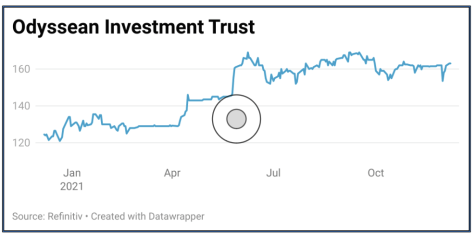

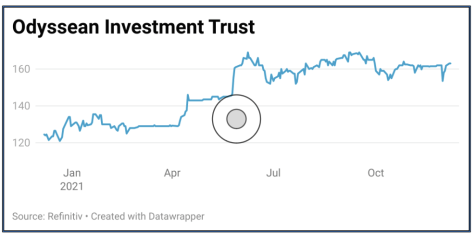

ODYSSEAN INVESTMENT TRUST (OIT) 156.5p

Gain to date: 60.5%

Original entry point: Buy at 97.5p, 10 September 2020

A takeover approach for Clinigen (CLIN:AIM) provides another boost for shareholder Odyssean Investment Trust (OIT) and extends the trust’s formidable run of selecting takeover targets.

Having attracted the attentions of activist Elliott, shares in specialist pharmaceutical products and services group Clinigen spiked on news (2 Dec) it is in talks with Triton Investment Management over a possible offer. It becomes the seventh company in Odyssean’s portfolio to receive a bid since November 2019.

Running a concentrated portfolio of smaller companies, Odyssean’s managers Stuart Widdowson and Ed Wielechowski have proven expertise in picking companies that could prove attractive to private equity or strategic trade buyers.

Results for the six months to September 2021 revealed a 13.5% rise in Odyssean’s net asset value per share, exceeding the 9.1% increase for the MSCI ex IT plus AIM Total Return index.

‘More impressively,’ explained chairman Jane Tufnell, ‘this performance has been delivered with an average net cash position in the portfolio of 22%, demonstrating the underlying strength of the performance of the portfolio companies.’

SHARES SAYS: Odyssean Investment Trust remains a buy.

‹ Previous2021-12-09Next ›

magazine

magazine