Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Is Alphabet antitrust case a threat or an opportunity?

Once peerless, there’s an argument that Alphabet (GOOGL:NASDAQ) is now facing its own ‘Hobson’s choice’. On the one hand, it is being threatened by enormous potential disruption as competitors like OpenAI and its SearchGPT chase share of its valuable search market, forcing it to throw billions of dollars at AI (artificial intelligence) infrastructure to stay ahead.

On the other, there’s a nightmarish labyrinth of tightening antitrust rules as regulators around the world show a willingness to bare their teeth to bring big tech to heel. On 10 September, the European Union’s top court backed a €2.4 billion EU antitrust fine for Alphabet after the Court of Justice said the company’s practice of favouring its own shopping search results over rival services ‘was discriminatory’. The ruling can’t be appealed.

This was just a taste of the bitter pill Alphabet could be forced to swallow if US regulators get their way. On the same day the EU fine was handed out, the US government launched a trial against Alphabet accusing the company of illegally monopolising the ad tech market.

The lawsuit, originally filed in 2023, comes after a combined investigation by the US government and more than a dozen states. The case focuses on a $31 billion component of Alphabet’s Google ad business responsible for placing banner ads on millions of websites, called Google Admob.

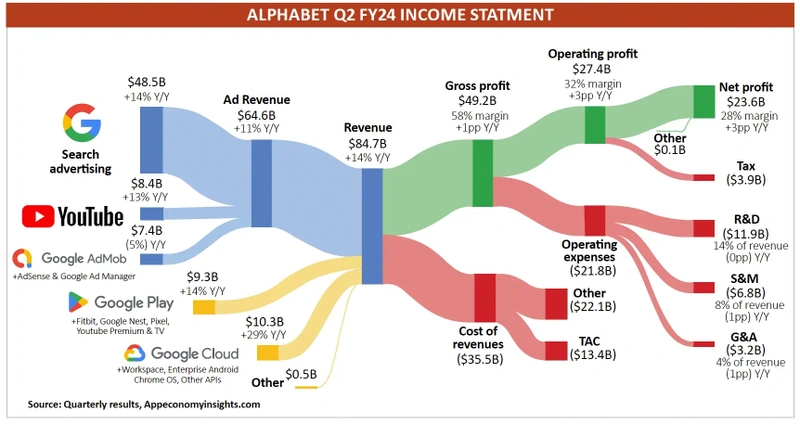

It’s a big deal. Search, which includes Google Admob, is Alphabet’s crown jewel, generating $237.9 billion of revenue in 2023, about 77% of its $307.4 billion total. For context, Google Play and Google Cloud produced $34.7 billion and $33.1 billion respectively last year.

TURNING UGLY

Alphabet will, of course, put up a stiff defence and it has already described the monopoly allegations as ‘unfounded’, claiming that it is just one of several hundred companies in the online ad business, including other tech giants like Meta Platforms (META:NASDAQ), Apple (AAPL:NASDAQ), Amazon (AMZN:NASDAQ), and TikTok, and that competition in the digital ad space is increasing, not decreasing as the lawsuit suggests, as more companies enter the lucrative sector.

But rare extreme measures are said to be under consideration by US rule makers, including an enforced break-up of Alphabet, a move that would be Washington’s first to dismantle a company for illegal monopolisation since unsuccessful efforts to break up Microsoft (MSFT:NASDAQ) two decades ago.

Less severe options could include forcing Alphabet to share more data with competitors and measures to prevent it from gaining an unfair advantage in AI products, according to reports.

Normally, markets tend to shrug off regulatory threats aimed at big tech firms, but not this time. Since the investigation findings were made public in July, Alphabet’s share price has fallen sharply, down more than 18%, a decline that has eaten away at much of the stock’s year to date gains and leaving the stock a poor relation to other big tech names.

Meta, Amazon, and Apple are up 51%, 24% and 19% respectively since the start of the year. Clearly, investors have been given plenty to chew over.

HOW REAL IS BREAK-UP THREAT

But would a break-up really be so bad? Not according to Needham analysts, who have argued that Alphabet is worth more in pieces than as a whole.

‘YouTube would be worth $455 billion to $634 billion if separately traded,’ they say, representing 25% to 35% of Alphabet’s current $1.87 trillion total enterprise value today, based on assumptions that investors typically pay more for pure-play assets. Additionally, increased disclosures and improved employee retention could further enhance shareholder value, says Needham.

Needham are far from alone in seeing Alphabet as an attractive opportunity even with daunting antitrust pressures. Target prices for the stock over the next 12 months range from $151 to $230, but consensus is pitch at $202, implying almost 30% upside from currently levels.

Analysts at Piper Sandler and Wolfe Research have also encouraged long-term investors to take advantage of the recent pullback in Alphabet stock. ‘The antitrust case, particularly regarding Google’s dominance in Search, poses near-term headline risks,’ said Piper Sandler, but the litigation process is lengthy, with appeals and potential changes in government mitigating the immediate impact.

‘We spoke with an antitrust lawyer to discuss Alphabet’s DoJ litigation and his view was that the government has successfully argued the merits within two of three cases, but time is on Alphabet’s side.’

The Search trial, which is most significant, has a lengthy remedies and appeals process ahead. Meanwhile, there could be a new administration in the interim and technology is advancing fast, they also noted. The recent ruling by judge Amit Mehta is characterised as ‘measured’ by the antitrust lawyer that Piper Sandler spoke to, with findings of monopoly power in Search and General Text Ads but without evidence of consumer harm.

‘A break-up or forced divestiture of Android/Chrome is unlikely,’ according to Piper Sandler’s legal expert. On this basis the investment bank argues: ‘Long-term investors should use recent weakness to accumulate shares.’

REMEDIES AT THE READY

Wolfe Research notes potential remedies that might include implementing choice screens and/or Apple entering a distribution agreement with a competitor, likely Bing, which would become the default search engine. They said their ‘incrementally positive view’ on Alphabet stock is grounded in four key factors:

First, in the choice screen scenario, their base case analysis suggests a 10% upside to consensus EPS (earnings per share) estimates and a more than 35% increase in the current share price. Secondly, even in a severe scenario where Apple switches its default search engine and Google loses 20% of its market share, the analysts project only a 5% downside to consensus EPS and around a 12% decline in share price.

Third, changes in the Network business are expected to have little effect on core EPS. Lastly, Wolfe points out that third quarter (to end September) Search revenue may exceed expectations, despite fears of a modest miss.

Alphabet shares are currently trading on about 21-times 2024 EPS and 18 2025 estimates, or 18.9 based on Stockopedia’s rolling next 12 months EPS. That’s a 16% discount to Meta stock (22.5) and a hefty 60% to Apple (29.9) with comparable growth expected to the former and twice that of the latter. The S&P 500 trades on a forward PE (price to earnings) of about 21, according to Wolfe Research.

Could the antitrust odour linger for a while yet? Potentially, especially if third-quarter results stink up the joint. They’re due 22 October with consensus forecasts pitched at $1.84 EPS on $86.3 billion revenue, based on Koyfin consensus data.

On the other hand, positive quarterly numbers could rally Alphabet supporters and drive a stock rally. It’s this latter outcome that Piper Sandler and Wolfe Research both back. The analysts view the antitrust case as more of a ‘distraction’ for long-term investors, with regulatory risks already priced into the stock.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Feature

Great Ideas

Money Matters

My Portfolio

News

- Chinese economic data piles pressure on leadership to take bold steps

- Can Costco continue to deliver the goods?

- Shares in International Consolidated Airlines reach for the sky

- Building materials group SIG hits rock-bottom on weak European sales

- Intel rolls the dice on foundry spin out, but will it be enough?

magazine

magazine