Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Is BT now an investment worth considering?

Is BT (BT.A) finally worth owning? For years it has been a complete dog of a stock and despite spinning back through our archives, Shares struggled to find the last time we had anything positive to say about the company or its shares.

Yet suddenly in May 2024, the stock jumped, chalking up rough 30% gains within days and now at roughly 138p. ‘There is a surge of energy running through BT after the telecoms group announced it had reached an inflection point,’ wrote AJ Bell investment director, Russ Mould.

New guidance for significantly increased cash flow, more cost savings and a higher dividend for shareholders all combined to deliver a bumper package of good news alongside March end 2024 full year results.

‘Many people assumed BT would continue to be weighed down by the hefty investment into upgrading its infrastructure and that ongoing takeover speculation would be the only catalyst to move the share price higher,’ wrote Mould, but ‘instead, it has knocked the market for six with one of the most bullish statements from the company in a long time’.

BT had produced the kind of statement that could encourage large numbers of investors to start reappraising the business, Mexican billionaire Carlos Slim recently taking a 3% stake in the business in an endorsement of the new strategy, and left some significant institutional investors with bloody noses. That’s because there had been a notable increase in institutions betting against BT since September 2023, with the amount of stock on loan to short sellers rising from 0.5% to 2.74% over this period.

BlackRock, the Canada Pension Plan Investment Board and AKO Capital were among the biggest short sellers of BT, according to FCA data last month. But it may be too early for short sellers to throw in the towel, and they by and large haven’t, and here’s why.

HOW DOES BT MAKE ITS MONEY?

While the name will be familiar to almost everyone reading this, they might not be as up to speed with its current business model and structure. BT provides mobile and fixed broadband communications services to individuals and companies through its Consumer and Business arms, supported by its internal Digital and Networks units. The Openreach fibre broadband business is a legally separate company but it is wholly owned subsidiary of the BT Group. It connects homes, mobile phone masts, schools, hospitals, broadcasters and a variety of different businesses to its fibre broadband infrastructure.

DECADE OF DISMAL RETURNS

The company has been consistently criticised in the past for poor levels of growth and service and having high levels of debt, elements that tend to attract short sellers. It has led to a lost decade of shareholder returns.

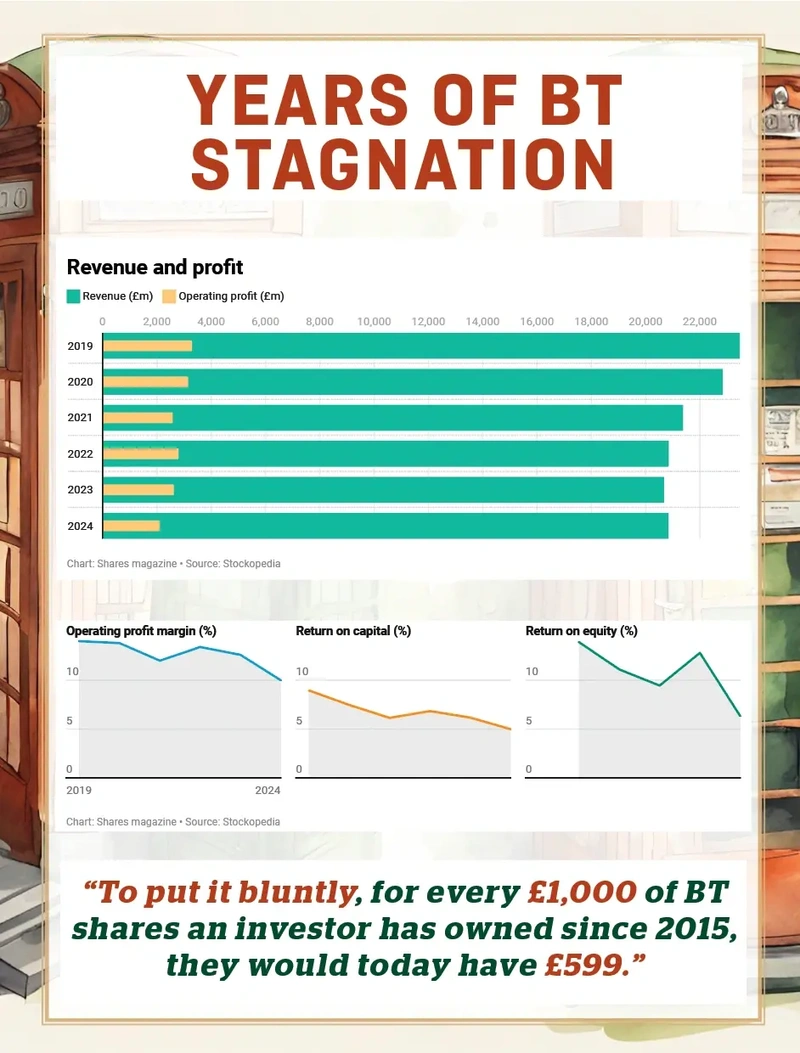

More than £3 billion of revenue has been lost (based on March 2024 results) since income peaked at a bit more than £24 billion in 2017, both operating and pre-tax profits have shrunk over the past decade (9% and 54% respectively) and net profit has fallen from more than £2 billion to £855 million last year.

OK, you might say, but BT is an income stock not a growth business, with reliably crucial dividends. Only, that’s not necessarily the case. Having risen to 15.4p per share in 2018, the payout then flatlined before being axed completely in fiscal 2021, as it conserved cash as the Covid pandemic ripped across the world, and sensibly so.

Yet when dividends were re-established, it was at a massively rebased level, paying shareholders 2.31p per share in 2022 and then 7.7p (2023) and 8p (2024), showing that the payout cut was permanent. Analysts at Berenberg forecast the dividend to incrementally grow in future but it will take years before getting back to pre-pandemic levels on current expectations. This year’s forecast yield is 5.8%.

As we explained in our income feature (‘Big dividends: the high yields you can trust, 12 October 2023), there are more reliable, higher yielding stocks on the London market.

British American Tobacco (BATS), for example, has an almost unblemished payout growth record over the past 10 years, barring 2018. FTSE 100 insurer Aviva (AV.) also lowered its dividend on Covid caution in 2020 but has since returned the payout to pre-pandemic levels and more with last year’s 31.8p per share payment (versus 29.9p in 2019), and it’s forward yield also trumps BT, at 7.4%.

Other important investment metrics have also been dismal when we dig into BT’s numbers. Returns on capital and equity are just 5% and 6.3% respectively, based on Stockopedia data. Operating margins were at a reasonably respectable 10% in fiscal 2024 but have been in decline for years – they were 21% in 2015.

What this ultimately means for shareholders is that BT stock has consistently lost them money. Morningstar data shows average total returns (capital and income combined) of -5% a year over the past decade, bettered by even a simple FTSE 100 tracker at roughly 5.9%.

Even a basic savings account would have done better, despite interest rates stubbornly below 1% for most of the last decade. To put it bluntly, for every £1,000 of BT shares an investor has owned since 2015, they would today have £599.

HOW MIGHT THINGS IMPROVE?

This year, BT has focused on expanding its fibre broadband network and boosting its 5G infrastructure, very sensible we would argue, considering the surging demand for more, faster data services from consumers, enterprise, and public sector organisations. By investing in digital infrastructure, BT aims to strengthen its market position and drive long-term growth.

One of the most significant developments for BT this year has been the rollout of its full fibre broadband network. The company aims to reach 25 million premises by the end of the decade, making substantial progress this year. This ambitious project is expected to enhance customer experience and drive future revenue growth.

BT has also been exploring partnerships to improve its service offerings. A notable partnership with Alphabet’s (GOOG:NASDAQ) Google Cloud aims to leverage AI (artificial intelligence) and machine learning to improve customer service and operational efficiency. This collaboration is expected to bring significant benefits in the coming years.

This all sounds promising yet the acid test is on execution, something BT hasn’t been great at. And lavish infrastructure capital expenditure means there’s limited scope for returns on that investment to improve much in the near term, in our opinion, and Berenberg seems to agree.

‘We note that BT’s RSP award (restricted share plan) for management has a ROCE (return on capital employed) underpin of at least 7% over the next three years, in order for the share awards to vest.’

Hardly demanding. Berenberg’s long range forecasts, out to fiscal 2030, imply patience will be rewarded down the line despite almost zero top line growth projected. The investment bank sees net profit doubling by then to about £1.56 billion, implying net profit margins going from 4% last year to 7.5%. The dividend by them is seen at close to 10p per share. But it’s a long line and trying to predict things more than five years ahead is fraught with risk.

Put frankly, even if things go well BT’s returns profile does not stand out. This is a highly regulated industry and a savagely competitive one. Cash flows are strong and reliable, and on a rolling 12-month PE (price to earnings) of 7.4 (as per Stockopedia data), the shares are inexpensive.

Yet it is difficult for us to see catalysts that could power the stock significantly higher, while competitive and execution risks remain entrenched.

DISCLAIMER: Financial services company AJ Bell referenced in this article owns Shares magazine. The author of this article (Steven Frazer) and the editor (Tom Sieber) own shares in AJ Bell.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Daniel Coatsworth

Editor's View

Feature

Great Ideas

Investment Trusts

Money Matters

News

- BP Marsh blows away forecasts with bumper returns

- Serica shares hit 12-month lows on fears over licences and windfall tax

- Pub and bar operators are looking forward to a bumper summer of sport

- US markets embrace better inflation narrative but Fed remains reluctant to declare victory

- Why shareholders voted for Elon Musk’s $56 billion pay package

magazine

magazine