The Indian economy is one of the economic success stories of the last 50 years with its economy, despite a pandemic-led wobble, increasing in size 12-fold over the last five decades.

This is underpinned by favourable demographics with a study recently published in Lancet suggesting the country will have the world’s largest working age population by 2100.

In the last two decades economic growth has been mirrored in the expansion of India’s stock market with the market capitalisation of all Indian domestic companies going from $225 billion in 2000 to more than $2.5 trillion in 2020 according to data from the World Bank.

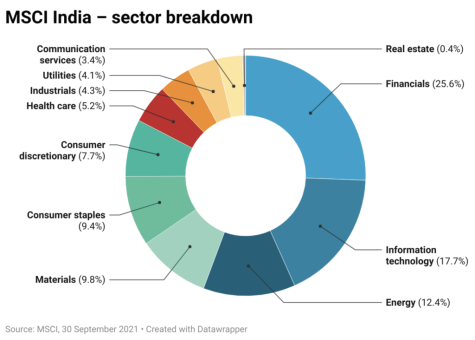

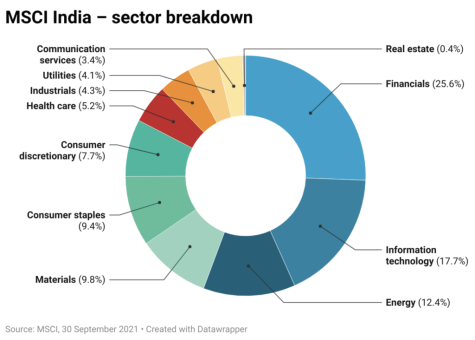

But what makes up the Indian market and how has it changed over time? Looking at the MSCI India index which is set up to capture the performance of India’s largest companies, there is a reasonable amount of diversification.

The financials sector dominates but like any number of emerging markets, innovation plays an increasing role with information technology coming up on the rails.

India’s largest companies tend to be older than those in other emerging markets like China suggesting there is scope for a wave of new innovative businesses to emerge in the world’s largest democracy.

Reliance Industries, a conglomerate business of the type which is less common in the West but still a major factor in emerging markets, is the largest single company in the MSCI India index with business interests which span everything from energy to telecoms and retail.

This outlook is part of a series being sponsored by Templeton Emerging Markets Investment Trust. For more information on the trust, visit here

‹ Previous2021-10-28Next ›

magazine

magazine