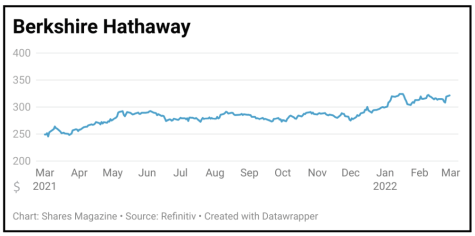

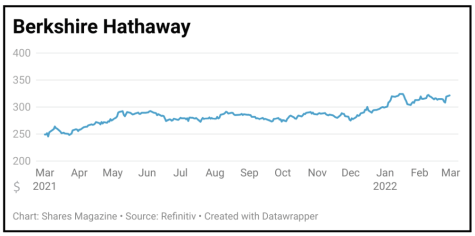

Berkshire Hathaway $321.75

Gain to date: 0.5%

Our recent recommendation to buy B shares in Berkshire Hathaway is reinforced by strong fourth quarter results.

The company’s annual report (26 Feb) revealed quarterly earnings of almost $40 billion, a rise of 11% versus the same quarter in 2020.

Operating earnings, which are a better reflection of the firm’s earnings power, increased by 45% versus 2020.

The key contributors to this robust performance included the BNSF Railway business and the plethora of electric companies within the portfolio.

In his annual letter Warren Buffett emphasised the paucity of attractive investments, highlighting that a period of low interest rates had resulted in inflated valuations.

This explains the recent decision to increase share buybacks. Berkshire bought back $6.9 billion of stock in the fourth quarter bringing the year to date total to $27.1 billion.

The magnitude of the share repurchases also underscores Buffett’s claim that he and Charlie Munger are having little success in finding alternative investment opportunities with a more attractive risk/reward profile.

SHARES SAYS: This is an investment offering attractive defensive qualities and plenty of diversification, reflected in its resilient performance during recent market weakness.

‹ Previous2022-03-03Next ›

magazine

magazine