Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

2023 stock pick: ASML is set for bumper revenue and earnings growth

According to trade data specialist OEC, semiconductors were the number one globally-traded product in 2020 with a 15% share of total goods by value at $1.7 trillion, computers were 12%, oil was 9% and cars accounted for 4%.

What drives this global trade in chips is the fact the world is becoming ever more connected, from the phones in our pockets to the cars we drive and the data centres storing all our files in the cloud.

Industry body SEMI estimates spending on chip-making equipment will hit a new record of $108 billion in 2022, while between 2021 and the end of 2023 overall spending on new chip-making facilities will top $500 billion.

ASML’s world-leading EUV (extreme ultraviolet) machines use lasers to vaporise molten tin droplets into plasma, emitting extreme ultraviolet radiation which is focused into a beam and bounced through a series of mirrors so smooth that if they were the size of UK they wouldn’t have a bump larger than one millimetre.

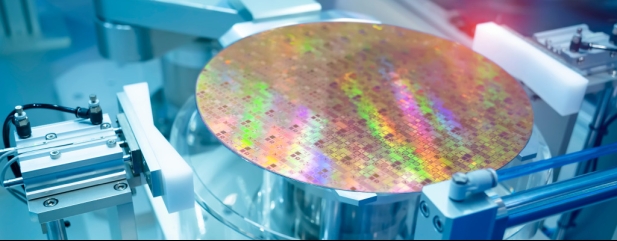

This beam hits a silicon wafer, drawing into it transistors with features measuring less than five nanometers or the length your fingernail grows in five seconds. This wafer, with billions or trillions of transistors, is then made into computer chips.

During the 21st century to date Amsterdam-headquartered ASML (ASML:AMS) has emerged as Europe’s largest semiconductor equipment maker.

The company has grown its earnings per share at an average rate of more than 25% per year for the past 18 years thanks to strong sales growth and rising profits margins as it sells more high value-added EUV machines.

While this is astonishing enough, the company says it sees a ‘substantial growth opportunity’ over the rest of this decade with annual sales reaching between €30 billion and €40 billion by 2025 and the gross margin rising to between 54% and 56%. By comparison, 2022 sales are estimated to be €21 billion with a 53% gross margin.

For 2030 the firm expects sales of between €44 billion and €60 billion with a gross margin between 56% and 60%.

In other words, sales could double from their 2021 level in the next three years and treble in the next eight years, with earnings growing even faster as margins continue to expand.

This means ASML will generate vast amounts of surplus cash which it can return to shareholders, and it announced a €12 billion buyback programme starting in November 2022.

And yet the shares, thanks to a market-wide shift in sentiment against growth stocks and short-term issues in the chip industry, have endured a tough 12 months. This has created what we believe is an outstanding opportunity to invest in a superb business.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Feature

- Cerillion’s share price is up 729% in five years: here’s why

- Tate & Lyle, London Stock Exchange and Jet2 shine in our 2022 stock picks

- How it went wrong for Amazon and what comes next

- Greggs: we reveal the secrets of its success and plans for the future

- The story behind the month’s big earnings upgrades

- The reasons why fund managers changed their mind on certain stocks in 2022

- Emerging markets: Views from the experts

- Revealed: the best and worst performing emerging markets in 2022

Great Ideas

- 2023 stock pick: JD Sports Fashion – a great business at the wrong price

- 2023 stock pick: Apple’s shares have become cheaper and it remains a cash-generating giant

- 2023 stock pick: GSK is cheap versus peers and is finally going places

- 2023 stock pick: It could be gold’s year and miner Shanta is a great way to play it

- 2023 stock pick: Premier Foods is looking tasty thanks to booming cake and sauce sales

- 2023 stock pick: Compass is an outsourcing winner with underappreciated growth potential

- 2023 stock pick: ME Group is a resilient, high quality business

- 2023 stock pick: Prudential could be the low-risk way to play China’s reopening

- 2023 stock pick: Walt Disney is ready for a big comeback under Bob Iger

- 2023 stock pick: ASML is set for bumper revenue and earnings growth

News

- Luxury firm Lanvin looks unloved as shares fall 28.5% following market debut

- Ukraine and rates: why the market’s two big bugbears are not going anywhere

- Why Marlowe shares have collapsed despite strong half-year results

- Why Victorian Plumbing shares have rallied 120% in three months

- Could the tobacco industry become extinct after radical new legislation?

- Games Workshop shares hit 11-month high on Amazon licensing deal

magazine

magazine