Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

What do Biden’s blunders mean for US bonds?

The debate over the mental acuity of Joseph R. Biden and his physical readiness to take on a second, four-year term as American’s forty-sixth president at the age of 82 (as he will be this November) is unlikely to abate any time soon.

The Democratic Party has until its convention in Chicago, scheduled for 19-22 August, to decide what it wants to do, if anything. However, US financial markets are not waiting to find out. Investors are drawing their own conclusions, assessing opinion polls and pricing in an increased chance of a return to office for Donald J. Trump, matching the achievement of Grover Cleveland, a Democrat and the only US president to lose office (in 1888) and then win it back (in 1892).

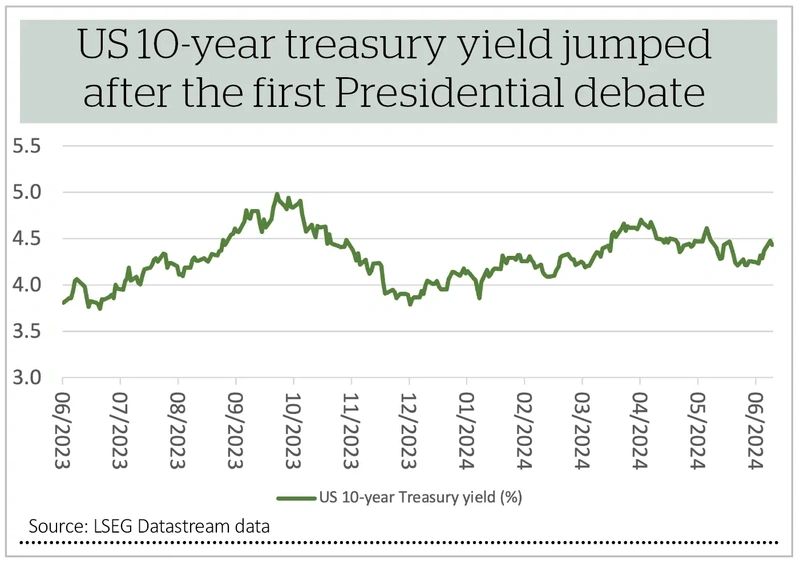

This can be seen most clearly in how the US 10-year treasury yield responded to the presidential debate hosted by CNN on 27 June. The benchmark US government bond saw prices fall and yields rise sharply in response to the broadcast as fixed income investors began to anticipate a Trump win and the inflation they feared that would bring.

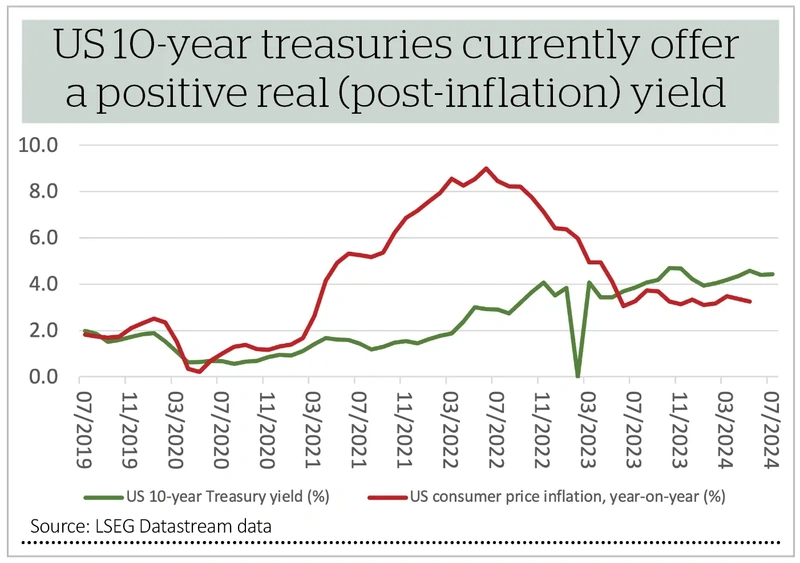

This leaves investors with a predilection for US sovereign bonds with a dilemma. On one hand, they may want to lock in the positive real yields on offer, especially if they think the US Federal Reserve will start to cut interest rates in the autumn of this year – the 10-year yield currently exceeds the prevailing rate of US consumer price inflation by one full percentage point.

On the other, they will be wary of a reignition of inflation which could erode the value of their carefully-harvested coupons or even erase it altogether if it moves above the 10-year yield on a sustained basis.

TRUMPIAN TREBLE

Bond markets are looking at the race to the White House with added concern, given how three of Trump’s key policy thrusts, as outlined in the first presidential debate, all feel inflationary.

- An extension of 2017’s tax cuts, and promises of more to come (thus boosting consumer spending).

- More tariffs on imported goods, not just from China (thus making imports more expensive)

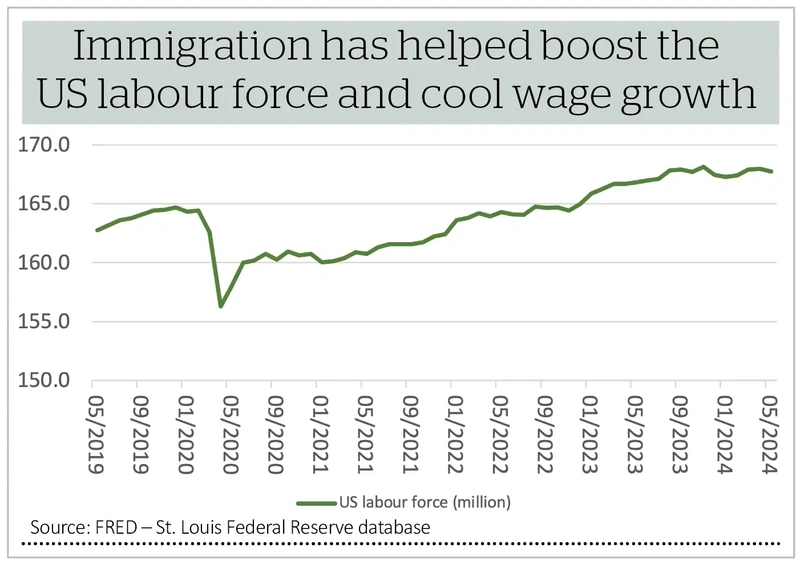

- Cutting immigration (thus limiting the growth in the pool of workers which has helped keep US wage inflation below the levels seen in the UK, for example).

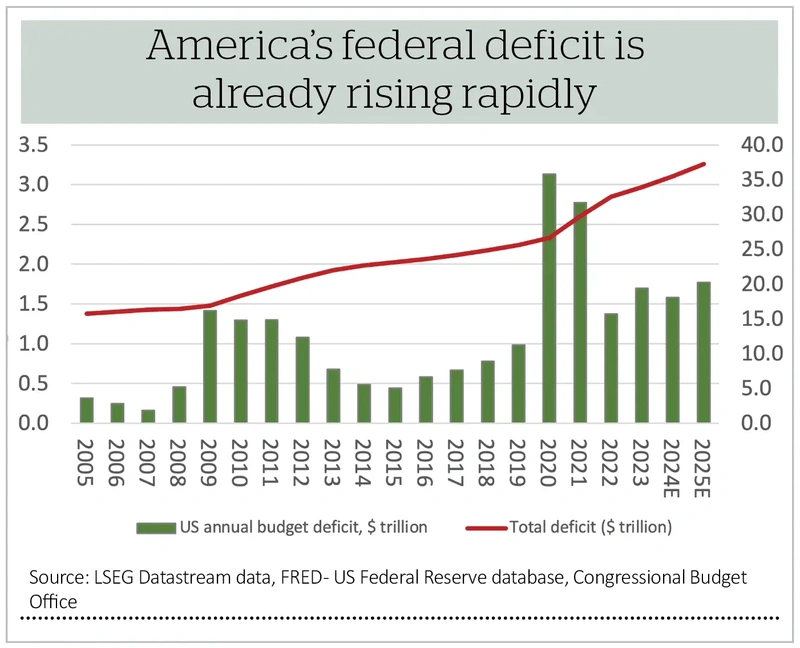

The tax cuts have a further knock-on effect on the yield on US treasuries. America is already running an annual deficit equal to around 6% of GDP (gross domestic product) and an aggregate deficit which exceeds 100% of GDP (numbers that, until recently, would have made any tin-pot republic blush with shame).

Trump’s proposed tax cuts would take both higher, and that assumes a benign economic environment – remember, America is racking up this enormous annual deficit when unemployment is barely 4% and the economy is growing.

Heaven knows what would happen if a soft (or hard) landing were to transpire and tax income receded just as welfare payments started to rise, although it seems fair to assume the annual deficit would balloon.

America would need to issue more debt (treasuries) to fund itself and it seems logical to assume it would need to offer plump yields to tempt in buyers.

This is not to say the Biden is promising hair-shirt austerity. His first term will see America rack up an additional $7 trillion or so in borrowing (and it took from 1776 to 2003 for the US to run up an aggregate $7 trillion deficit, to give some perspective on the current rate of overspend).

YIELD TO PRESSURE

All of this begs the question of what an appropriate level for US 10-year yields might be. The base case is the 2% inflation target. An investor may then wish to add some term premium to that, since the headline rate is stuck near 3%, thanks to strong services inflation, and is no lower than a year ago, suggesting it may take time to return to target. Then there remains the incipient inflation risk offered by both presidential candidates.

Then there is America’s massive deficit, which could both pressure the Fed to cut rates to keep the Federal interest bill manageable (since it is now running at $1 trillion a year) and oblige the US to offer tempting yields so it can find buyers for its newly- issued debt.

None of that suggests a benchmark yield on 10-year treasuries of anything lower than 4%, which is not much below the 4.43% on offer at the time of writing. Capital upside may therefore be limited, so investors have to decide whether the coupon is enough to compensate for inflation risk if US treasuries are to form a part of a balanced, diversified portfolio.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Feature

Great Ideas

News

- Confident Supreme continues to deliver the (fast-moving consumer) goods

- Victrex shares dip with second-half target under threat

- Paramount agrees $28 billion merger with Skydance Media

- Political stability in the UK is in stark contrast to uncertainty across the channel

- Britvic set for stock market exit after agreeing £3.3 billion Carlsberg buyout

magazine

magazine