re minded to stay positive on the private label manufacturer, since the business is being buffeted by external factors rather than internal issues. Accrol has been transformed by chief executive Gareth Jenkins and has exciting longer-term growth potential, supported by the expansion of the major discounters.

Earnings for the year to next April will be lower than previously expected due to a time lag in passing on increased supply chain costs to customers. The HGV driver shortage, rising raw material prices and a slower than expected recovery in footfall for discounters have conspired to constrain Accrol’s sales and profit growth.

While forecasts have been downgraded, Accrol still expects to deliver revenue growth of 25% and a 20% improvement in adjusted EBITDA this year. And the company, which sells non-discretionary products, remains well placed to benefit from a recovery in tissue volumes as the effects of the pandemic unwind.

SHARES SAYS: Accrol’s profit warning is unfortunate, but we think the shares are oversold. Still a buy.

‹ Previous2021-10-28Next ›

magazine

magazine