Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Why portfolio construction matters and how it can help you reach your investments goals

This feature marks two new beginnings. The first is a three-part-series exploring portfolio construction, management and how to adapt for major life milestones.

It is also the start of a brand-new section in the magazine. We want to find out how readers approach their own investment portfolios and the methods they use to construct and manage them. You can read more about how to get involved at the end of this article.

To kick things off we explain why portfolio construction is important and will run through an example of how to construct a portfolio using passive ETFs (exchange traded funds).

Whether you are a complete beginner starting out on your investment journey or a more experienced investor, we hope the series will become a helpful resource.

At first glance portfolio construction can appear a bit dry, but its importance cannot be overstated. AJ Bell’s investments managing director Ryan Hughes puts it succinctly: ‘One of the mistakes that beginners make is that they act like a collector, buying investments without regard to the way that each fit into the portfolio.

‘Each investment should bring something different. The aim is to achieve the highest returns with the lowest risk.’

UNDERSTANDING THE RISK

In the context of investing, risk refers to the amount of uncertainty associated with an investment’s return.

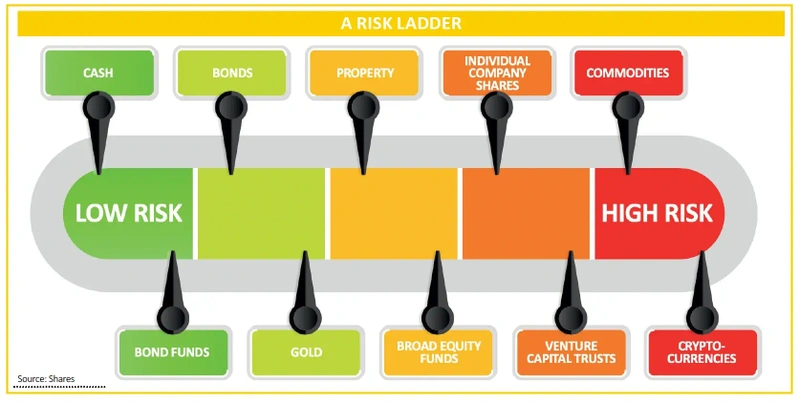

Some asset returns are more uncertain than others, so it is best to think about uncertainty or risk, as a spectrum, from very certain to highly uncertain.

Risk and return are inextricably linked. Safer assets such as cash in the bank have historically delivered the lowest returns. Riskier assets like stocks have historically produced the highest returns. The catch is that stock returns are far more variable and can inflict painful losses over shorter periods.

Many decades ago, some clever academics discovered an answer to this thorny issue. It turns out that combining assets with different risks and expected returns can reduce the overall variability of a portfolio’s return.

They invented a mathematical framework which, in theory, allows investors to maximise expected return for a given level of risk. Each investor should aim to define their own risk appetite which sits at the core of an investment plan.

For example, James may be comfortable seeing the value of his portfolio moving up and down by around 10% a year while Jane isn’t flustered if her portfolio value swings around by 15% to 20%. James would ideally own a bigger proportion of lower risk, lower return assets than Jane.

The idea of spreading risk is referred to as diversification. Nobel laureate Harry Markowitz described diversification as the only free lunch in investing. Diversification principles can also be applied to the stock portion of a portfolio, which we discuss later in the article.

THE RISK SPECTRUM

Government bonds (a type of I.O.U issued by the state) are close to risk-free investments because the state can always raise taxes to service its debts. Bonds provide a relatively safe, fixed income.

Bonds have another feature which makes them potentially useful in portfolio construction. During periods of stock market volatility, when stocks are often falling, investors tend to flock to bonds for their relative safety and positive return.

Increased demand for bonds pushes up their prices which offsets some of the losses incurred by stocks. That is the theory.

In practice, this relationship does not always hold. It can flip around with bonds prices dropping at the same time as stock prices.

The steep rise in interest rates since the pandemic is a good example with government bonds inflicting bigger losses than stocks in 2023. It is worth bearing in mind that bonds are very sensitive to changes in inflation because the income they pay is fixed.

Stocks are towards the riskier end because most of their potential return comes from rising share prices. These in turn, are linked to unknowable factors like profit growth and dividend income.

Not only are stock prices unpredictable, but there is no protection for shareholders if things go wrong. Another reason not to put all your eggs in one basket. By contrast bonds have legal protection for bond holders.

DIVERSIFICATION IN A STOCK PORTFOLIO

Not all stocks have the same risk and return characteristics, so investing in a variety of stocks can be beneficial. The most common way to achieve stock diversification is to spread investments across different industries, sectors and geographies.

On top of that, it is also worth considering key factors like size, cheapness and momentum which are known to drive stock returns over the long run. Studies have shown that small-cap value stocks tend to outperform.

Remember, investment styles come into and out of favour, so it might be better to have a mixture or be style agnostic.

How many stocks do you need to achieve most of the benefit of diversification? There is no precise answer, it depends on the portfolio. If you tend to invest in large cap stocks which pay dividends, as few as 15 names should be enough.

If you prefer small caps, then 25 names might be needed to account for the higher volatility of small cap shares.

Beyond a certain level of diversification, the costs start to outweigh the benefits. Summing up, we have discovered that spreading investments across many risk factors creates portfolio stability and helps to maximise return for a given level of risk.

BUILDING A PORTFOLIO WITH ETFS

Next, we look at how to build a portfolio using passive funds. ETFs track major stock and bond indices and, increasingly, popular investing themes.

They are an effective way to achieve broad diversification at a competitive price. They enable an investor to get exposure to thousands of companies and bonds by buying just a few products.

This approach also means you do not need to take any risk backing an active fund manager or go through the stress of analysing and picking individual companies.

The first step is to figure out your own individual risk appetite. Are you the type to get nervous when markets take a fall amid scary headlines about recession, or the cool, calm and collected individual who takes it all in their stride?

Referring to the risk spectrum mentioned earlier, cautious types will probably feel more comfortable allocating a bigger proportion to safer assets like bonds while adventurous types will want more equities exposure. Those in the middle will aim for a balance between the two.

Age is another important factor in defining risk appetite. Younger investors have a longer investment runway and therefore can take on more risk.

Finally, remember to define your investment goals and timeframe and never lose sight of the fact investing is a marathon and not a sprint.

PORTFOLIO CONSTRUCTION IN PRACTICE

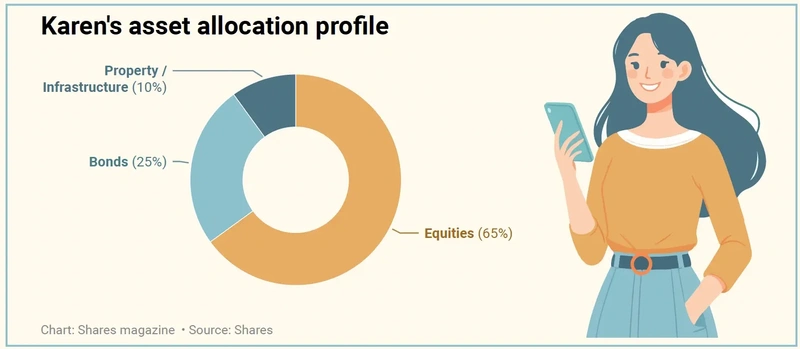

Karen is 36 years of age, married with two children and works as a dental hygienist. She has a happy-go-lucky approach to life and feels comfortable taking a little more risk to bag a potentially better long-term return.

STOCKS

Karen is pursuing a global approach to investing in stocks and researched some popular ETFs which track the MSCI World index. Karen applied the same thinking to other assets which comprise her total portfolio.

The stock product she landed on is the iShares Core MSCI World ETF (SWDA) which is the largest ETF tracking the index with assets of £61 billion. It gives exposure to more than 1,400 stocks across 23 developed stock markets for a cost of 0.2% a year.

The manager tracks the MSCI World index by buying a selection of the most relevant constituents.

BONDS

The broadest index which tracks global bond markets and is used by fund managers as a global benchmark is the Bloomberg Global Aggregate Bond index.

It is comprised of more than 15,000 investment grade (higher quality) bonds issued in developed and emerging markets across the globe. An efficient way to track the index is via the Vanguard Global Aggregate Bond ETF (VAGS) which is the largest tracker with assets of £1.6 billion.

The ETF gives exposure to around 9,000 bonds by selecting the most relevant constituents and has a total expense ratio of 0.1% a year.

PROPERTY / INFRASTRUCTURE

Property and infrastructure funds aim to provide some inflation protection and a stable, reliable income. Karen believes they are a good diversifier for her portfolio.

A relevant property benchmark for UK investors is the FTSE EPRA/NAREIT index which tracks UK listed real estate companies and trusts. The £627 million iShares UK Property ETF (IUKP) tracks the index by using the full replication method.

This means it invests in all 40 constituent stocks of the index it tracks and has a total expense ratio of 0.4% a year. The fund has a yield of 3.8% and dividends are paid quarterly.

The iShares Global Infrastructure ETF (INFR) tracks the FTSE Global Core Infrastructure index which invests in the largest global infrastructure stocks across the globe.

The £1.2 billion fund fully replicates the underlying index for a total expense ratio of 0.65% a year giving investors exposure to nearly 260 companies. Dividends are distributed quarterly, and the fund has a yield of 2.3%.

DISCLAIMER: AJ Bell, referenced in this article, owns Shares magazine. The author (Martin Gamble) and editor (Tom Sieber) own shares in AJ Bell.

WE WANT TO HEAR FROM YOU

We are looking for individuals or couples to share their experiences of managing their own investment portfolios.

If you would like to take part, we want to know why you chose certain stocks, funds or bonds, why you might have subsequently sold some of them, and what you hope to achieve from investing.

We will pay £50 in John Lewis vouchers as a thank you to anyone whose story is published in the digital magazine.

Drop us a line with your name and two lines describing your investment experience. For those picked to feature in the magazine, we’ll be in touch to get the full story.

CONTACT: shareseditorial@ajbell.co.uk with the words My Portfolio in the subject line.

DISCLAIMER: Shares/AJ Bell does not provide advice or personal recommendations. The My Portfolio articles are for information only. You must do own research and consider your own personal circumstances before making investment decisions.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Feature

Great Ideas

Money Matters

My Portfolio

News

- Chinese economic data piles pressure on leadership to take bold steps

- Can Costco continue to deliver the goods?

- Shares in International Consolidated Airlines reach for the sky

- Building materials group SIG hits rock-bottom on weak European sales

- Intel rolls the dice on foundry spin out, but will it be enough?

magazine

magazine