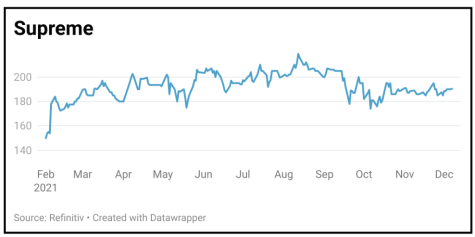

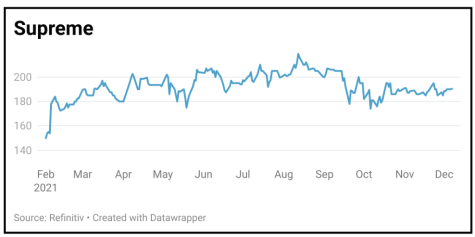

SUPREME (SUP:AIM) 200p

Gain to date: 6.7%

Original entry point: Buy at 187.5p, 27 May 2021

Our ‘buy’ call on Supreme (SUP:AIM) is 6.7% in the money and we remain enthused by the fast-moving consumer products maker’s growth and income potential.

Strong first half results (7 Dec) demonstrated the resilience of the batteries, vaping and vitamins specialist, with sales up by 9% to £61.1 million and pre-tax profit powering 25% higher to £8.5 million, driven by organic growth, acquisitions and new product launches; cash-generative Supreme also declared a maiden dividend of 2.2p per share.

Gross margin improved from 25% to 30%, driven in large part by faster growth in higher-margin vaping and sports nutrition categories, which the group mostly manufactures itself.

Encouragingly, Supreme expects adjusted EBITDA for the year to March 2022 will be ‘at least in line’ with market expectations following a good start to the second half and has ‘consciously invested in additional stock of key lines and raw materials’ to provide shelter from any near-term supply chain disruption.

Following the results, Berenberg noted that NHS prescriptions will be positive for its vaping business and the sports nutrition and wellness division is ‘growing nicely’.

SHARES SAYS: Keep buying at 200p.

‹ Previous2021-12-09Next ›

magazine

magazine