Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Investors celebrate Diageo’s ambitious growth targets

Shares in drinks-maker Diageo (DGE) hit a new all-time high of £39.48 this week after the firm released an ambitious set of sales targets reaching from the current financial year out to 2030.

Chief executive Ivan Menezes said: ‘We believe our sales growth trajectory has accelerated, underpinned by the strength of our advantaged position across geographies, categories and price tiers,’ adding he still saw ‘significant headroom for growth’.

SETTING THE BAR HIGH

For the first half of the current financial year, which began in June, the Johnnie Walker scotch to Tanqueray gin producer is now targeting organic net sales growth of at least 16% and even faster organic operating profit growth.

In the medium term, that is from June 2022 to June 2025, the firm expects organic net sales growth to moderate to a range of between 5% and 7%, with organic operating profit growth expected to be between 6% and 9% per year.

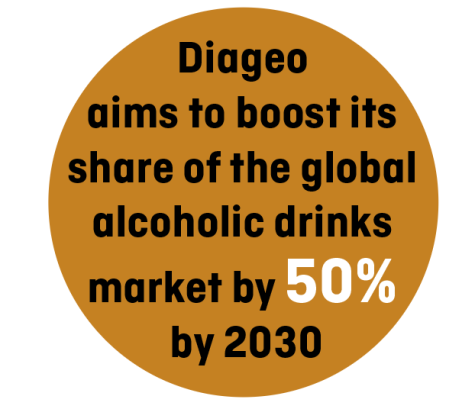

Looking further out, the firm wants to raise its share of the global alcoholic beverage market from 4% in 2020 to 6% by 2030, in other words a 50% increase.

Nick Train, manager of the Finsbury Growth & Income Trust (FGT), is a long-term supporter of the firm, which is the top holding in the trust.

‘We want more luxury, more premium, more pricing power in the portfolio. With each passing year, more of Diageo’s growth and value is accounted for by its super-premium and premium brands,’ says Train.

GOING OUT IS IN AGAIN

As well as a resilient off-trade, Diageo has benefitted increasingly from the recovery in the on-trade as pubs and bars have reopened.

Despite the challenges with getting staff, the hospitality industry is back to pre-pandemic levels of activity in many areas as people revert to spending on ‘experiences’ instead of ‘stuff’, as they did during lockdown.

Pub group Young & Co’s (YNGA:AIM) almost trebled its turnover in the six months to September thanks to summer cocktails, Sunday roasts and its new Burger Shack menu which have drawn in more customers.

Café-bar operator Loungers (LGRS:AIM) enjoyed like for like sales 26% higher than pre-pandemic levels from mid-May to the start of October, while restaurant, pub and leisure firm Restaurant Group (RTN) has just raised its full year earnings forecast this year thanks to better than expected trading since its half-year results.

There have also been positive updates from leisure operators Brighton Pier (PIER:AIM) and Hollywood Bowl (BOWL), and restaurant groups Fulham Shore (FUL:AIM) and Various Eateries (VARE:AIM).

Disclaimer: The author owns shares in Finsbury Growth & Income Trust.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine