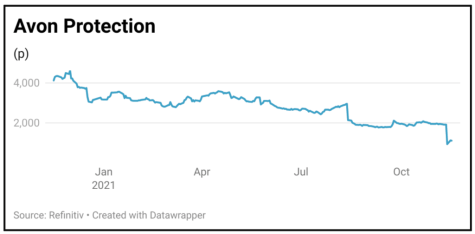

Avon Protection (AVON) £11.15

Loss to date: 59%

Original entry point: Buy at £26.94, 29 July 2021

The latest warning from protective equipment firm Avon Protection (AVON) leaves us with egg on our faces having made the initial buy call in July and then doubled down in August when the company delivered its first revenue warning.

Things got even worse on 12 November as Avon revealed new delays on orders for its body armour business and announced a strategic review of the division.

The statement hinted at big impairments to results for the 12 months to 30 September 2021, which will now be announced in early December rather than the scheduled 23 November. Body armour revenue for the September 2022 financial year is expected be well below the previously guided $40 million.

Investment bank Jefferies estimates that body armour accounts for around 15% of group sales and suggested up to 10%-to-15% of its forecast group earnings could be at risk in the September 2022 and September 2023 financial years.

This is the latest in a series of setbacks which have seen the shares retreat to less than a quarter of the record highs achieved in October 2020.

SHARES SAYS: We’re ducking out given that management’s credibility is shot, there could be a potential material change in the business, and the risk it makes expensive acquisitions to revive growth.

‹ Previous2021-11-18Next ›

magazine

magazine