Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

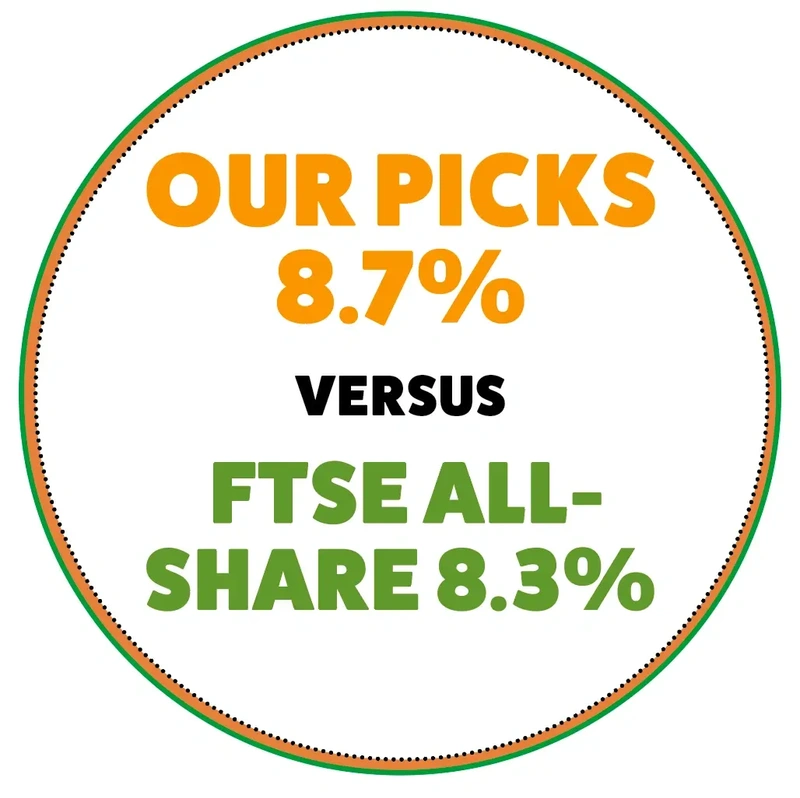

Our 2024 picks are still beating the market but performance is uneven

Now that the dust has settled after the UK elections and attention has turned back to markets, we have updated the performance stats on our tips for 2024.

Overall, our picks have gained 8.7% year-to-date compared with an 8.3% rise in the FTSE All-Share.

That’s not to say it has been plain sailing – our returns range from a gain of almost 60% to a loss of more than 40%, the latter is in a US tech stock while the former is in a company which this year celebrates its 150th anniversary.

Specialist engineering firm Hunting (HTG) began life as a shipping business in the late 19th century and has evolved into a global leader in making precision equipment for the energy, aerospace, telecoms and medical industries.

The shares have gained 57.6% year-to-date, as of the time of writing, thanks to major contract awards and strong OCTG (oil country tubular goods) and subsea markets and strength in its advanced manufacturing arm.

On the flipside, its US Titan oil services business has struggled this year due to lower onshore activity levels and the firm has had to implement a cost-saving plan which should at least minimise the impact on margins.

Our second-best performer is retirement income specialist Just Group (JUST), which has gained slightly more than 30% after generating record revenue and cash flow last year due to a surge in demand for its products.

At its last trading update chief executive David Richardson said he was ‘delighted’ with the firm’s 2023 performance and was confident of exceeding his medium-term growth pledge, with profits now expected to double 2021’s level by the end of this year rather than by 2026 as previously hoped.

In addition to its organic growth, Just Group recently revealed it had signed a strategic partnership with US asset manager Invesco to launch a retirement solution for advised clients.

Biotech specialist Puretech Health (PRTC), has notched up double-digit gains, although its performance has more than halved since the first quarter when it jumped on the news US pharma giant Bristol Myers Squibb (BMS:NYSE) was buying Karuna Therapeutics, one of its ‘founded entities’.

The company decided to return some of the proceeds from the Karuna sale to shareholders via a $100 million tender offer which was announced on 19 March and priced at a 25% premium to the prevailing share price.

We suspect the time lag between the proposed tender announcement and its execution, beginning on 20 May and ending on 20 June, has contributed to heightened volatility in the shares.

There has also been some confusion on the tax treatment for shareholders, and Puretech issued a clarification on 4 June meaning investors can now focus on the fundamentals of the business.

SUPPORTING ROLE

Three more UK-listed stocks also made double-digit gains, media and information group RELX (REL), which has been corralled into the AI (artificial intelligence) theme by many analysts and investors, is up just under 15% but that is after giving back some ground this month in sympathy with the global tech sector which has come in for a bout of selling.

At its general shareholder meeting a few months ago the firm said it had started the new financial year well with ‘positive momentum across the group’ and expected strong underlying growth in revenue and operating profit, which is the kind of statement we like.

Our bet on consumers being attracted to its value-for-money proposition seems to have been borne out by the first-half performance of leisure and entertainment firm Hollywood Bowl (BOWL), which reported record first-half revenue with the UK topping £100 million for the first time in a six-month period.

Considering the company generated strong growth last year it was something of a risk to assume that would continue, especially when the evidence suggests lower-income consumers are pulling in the purse strings, but we believe the management team has the skills to continue evolving the business, both in the UK and Canada where it is expanding cautiously.

Bermuda-based insurer Conduit Holdings (CRE) is enjoying market conditions it describes as being at ‘historically favourable’ levels in terms of prices and margins.

The firm’s ability to navigate the markets and pick out the subsectors offering the most attractive risk-adjusted returns is winning it plenty of praise from analysts who are all of one mind in terms of raising their forecasts to keep up with events.

BRINGING UP THE REAR

Our final four picks have nothing in common other than the fact they have lagged the UK and global benchmarks and in three cases are actually in negative territory.

Discount retailer B&M European Value (BME) has been punished despite positive trading across the group as shown by its latest results, while shares in medical devices firm Smith & Nephew (SN.) are trading at 2014 levels which is doubtless why activist investor Cevian has taken a 5% stake in the hope of being able to unlock value.

Shares in software firm Adobe (ADBE:NASDAQ) have recovered some ground since their year-to-date nadir in early June as the company reported earnings and revenue above consensus in the quarter to 31 May and also lifted guidance for the full year.

Document database firm MongoDB (MDB:NASDAQ) has taken a real kicking off the back of weak guidance in May which saw projected revenue for the 12 months to January 2025 cut from a range of $1.9 billion to $1.93 billion to a range of $1.88 billion to $1.9 billion. This followed a very weak first quarter for the business and investors will be hoping for better when the group posts its second-quarter earnings on 29 August.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Feature

- Discover what the experts expect for the rest of 2024

- Our 2024 picks are still beating the market but performance is uneven

- What the does the King’s speech mean for the economy and stocks?

- How does South Korea compare to other emerging markets?

- Emerging markets: semiconductor price hikes, South Korea 'value up' and geopolitical tensions

- Three ways to buy tech

magazine

magazine