Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Food-to-go leader Greggs continues to deliver on its growth promise

Greggs (GRG)

Buy at £29.79

Market Cap: £3 billion

Back in July we flagged food-on-the-go purveyor Greggs (GRG) as a mid-cap ‘star’ thanks to its ability to consistently grow its earnings at a double-digit rate and its attractive valuation.

The shares have put on a couple of pounds in the last couple of months, and although sales in July and August were slightly slower than expected, most likely due to the cold, damp weather at the start of the summer and further heavy rain in August, the company reported ‘stronger’ trading in September and has maintained its full-year outlook.

With cost-of-living pressures easing and interest rates falling consumers have more disposable income in their pockets, and we believe low-ticket discretionary spending stocks like Greggs will be among the first to experience a pick-up in sales.

THE RISE OF A HIGH-STREET HERO

We doubt Greggs needs much introduction, given the rising popularity of food-to-go and the firm’s presence across the UK retail landscape, but its is worth looking at how the brand has become so successful over the last five years.

While repeated lockdowns in 2020 briefly pushed the Newcastle-based company into a quarterly loss for the first time in its history, it managed to rebuild its earnings remarkably quickly and by the end of 2021 profits were almost back to pre-pandemic levels.

It achieved this by continuing to roll out new stores, including its first drive-through sites, and by setting up a delivery service across nearly 1,000 outlets or half its estate at the time, which proved hugely popular.

The firm also broadened its menu, introducing new vegan-friendly food and drink options, and rather than hunkering down it continued to invest in its production capacity in anticipation of a ‘return to normal’.

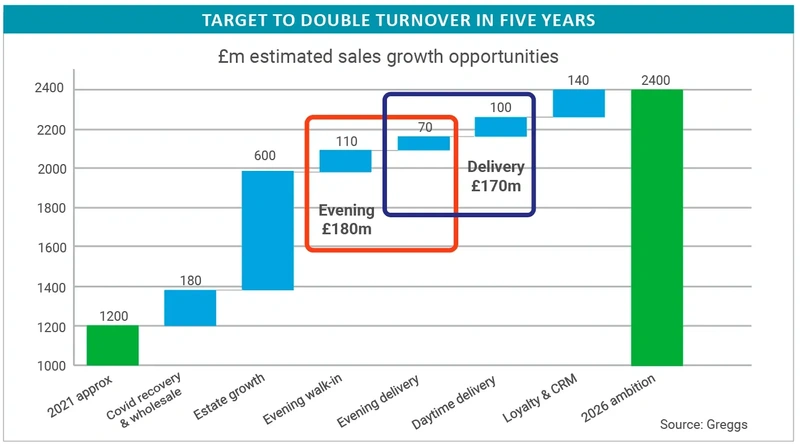

In late 2021, Greggs set out an ambitious plan to double sales to £2.4 billion by 2026 by increasing the pace of net store openings to around 150 per year, relocating some of its existing shops to better premises with multi-channel potential, extending trading into the evening, broadening its delivery service and expanding use of its app-based loyalty scheme.

DELIVERING ON ITS GROWTH STRATEGY

Just over half-way though the plan, the company shows no sign of slowing down – net store openings this year are expected to be between 140 and 160, including around 50 relocations, while sales for the first nine months are up 10.6% and on track to reach £2 billion by the year-end.

As well as extending its store network, the firm is improving the quality and using new formats, with two further drive-through outlets opened so far this year.

It is also continuing to invest in its production facilities, with a new chilled and ambient national distribution centre planned in Kettering, as well as in its supply chain and distribution centres to support its expanded branch network.

A new autumn menu has been rolled out with new hot products and more vegan items with a seasonal twist together with new over-ice drinks.

Also on a positive note, the firm says it now sees the overall level of cost inflation this year being towards the bottom end of its 4% to 5% range of expectations which we take to mean its operating margin may be higher than anticipated.

According to Stockopedia, consensus forecasts are for sales of £2 billion this year and £2.2 billion in 2025, suggesting the target of £2.4 billion by 2026 is within reach, while earnings per share are seen at 134p and 148p respectively, putting the shares on a 2025 PE (price to earnings) ratio of 20 times which is around the average of the last 30-odd years.

While Greggs isn’t considered an income story, existing shareholders have been well rewarded this year with a special dividend of 40p per share on top of a final 2023 dividend of 62p, an interim 2024 dividend of just under 20p (up from 16p last year) and a 15% gain in the share price.

With the popularity of its value-for-money offering, the investment in its store estate and supporting infrastructure, longer opening hours, delivery service and the data coming in from its loyalty scheme which it can use to target its marketing more effectively, we can see Greggs hitting its medium-term targets with ease, which should result in a re-rating of the shares over the next year or two.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine