Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

US money market funds attract record inflows ahead of Fed rate cuts

US money market funds raked in their biggest haul of the year in the month of August, some $127 billion, taking total cash assets to a record $6.26 trillion according to data from the Investment Company Institute.

To put that into perspective the total value of all publicly traded US stocks is $56.5 trillion based on the Wilshire 5,000 Total Market index. That means money market funds hold cash equivalent to around 11% of the value of the stock market.

That may sound like a high percentage but historically it is relatively low.

Demand has been boosted by investors wanting to lock in decades high interest rates before the Federal Reserve likely begins cutting rates at its next policy meeting on 17 September.

The popularity of money market funds has been driven by the one of the steepest rate hiking cycles in history which has taken official interest rates to 5.5% from virtually zero in 2021.

A SIMPLE EQUATION

For many retail investors the equation is quite simple: Why take the extra risk of investing in the US stock market, which is trading on one of its richest ever valuations by some measures, when you can earn a risk-free rate north of 5%?

That is equivalent to half the average long term total return (including reinvesting dividends) of the S&P 500 index, for taking no risk.

Retail investors are in good company. Famed investor Warren Buffett revealed the sale of around half of Berkshire Hathaway’s (BRK-B:NYSE) stake in Apple (APPL:NASDAQ), taking the firms cash hoard to a record $277 billion, roughly equivalent to the $285 billion value of Berkshire’s public stocks portfolio.

Another reason to hold on to cash in the face of imminent rate cuts is the uncertainty surrounding the pace and timing of those cuts as Fed chair Powell spelt out very clearly at his Jackson Hole Symposium speech on 23 August.

If the incoming data remains patchy or inflation proves stickier, the Federal Reserve has given itself some wiggle room to slow the pace of rate cuts which could mean higher rates for longer.

As mentioned earlier, from a valuation perspective, the US stock market is looking expensive.

Based on Robert Shiller’s CAPE (cyclically adjusted price to earnings) ratio, the S&P 500 index is trading on a rich 36.1 times.

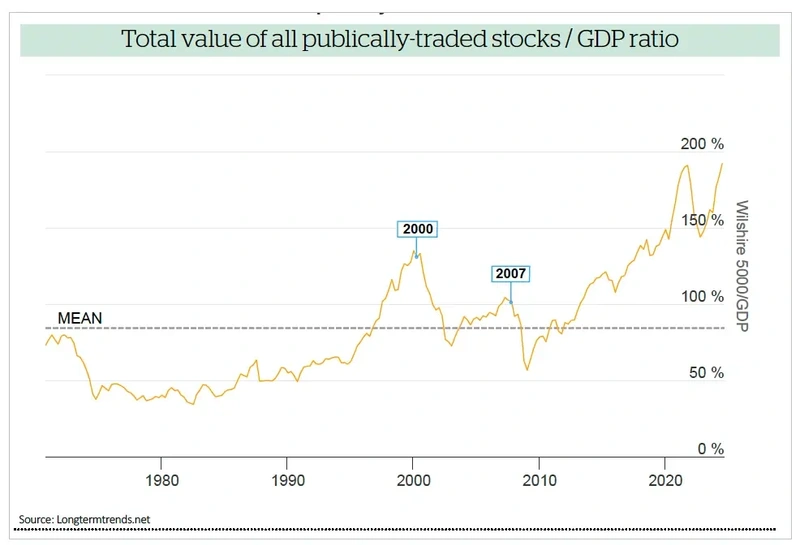

It has only been more expensive on two other occasions – December 1999 (44.2 times) and November 2021 (38.6 times). The S&P index is also flashing ‘very expensive’ on the so-called Buffett indicator which measures the value of the stock market against GDP.

These metrics do not prevent some strategists from making the case that investors sitting in cash are missing out on better returns which stocks and bonds have historically provided. Investors are also able to invest outside of the US market in areas which are not on such lofty valuations.

Research by Seattle-based Coldstream Wealth Management has looked back into the data archives.

It found that on average in the 12-months following the start of a typical rate cutting cycle stocks have returned 11% with treasuries returning 5% and cash 2%.

The obvious problem with this type of approach is that the current economic cycle is anything but typical. We have seen a global pandemic, the discovery of a vaccine in record time that disrupted global supply chains which were further impacted by conflicts in Europe and the Middle East. A truly unique confluence of events.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Dan Coatsworth

Feature

Great Ideas

Investment Trusts

News

- Report reveals UK pension funds have remarkably low domestic share holdings

- US August payrolls fail to quell investor worries of hard landing

- Apple iPhone 16 launch falls flat as investor worries escalate

- Gamma Communications rings up new highs after raising outlook

- Lords Group shares hit new low on continued ‘challenging’ trading

magazine

magazine