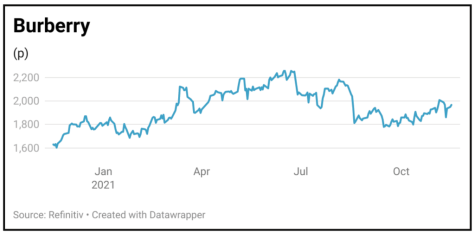

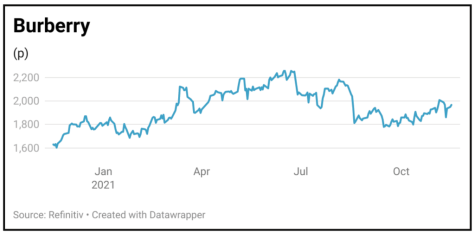

BURBERRY (BRBY) £19.65

Gain to date: 20.3%

Original entry point: Buy at £16.34, 19 Nov 2020

Our buy call on Burberry (BRBY) is 20.3% in the money, although shares in the British luxury brand took a tumble on first half results (11 Nov).

The leather goods, jackets and shoes seller reinstated the interim dividend at 11.6p after reporting a jump in pre-tax profits as sales returned to pre-pandemic levels. Burberry said full-price sales are growing at a double-digit percentage rate, driving margin expansion and strong free cash generation.

Yet while the Americas, China and South Korea delivered strong double-digit growth versus the comparable pre-Covid period, reduced tourist levels are weighing on the EMEIA (Europe, Middle East, India and Africa) region. Ongoing travel restrictions are limiting tourist flows, although this headwind could pass as restrictions are relaxed and assuming well-heeled Asian tourists return to Europe in numbers.

Encouragingly, Burberry is seeing an acceleration in performance in countries less impacted by travel restrictions and remains comfortable with current year market expectations. Medium-term guidance for high single-digit top line growth and ‘meaningful margin accretion’ remains intact too.

The pricing power conferred by its strong brand means the company can contend with inflationary pressures.

SHARES SAYS: Burberry is still a buy.

‹ Previous2021-11-18Next ›

magazine

magazine