Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Three ways to buy tech

Pretty much all investors are tech investors. Whether you like the space or not, it is almost impossible to avoid owning exposure to the technology sector. More than a few analysts have referred to tech as a utility, as vital to modern everyday life as water, electricity, steel, and oil.

For example, of the top 10 holdings of the £60.4 billion iShares Core MSCI World ETF (SWDA) – the biggest world index ETF listed in the UK – eight are tech companies. Only pharma firm Eli Lilly (LLY:NYSE) – is pharma tech? – and Warren Buffet’s Berkshire Hathaway (BRK.B:NYSE) are outliers. The latter itself is a big backer of Apple (AAPL:NASDAQ).

It wasn’t always this way. Of today’s 10 largest members of the S&P 500 Index – which, incidentally, is the same as the world index, only Microsoft and Eli Lilly were among the index’s 25 biggest companies at the start of the millennium. The list then topped by General Electric’s (GE:NYSE) $390 billion market cap.

The likes of Meta, Broadcom (AVGO:NASDAQ), Tesla (TSLA:NASDAQ), and Alphabet (GOOG:NASDAQ) had not even sold shares to the public back then.

Global stock markets have been transformed over the past couple of decades by tech companies, but what are your options when it comes to investing in tech?

In simple terms, there are three main avenues, each with its own pros and cons.

OPTION 1: Passive index funds

OPTION 2: Actively managed funds

OPTION 3: Individual stocks

WHY DO INVESTORS WANT TO INVEST IN TECH?

We’ll get to each in a bit, but first, why are investors so drawn to tech companies?

The technology space is without a doubt one of the broadest, most exciting, and important investment areas, touching everything from education to hospitality, recruitment, healthcare and life sciences, sustainable energy, finance, law and much else, with innovations across software platforms and generative artificial intelligence (AI) in particular presenting ever new, more cost effective, and user-friendly ways to solve age-old problems.

Typically, investors have looked to the US Information Technology sector for tech, but it is no longer straightforward. For example, Google parent Alphabet and Meta Platforms (META:NASDAQ) are both tech firms that make most of their revenue from digital advertising, and they sit in the Communications Services sector, as does streaming TV service Netflix (NFLX:NASDAQ).

Amazon (AMZN:NASDAQ) sells stuff to millions but also owns the world’s leading cloud computing infrastructure operator AWS. Its’ home is the Consumer Discretionary sector, as is Tesla’s.

Ride sharing platform Uber Technologies (UBER:NYSE) is classed as an Industrials stock.

Ben Bei, product strategist at BlackRock, says the investment bank’s philosophy goes beyond the traditional definition of information technology and explores the entire equity space to identify companies with a strong technology element. ‘This gives us an extremely diverse range of corporates across this broader technology universe, with as many as 1,200 companies for consideration,’ he says.

According to Mike Seidenberg, lead manager of the Allianz Technology Trust (ATT), there are three reasons why enterprise buys tech – grow revenues, save costs, and improve customer service.

It is this promise that underpins long-run attractive growth opportunities in the tech space for investors, ones that generate market beating revenues trajectories and margins that yield real profits and cash flows for the winners.

‘US tech stocks have skyrocketed by 142% since the end of 2019, whereas US non-tech stocks have gained just 38%,’ CPR Asset Management observe, using data to April 2024.

Just look at Nvidia’s (NVDA:NASDAQ) crazy past 18 months. In the year to 2020 (to the end of January), it reported net income of roughly $2.8 billion on $10.9 billion revenues, according to Morningstar data. By fiscal 2023 that had grown to roughly $4.37 billion on about $27 billion. Last year (to Jan 2024), the equivalent figures were $29.8 billion on $60.9 billion.

This year, consensus forecasts see Nvidia net income and revenues doubling again, and by fiscal 2027, Koyfin’s consensus data implies revenues of $189 billion. That implies EPS (earnings per share) of $4.34. In 2020 EPS was $0.11.

It took Apple five years to bridge the $1 trillion to $3 trillion market cap gap, Microsoft (MSFT:NASDAQ) about the same. Nvidia did it in barely a year.

Nvidia is, of course, an outlier, even among big tech firms, but returns from the US Information Technology sector are forecast to far outstrip all other sectors.

Data from S&P implies that the Information Technology sector will contribute between 20% and 25% of operating earnings of the S&P 500 out to the December 2025 quarter, the most of any single sector. Most of the others are seen bringing single-digit contributions to the table. That compares to the sector representing just 13.4% of the index in terms of company numbers.

And, as discussed, tech arguably spans other sectors too, according to BlackRock’s Bei, the asset manager sees technology falling into six subsectors – Hardware, Semiconductors, Internet, Services, Software, and Games and Data Centres.

Let’s return to the knitting of this feature – the options available to investors to invest in tech.

OPTION 1: PASSIVE FUNDS

The main job of a passive or ‘tracker’ funds, often within an ETF structure these days, is to deliver a return that’s in line with the market they track, not to beat it. They are designed to simply replicate the movement of the market they’re following.

Given that all the so-called ‘Magnificent Seven’ tech firms are in the S&P 500, plus other tech favourites, like Advanced Micro Devices (AMD:NASDAQ), Adobe (ADBE:NASDAQ) and Palo Alto (PANW:NASDAQ), you could simply buy an ETF that tracks that index.

This is a low-cost route. The SPDR S&P 500 ETF (SPX5) is available at a 0.03% ongoing annual charge. The downside to this is fairly obvious, that while you are capturing exposure to the stocks you like, you’re also exposed to plenty more you probably don’t.

This is true even if you look at Nasdaq, the market where most of the biggest and brightest tech firms trade. Take the Nasdaq 100, for example, the 100 largest Nasdaq firms. As an exercise for this feature, Shares used its knowledge of the tech space and spun through every company in the Nasdaq 100 to see, immediately, the number of companies that stood out as potential investment candidates.

We landed on around 25. Your own list of investment candidates might be larger, or quite likely, smaller. One of the more popular Nasdaq 100 trackers, and one of the largest, is the £5.76 billion Invesco EQQQ Nasdaq-100 ETF (EQQQ), on an ongoing charge of 0.3%.

In short, buying shares in this ETF means being we’d get exposed to three-quarters of stocks that we don’t want, a conundrum presented by any index tracker.

Factor ETFs could help. JustETF lists more than 100 of these thematic ETFs, if we are loose with the tech definition, from battery technology to digitisation, semiconductors to space. And you will have to pay higher costs. For example, JustETF lists five AI ETFs with ongoing charges ranging from 0.4% to 0.75%.

OPTION 2: ACTIVELY MANAGED FUNDS

In contrast to passive funds, the job of an active fund manager is to cherry pick the investments likely to give shareholders the best returns over the medium-term and beat the performance of the fund’s stated benchmark or index.

Normally, this involves a team of analysts and researchers who help generate ideas and then monitor investment selections alongside the manager. In theory, this presents investors with a carefully curated portfolio of technology stocks capable of delivering superior performance while offering reasonable diversification within the space, tapping into structural themes that can really move the needle, such as cloud computing, AI, cybersecurity and much else.

Many active technology fund managers put a look of effort into identifying companies that are less known, less understood and that are generally smaller than the Apple, Amazon and Alphabet’s, although most will still own some big tech stocks.

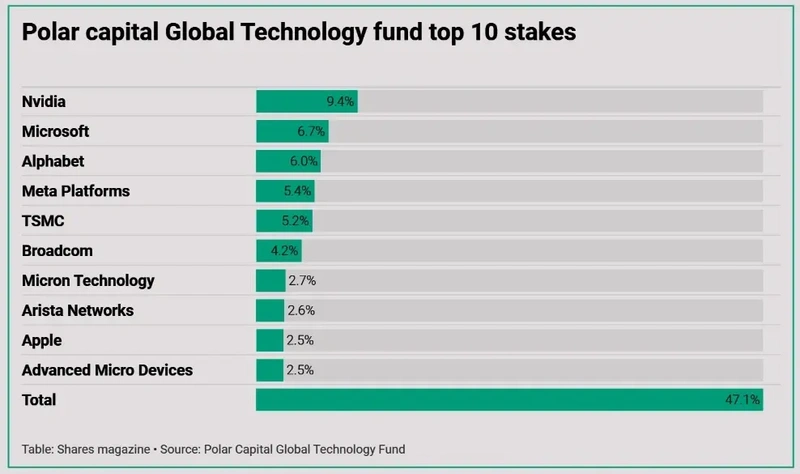

What this should mean is that active tech funds give an investor more of what they want, less of what they don’t want to own, and/or a bigger share of stocks that you might otherwise get from a passive fund. For example, the Ben Rogoff-run Polar Capital Global Technology Fund (B42W4J8) has 9.4% portfolio exposure to Nvidia versus the index’s 7%, while Apple represents just 2.5% of the portfolio versus 6.6% for the S&P 500.

The trouble is there’s never any guarantee that even the most talented fund manager will pick investments that will outperform on a regular basis. All investments are at the mercy of market conditions and sentiment so they could rise or fall in value. Some promising shares may nose-dive one year only to rebound the next. The best active managers are the ones who can navigate market volatility year-in, year-out, so if you’re looking at going down the active route, look at a manager’s long-term track record across a variety of market conditions but keep in mind that his past performance isn’t necessarily a reliable indicator of future performance.

The Polar Capital fund has returned an average 21.8% per year over the past decade versus 17.4% of the overall technology sector, according to data from AJ Bell, and 12.8% for the S&P 500, based on Morningstar information. The Allianz Technology Trust (ATT) has been run by Mike Seidenberg for the past couple of years, but he has been part of the Allianz team since 2009. It has generated an annualised total return of 22.1% over 10 years from a more concentrated portfolio than Polar’s of around 40 stocks.

Similarly, Hyunho Sohn has run the Fidelity Global Technology Fund (BJVDZ16) since 2013, so he’s also seen the good, bad, and ugly of tech. His fund has returned an average 23% a year over the past decade.

But investors are expected to pay a premium for this outperformance, 1.11%, 0.7% and 1.04% ongoing charges for Polar, Allianz and Fidelity respectively. Even so, these tech funds remain popular with AJ Bell platform users, and are among the most popular tech specialist picks. As is Blue Whale Growth (BD6PG78). While a growth fund rather than a tech specialist, its portfolio is nonetheless packed with tech stocks, such as Nvidia, Microsoft, Lam Research (LRCX:NASDAQ) and Meta.

This is simply a because tech is where manager Stephen Yiu sees many of the best returns opportunities, an investment strategy that seems unlikely to change anytime soon.

OPTION 3: BUY YOUR OWN STOCKS

Buying your own stocks is the third option, one that many investors prefer. It obviously means you need only own want you want to own, with no deadwood.

It also means that you must conduct your own time-consuming research, which isn’t for everyone, especially if you are to achieve a portfolio with reasonable diversification. Without an expert to guide you, it may mean arriving late to emerging tech trends, or missing out altogether. It can also be expensive if you want to manage your portfolio actively, racking up dealing charges, not just when you buy a new stock, but each time you might want to top slice winners or reduce exposure to poor performers.

The routes investors should take into the technology sector of course depends on their specific objectives, as well as their attitude towards risk and their experience. Those relatively new to investing might prefer to restrict themselves to a selection of passive options with some exposure to actively managed funds.

Others will feel confident buying individual stocks themselves. We believe that active and passive funds both have a role to play in a diversified investment portfolio, but that there is nothing wrong with buying individual stocks if you have the capacity and know how to research them properly.

By utilising different assets that are available, there is no reason why ordinary investors cannot create a successful tech portfolio capable of withstanding market cycles while capturing mispricing and growth opportunities along the way.

DISCLAIMER: Financial services company AJ Bell referenced in this article owns Shares magazine. The author of this article (Steven Frazer) and the editor (Tom Sieber) own shares in AJ Bell. Steven Frazer owns a personal interest in Allianz Technology Trust and Blue Whale Growth Fund.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Feature

- Discover what the experts expect for the rest of 2024

- Our 2024 picks are still beating the market but performance is uneven

- What the does the King’s speech mean for the economy and stocks?

- How does South Korea compare to other emerging markets?

- Emerging markets: semiconductor price hikes, South Korea 'value up' and geopolitical tensions

- Three ways to buy tech

magazine

magazine