Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

How do ISAs stack up against pensions as investment vehicles

There are two main vehicles for protecting returns from your investments and savings from HMRC: ISAs and pensions.

In this article we go back to basics and discuss how these two, sometimes referred to as tax wrappers, can be used by savers and investors and consider the advantages and disadvantages of having an ISA and pension.

WHAT IS AN ISA?

An ISA or individual savings account allows you to save and invest in money in a tax efficient way.

There are four main types of ISAs:

Cash ISA

This is a cash only savings account based on a fixed or variable rate.

Investment ISA

This is also known as a stocks and shares ISA.

An investor can hold a wide range of assets in this account from funds, shares, cash, gilts, bonds, ETFs (exchange traded funds) and ETCs (exchange traded commodities).

Innovative Finance ISA

This type of ISA allows an investor to lend their tax-free ISA allowance to borrowers through P2P (peer-to-peer) lending platforms.

Lifetime ISA

A Lifetime ISA benefits from a 25% bonus from the government.

It is designed specifically for people aged (18-39) who are saving for their first home or retirement.

If you withdraw money before the age of 60 (unless it is to fund the purchase of a first home or you are terminally ill with less than 12 months to live) you’ll pay a government withdrawal charge of 25%. You can no longer pay into a Lifetime ISA once you reach 50.

WHAT ABOUT PENSIONS?

A pension is one of the most tax efficient ways to save for your retirement as you can get tax relief on the cash you put in.

You can pay money into a pension and receive tax relief up to the value of your earnings, capped at £60,000 every tax year.

There are several types of pensions from the state pension (which is provided by the government and is based on your national insurance contributions and paid to you once you reach state pension age) to a workplace pension which is established by an employer for its employees.

There are two main types of workplace pension:

Defined benefit

The amount you receive at retirement in a defined benefit scheme is determined by the final salary you received from your employer and the length of service.

Defined contribution

The income at retirement depends on the amount of money generated by contributions, both from employer and employee, tax relief and investment returns.

SIPP (self-invested personal pension)

A SIPP is a personal pension where you can choose the investments you invest in for example, shares, investment trusts, funds and exchange-traded funds.

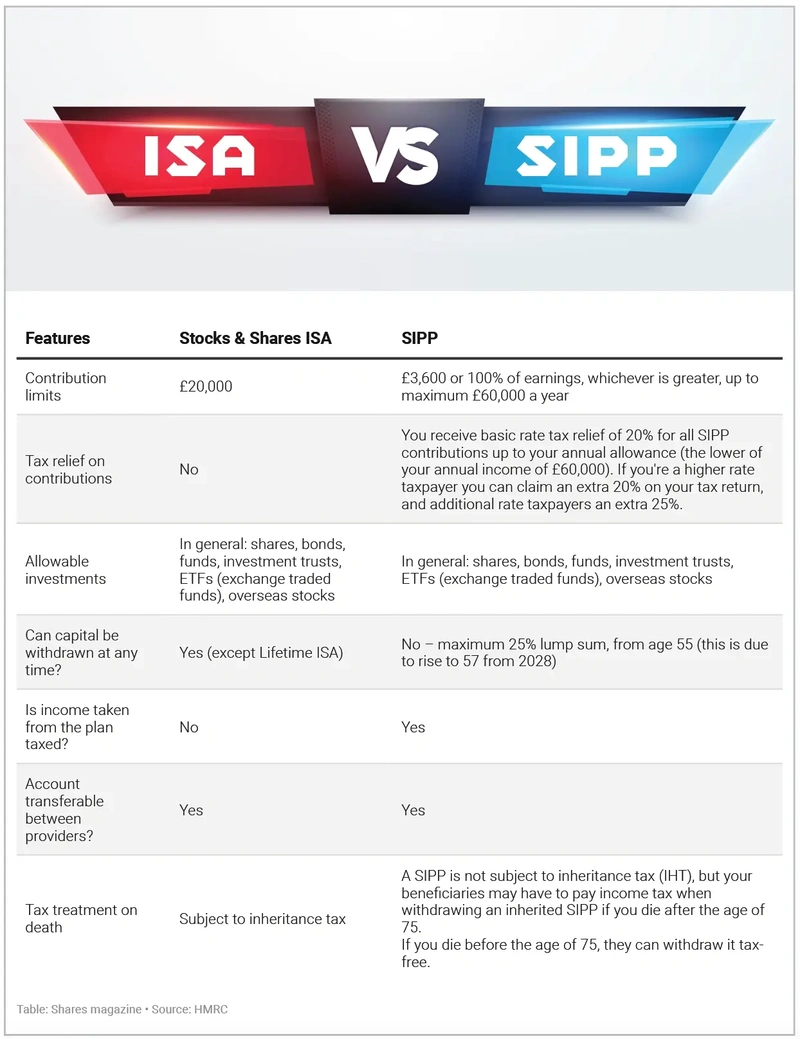

WHAT ARE THE MAIN DIFFERENCES?

The main difference between an ISA and a pension is one of access. The money you put into a pension is locked away until you turn 55 – this age increases to 57 from 2028.

In contrast a person can access the cash in an ISA whenever they want and not wait until 55. Another difference is how they are taxed. A pension has a more generous tax benefit on contributions – you don’t pay tax on the cash you put into a pension; however, you pay tax on what you withdraw when you retire; an ISA has the advantage of providing tax-free access to your cash.

Both pensions and ISAs are, however, free from CGT (capital gains tax) and tax on UK dividends.

OTHER CONSIDERATIONS

One of the main advantages of an ISA is that you have tax-free access to your cash sooner than if it was in a pension.

However, if you are saving your cash through a Lifetime ISA for buying your first home, or fixed-term cash ISA you won’t be able to have access until the fixed time-limit expires. It might be five years for a five-year fixed rate ISA and in the case of a Lifetime ISA if you withdraw the money for any other purpose then buying your first home or for retirement after the age of 60, you’ll face a 25% penalty on the amount withdrawn.

There is also an annual limit of £4,000 on contributions to a Lifetime ISA, savers might find the cap restrictive if they want to save more than this amount.

One of the main benefits of having a personal pension is the tax relief and IHT (inheritance tax) friendly nature (a pension typically sits outside of a person’s estate for IHT purposes). If you use a SIPP. you are also in control of where your money is being invested.

You can look after your SIPP online and transfer other pensions (depending on their type) into your SIPP to consolidate your retirement fund. Some (but not all) employers may contribute to your SIPP instead of a workplace pension.

LIMITS AND ALLOWANCES

The total amount you can save in ISAs within the current tax year is £20,000. This encompasses the amount you can allocate across all types of ISAs, including stocks and shares ISA, cash ISA, Lifetime ISA (up to £4,000 which counts towards the £20,000 limit) and innovative finance ISA.

You can also take advantage of the £9,000 limit when you save for child using a Junior ISA.

As discussed, an annual allowance limits the amount someone can pay into pension schemes and still be eligible for tax relief. It is £60,000 in 2024/25. You cannot usually receive tax relief on pension contributions of more than 100% of your earnings unless the contributions amount to £3,600 or less.

The annual allowance is reduced for higher earners. It is reduced by £1 for every £2 someone earns over £260,000 (including pension contributions). Tapering stops when the annual allowance reaches £10,000.

A person cannot usually receive tax relief on pension contributions worth more than 100% of their annual earnings. However, people can still contribute £3,600 a year into a pension with tax relief even if they earn less than this.

You can usually take up to 25% of the amount built up in any pension as a tax-free lump sum from the age of 55 onwards (increasing to 57 from 6 April 2028). The most you can take is £268,275.

ISAS AND PENSIONS IN ACTION

Using a Lifetime ISA to get on the property ladder

James and Clare are 23 and 24 years old and recently married. They want to get on the property ladder in London after renting for several years. They have decided Clare will save the maximum amount of cash she can per month within the Lifetime ISA limit of £4,000 a year, while James takes care of other outgoings. This works out at £333 per month which they plan to invest over a 10-year timeframe.

They have begun their decade long journey by opening a Lifetime ISA account with an investment platform, initially investing in one-stop-shop fund which invests in a range of asset classes to achieve a relatively conservative 5% return.

If they save the £333 per month over their designated 10-year horizon, rough calculations suggest they would be sitting on a healthy deposit total of more than £50,000 assuming they achieved the 5% return and not including charges.

Employing a SIPP to boost retirement income

Beryl is in her early 50s and is keen to maximise her pension contributions to fund a comfortable retirement.

Beryl already has several small workplace pensions she has accrued in her career in marketing totalling £100,000. She is looking to transfer this sum to a SIPP and make ongoing contributions of £750 per month.

She is confident in making her own investment decisions, hence her decision to go down the SIPP route. Given she doesn’t plan to retire for more than 10 years she invests in several exchange-traded funds which offer exposure to a mix of stocks, bonds, property and infrastructure.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Feature

Great Ideas

News

- Confident Supreme continues to deliver the (fast-moving consumer) goods

- Victrex shares dip with second-half target under threat

- Paramount agrees $28 billion merger with Skydance Media

- Political stability in the UK is in stark contrast to uncertainty across the channel

- Britvic set for stock market exit after agreeing £3.3 billion Carlsberg buyout

magazine

magazine