Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Stodgy sectors come to the fore in 2024

This column is no adherent to ‘efficient market hypothesis’, not least because there would not be equity booms and busts, or even marked day-to-day volatility, if investors really knew what was coming around the corner – it simply would not be possible to make a profit if everything was perfectly priced.

However, it does have a lot of sympathy with the argument that a security’s price is a very fair reflection of what is known, and thought, about what is happening to it now, especially given the number of very smart professional (hedge, pension and institutional funds) and retail investors who will be looking at it, day in, day out.

In sum, the market may not always be right, but its views must be respected and so it is always worth paying attention to what the market is saying – either because the investor feels it is wrong, and there is a contrarian opportunity to be had, or because a subtle shift in sentiment that runs against the prevailing wisdom is underway.

In this context, a return to favour among more defensive equity sectors very much catches the eye, at a time when investors are grappling with whether central banks are getting it right with the timing of their interest rate and whether the US may be about to slowdown just when the world is relying more heavily than ever on its key economic engine for growth.

SHOCK TO THE SYSTEM

Given all of the headlines still grabbed by, and the $14.5 trillion aggregate stock market valuation attributed to, the so-called ‘Magnificent Seven’, it would be logical to assume that tech stocks are still doing rather well, even after the summer stumble. Nor it is far from the truth, as Technology is the second-best performer in 2024 to date among the eleven super-sectors which comprise the S&P 500 index. However, the best performer is Utilities.

This could be down to the possible boost to demand for electricity from data centres than run the large language models behind artificial intelligence and store vast swathes of digitised information and content. It could be because utilities are seen as so-called ‘bond proxies,’ and a sector that usually does well when interest rates (and bond yields) are falling, as this makes the yield on utility stocks seem more attractive on a relative basis. And it could be because investors are subtly looking for a haven, and industries where demand is relatively predictable and not too sensitive to the wider economy, just in case an unexpected slowdown is coming around the corner in the US.

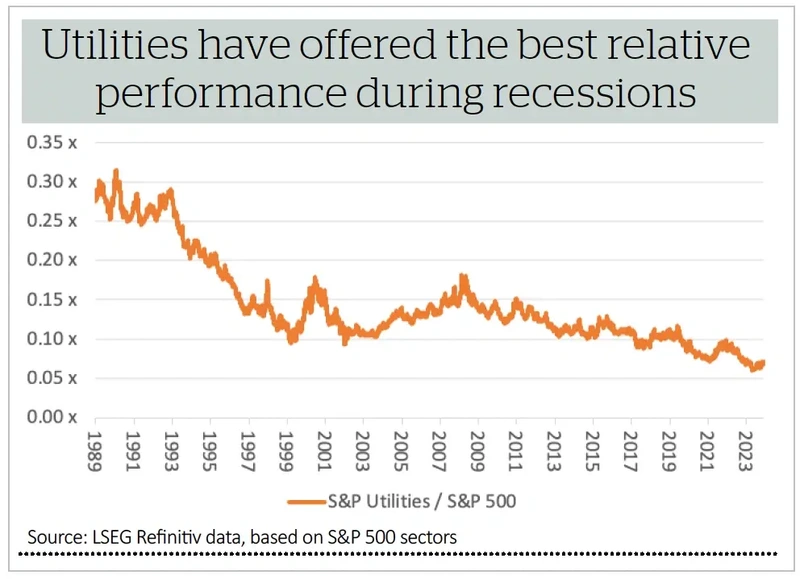

The long-term chart for Utilities’ performance relative to the S&P 500 remains ugly, but it is worth noting how the sector’s defensive, economically insensitive characteristics enabled it to outperform during 1990-92, 2000-02 and 2007-08, just as the US entered a recession or encountered some form of financial market meltdown, or both.

BEST OF BRITISH

The presence of Financials among the leaders offers some reassurance, as does how every US sector is still in positive territory this year, but the presence of Consumer Staples and Telecoms in the top five is not necessarily what you would expect to see if investors were truly confident in America’s economic outlook.

According to the official data from the Office for National Statistics, the UK is emerging from the shallow recession suffered in the second half of 2023, but it is making heavy weather of doing so, if the UK equity market is to be believed. Again, relatively defensive sectors are to the fore, in the shape of Health Care, Consumer Staples and Telecoms. Materials and Energy are the laggards, just as they are in the US, and commodity price weakness could speak of nerves regarding the global economic outlook.

Utilities have fared less well on this side of the Atlantic, and that could be down to uncertainty over the new AMP8 regulatory cycle for water companies than begins in April 2025, especially as water and waste treatment services providers are still the subject of much public opprobrium over the quality of their services, the prices they charge and the bonuses they pay. Utilities were also the subject of windfall taxes when Tony Blair’s Labour Government took over in 1997 and investors may have taken some evasive action with this year’s election in mind.

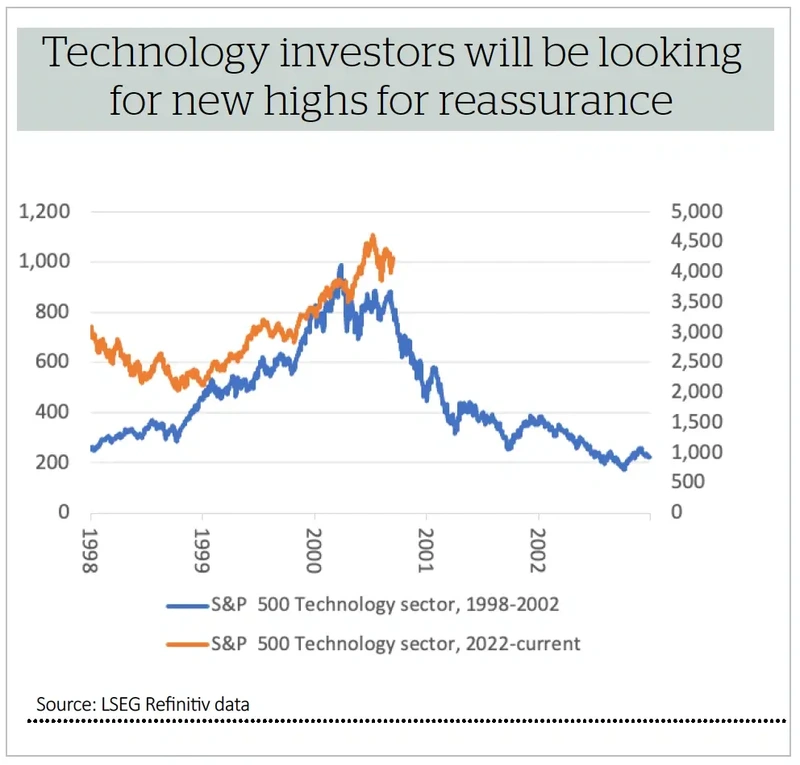

These trends could yet prove ephemeral, and sentiment could switch again – technology for one is unlikely to go down without a fight. If indeed summer’s ructions are the first signs of a top in the sector which, for the moment at least, peaked in mid-July there may be many attempted rallies before the bull market cracks, just as there were in 2000 when the tech bubble burst. The telling indicator back then was each rally failed to reach the prior peaks and that may be a trend to note this time around, too.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Feature

Great Ideas

Money Matters

My Portfolio

News

- Chinese economic data piles pressure on leadership to take bold steps

- Can Costco continue to deliver the goods?

- Shares in International Consolidated Airlines reach for the sky

- Building materials group SIG hits rock-bottom on weak European sales

- Intel rolls the dice on foundry spin out, but will it be enough?

magazine

magazine