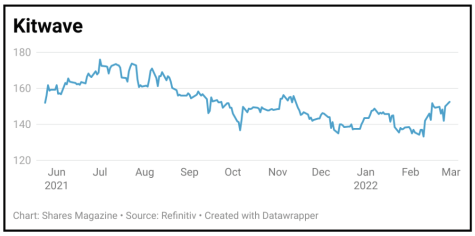

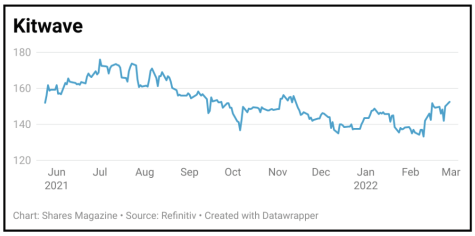

Gain to date: 3.7%

Our ‘buy’ call on Kitwave (KITW:AIM) is now 3.7% in the money as the market responds to earnings upgrades from the food and drink wholesaler and we remain positive about the company’s organic and acquisitive growth prospects in the UK’s fragmented grocery and foodservice wholesale market.

Kitwave says current trading is slightly ahead of market expectations.

Revenue recovered strongly in the second half of the last financial year as Covid restrictions eased, enabling Kitwave to generate earnings of £15.1 million on turnover of £380.7 million. The company has navigated the pandemic, and supply chain and product availability issues, thanks to its in-house delivery fleet and strong relationships with suppliers.

With trading virtually back at pre-pandemic levels, Canaccord upgraded its 2022 revenue estimate by 2% to £462.5 million and its adjusted earnings estimate by 7% to £24.3m, implying growth of 61.7% year-on-year.

Kitwave trades on a price to earnings ratio of 9.9 with a 4.5% yield.

SHARES SAYS: Kitwave has plenty of room to grow as well as significant re-rating potential.

‹ Previous2022-03-03Next ›

magazine

magazine