Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Could higher taxes derail the share buyback gravy train?

Announcing a new share buyback programme has been one way to trigger a share price boost. The ease at which companies have made such capital allocation decisions has naturally caught the attention of politicians, thus buybacks are increasingly a target for tax collectors.

Joe Biden has already pushed through a 1% tax on buybacks in the US and wants to raise that level to 4% if he gets a second term as US president. That has UK politicians thinking along the same lines, particularly as it is one way to boost the public purse.

Raising tax can be emotive issue with the general public but the nation is unlikely to shed a collective tear if companies on the UK stock market must cough up a bit more money to the government.

The Liberal Democrat Party has called for 4% tax on share buybacks by FTSE 100 companies. While the general election polls do not suggest the Lib Dems have a chance of getting into Number 10 on 4 July, the mere idea might plant the seed for whoever does form the next government to follow suit. Indeed, while there was no mention of buyback taxes in either the Conservative or Labour election manifestos, one cannot rule it out.

The next prime minister and chancellor might want to give this serious thought, particularly as there is a clear need to improve the country’s finances. This looks like an easy win and whoever is victorious at the general election will need to scoop up the low hanging fruit from a tax perspective as quickly as they can.

The FTSE 100’s members returned £58.2 billion to their shareholders through buybacks in 2022 and £52.6 billion in 2023. With £36.7 billion worth of FTSE 100 buybacks already announced in 2024, it looks like another bumper year. The next government could raise £1.5 billion on buybacks purely based on the amount declared year-to-date, so it is a meaningful source of tax.

WHY COMPANIES BUY BACK SHARES

Share buybacks are one way for a company to deploy surplus cash. Companies often refer to buybacks as a way of returning cash to shareholders but they are not physically paying money to investors in the same way as dividends.

They buy the shares in the market – certain companies keep them in treasury for share-based payments to staff, but most cancel the shares. The latter reduces the number of shares in issue which increases the earnings per share. That in turn can improve the market value of a company.

While this is straightforward to understand, it is important to question if there is a better use for the spare cash. Businesses should constantly reinvest money so they can stay ahead of the competition. That does not mean back-to-back acquisitions, it is about allocating capital sensibly and strategically.

Splashing the cash on buybacks might please investors near-term, but this action might be to the detriment of the business longer term. It is like gorging on chocolate – an instant sugar high but with regret later on.

Sometimes buybacks are a way of deploying unusually elevated levels of surplus cash alongside special dividends, principally from asset disposals. For example, HSBC (HSBA) and Vodafone (VOD) are going down that route after selling parts of their business.

Others might splash cash they could use in a better way elsewhere. For example, pharmaceutical group Merck (MRK:NYSE) unveiled a $10 billion buyback programme in 2000, despite its pipeline of new treatments looking slim and important patents approaching their expiration date which means rivals could launch generic copycat versions. As one analyst said at the time, ‘$10 billion would have funded a lot of research and development.’

MORE TAX ON BUYBACKS = MONEY REDIRECTED TO DIVIDENDS?

Joe Biden’s decision to impose a 1% tax on buybacks in 2022 started the debate over whether the share buyback trend would lose momentum. This does not appear to have happened.

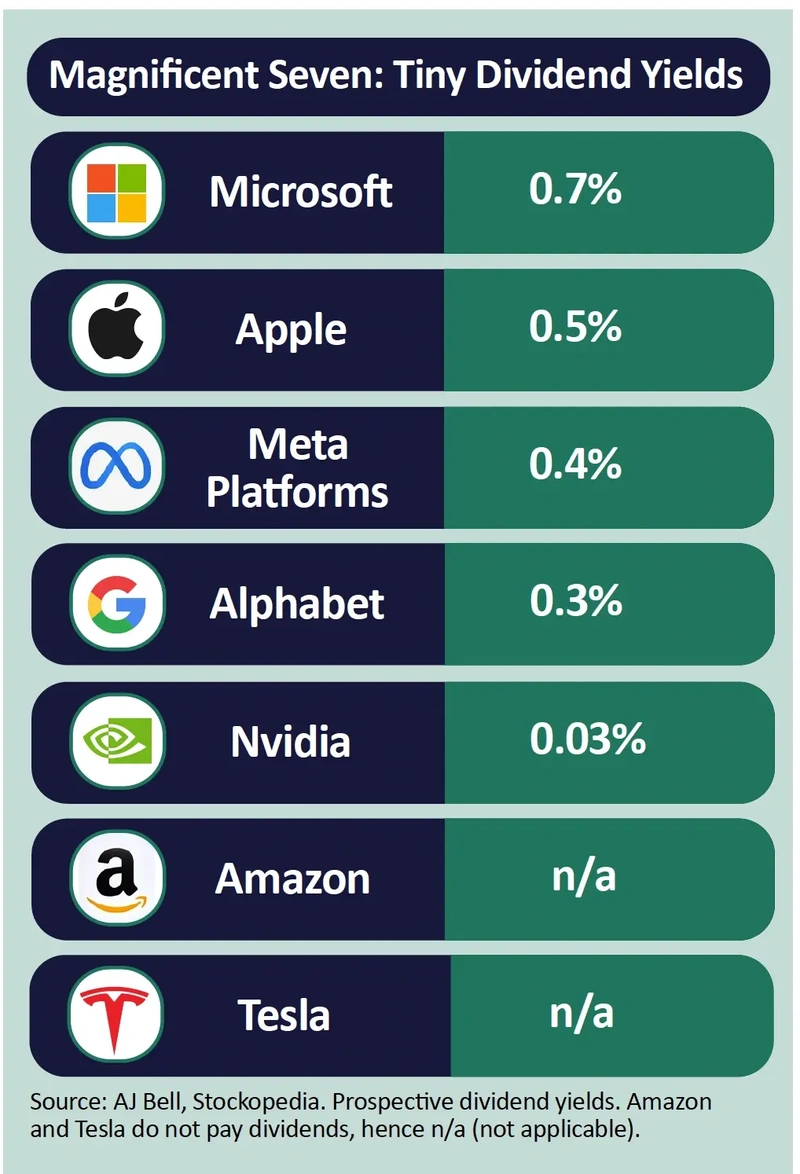

Big technology companies might have become more generous with dividends, but most dividends from these types of companies are token payments and sit second place to share buybacks. You are certainly not going to see any of the Magnificent Seven group of companies show up on a filter of high-yielding stocks. The most generous dividends come from Microsoft (MSFT:NASDAQ) and its prospective yield is a meagre 0.7%.

At its currently stands, share buybacks look like they are staying on the menu, despite the prospect of greater tax rates. Investors certainly welcome this strategy.

Just look at how Apple’s (AAPL:NASDAQ) shares jumped 6% after unveiling a $110 billion share buyback at the start of May, the largest buyback programme in US corporate history.

The electronics giant has come under fire in recent years for sluggish performance as iPhone sales struggle in China and a perceived lack of new, innovative product launches. Yet the buyback was enough to win back the market’s favour.

DO BUYBACKS TRANSLATE INTO SHARE PRICE GAINS?

To answer this question, it is worth looking at the world of ETFs (exchange-traded funds). There are ETFs everything imaginable these days and investors can tap into them to find investments relevant to certain themes.

Amundi and Invesco are among those offering ETFs that track an index of companies actively buying back shares. Their list of holdings effectively gives investors a starting list when researching relevant names.

While it is impossible to draw any firm conclusions from a single investment product, it is worth flagging the performance of the pound-denominated version of Invesco Global Buyback Achievers (SBUY) which has generated more than twice the total return of the FTSE 100 since it launched on 28 October 2014 (199% versus 86% respectively, according to FE Fundinfo data). While impressive, it is a tough lighter than the 211% from widely used global equities benchmark MSCI World index in sterling over the same period.

The Invesco Global Buyback Achievers ETF tracks an index of companies that have reduced the number of shares in issue by 5% or more in the trailing 12 months via buybacks. Current holdings include oil producer Shell (SHEL), pharmaceutical group Novartis (NVS:NYSE) and healthcare giant Johnson & Johnson (JNJ:NYSE).

NO GUARANTEES OF A BOOST

While there are examples of stocks racing ahead on buyback news, there are exceptions. For example, life insurer Legal & General (LGEN) has historically used spare cash to fund dividends but on 12 June it outlined a new capital returns structure including a move to start share buybacks.

You might have thought the latter news would have fired up the share price, but investors did not like the fact buybacks are happening at the cost of lower dividend growth over the long term. The shares tanked on the announcement.

It is hard to predict how UK-listed companies would react in the event of a buyback tax. They could, in theory, increase their dividend payments and return cash via that mechanism instead. However, that could raise the stakes during the next economic downturn as shareholders tend to take news of a dividend cut harder than they do the announcement of a postponed or cancelled share buyback.

Where we go next is uncertain, but the fact buyback taxes are a live issue either side of the Atlantic on buybacks means this is something to watch closely, whether it happens in the near-term or in the future. The more companies buy back shares, the more a government will spot it as an opportunity to generate more tax income.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Daniel Coatsworth

Editor's View

Feature

Great Ideas

Investment Trusts

Money Matters

News

- BP Marsh blows away forecasts with bumper returns

- Serica shares hit 12-month lows on fears over licences and windfall tax

- Pub and bar operators are looking forward to a bumper summer of sport

- US markets embrace better inflation narrative but Fed remains reluctant to declare victory

- Why shareholders voted for Elon Musk’s $56 billion pay package

magazine

magazine