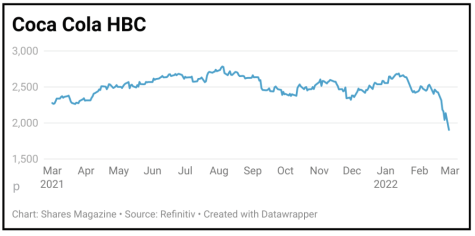

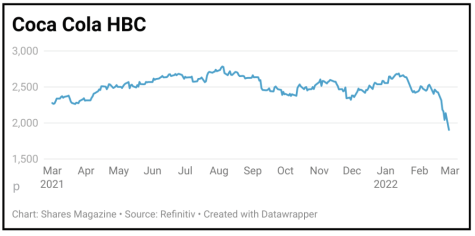

COCA-COLA HBC (CCH) £18.19

Loss to date: 22.2%

Shares in Coca-Cola HBC (CCH) have slumped in recent weeks as investors absorb the negative earnings implications of the Coca-Cola bottling partner’s significant exposure to Russia and Ukraine, which combined spoke for 36.2% of the soft drinks group’s emerging markets volumes in 2021.

Even though this high-quality beverages play is a global reopening beneficiary, recently delivered (22 Feb) forecast-beating earnings for 2021 and raised its dividend payout ratio target from 35%-to-45% to 40%-to-50%, we are exiting the position at a loss for three key reasons.

Firstly, the unfolding tragedy in Ukraine means Coca-Cola HBC will experience major disruption and a weakening of consumer confidence across its key Eastern and Central European markets. The situation on the ground will halt the recent positive momentum in its Russia and Ukraine business and, along with a currency headwind from the collapsing Russian rouble, is likely to result in material downgrades to earnings forecast over the coming months.

Secondly, sentiment towards companies with exposure to the embattled region is set to remain poor and thirdly, we would now expect big institutional investors to begin selling down positions in Coca-Cola HBC, thus exerting further downwards pressure on the share price.

SHARES SAYS: Risks to earnings are rising. Sell Coca-Cola HBC.

‹ Previous2022-03-03Next ›

magazine

magazine