Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Report reveals UK pension funds have remarkably low domestic share holdings

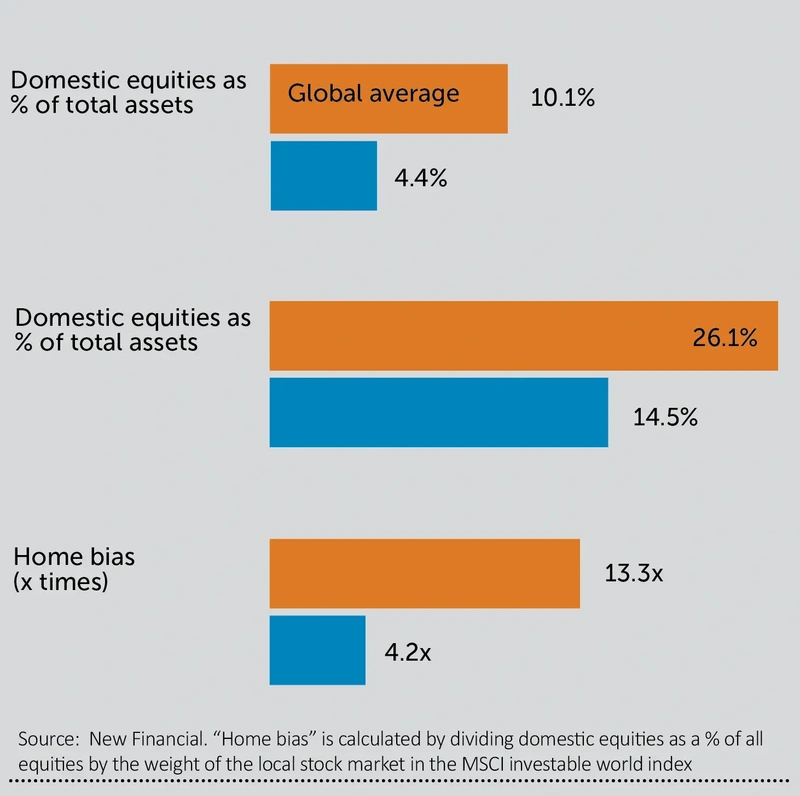

A study by think tank New Financial has revealed UK funds have a significantly lower absolute and relative allocation to domestic listed and unlisted stocks than almost any of their global peers.

The report, by William Wright and James Thornhill, concludes UK pension funds could increase their allocation to the UK market by 50% to 100% and still be comfortably in line with both their international counterparts and historic norms.

The authors found the proportion of UK pension funds invested in UK equities has fallen to just 4.4% from over 6% last year and more than half of all assets 25 years ago.

Within that figure there are big divergences, with public sector defined-benefit (DB) schemes investing around 9% in UK equities, private-sector defined contribution (DC) schemes around 8% and corporate DB schemes allocating just 1.4% of their assets to domestic stocks.

Whichever way you analyse it, however, the figure of 4.4% is one of the lowest of any pension system on the planet with only Canada, Norway and the Netherlands having a smaller allocation.

In any debate on the decline in UK pension funds investing in their own domestic market, two broad arguments keep recurring say the report’s authors.

First, UK pensions and the stock market are somehow ‘uniquely dysfunctional’ and everyone else manages to handle the balance between domestic and international investment better than we do.

Second, this is part of a ‘structural shift’ across the global pensions industry towards investing on a global market-weighted basis so there is little point in the UK shouting at the waves as they put it.

Yet the report is highly relevant to the current political debate, with the new Labour government reviewing the pension industry and thinking about how to encourage greater investment in the UK.

Before the election, much was made of the potential for a ‘British ISA’ to funnel money into UK shares but that idea bit the dust after the new government accepted yet another savings product would just complicate the landscape.

There has also been talk of creating a UK sovereign wealth fund along the lines of Norway – an idea also being embraced by US politicians – but that could be years away.

While the report doesn’t specifically recommend UK pension funds increase their allocation to the UK, the authors suggest funds could as much as double their exposure to domestic stocks and still not be out of kilter with historic averages or their global peers.

Considering the ongoing valuation support for UK equities, and the prospects for a ‘soft landing’ and subsequent economic recovery, this would surely be an ideal time for UK pension funds to ramp up their investment in domestic stocks.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Dan Coatsworth

Feature

Great Ideas

Investment Trusts

News

- Report reveals UK pension funds have remarkably low domestic share holdings

- US August payrolls fail to quell investor worries of hard landing

- Apple iPhone 16 launch falls flat as investor worries escalate

- Gamma Communications rings up new highs after raising outlook

- Lords Group shares hit new low on continued ‘challenging’ trading

magazine

magazine