Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

The merits of pursuing an equal-weighted strategy

As the leadership of the market has become ever more concentrated on just a handful of stocks there has been increasing interest in getting equal-weighted exposure to the markets.

But what does this mean and what are the pros and cons of products which adopt such an approach? An equal-weighted index is one where all the constituents have the same weighting, unlike most indices which are weighted by market valuation. Put simply, the latter set-up means the direction of the market is heavily tied to the biggest stocks.

People typically invest in broad market indices to achieve diversification but in an index like the S&P 500 or MSCI World, where just three stocks, Apple (AAPL:NASDAQ), Nvidia (NVDA:NASDAQ) and Microsoft (MSFT) have a weighting of around 14% and 19% respectively, their diversification needs arguably aren’t being fully met.

The combined weight of the top 10 holdings in the MSCI World Index is currently 25% of that index, the highest concentration in more than 40 years.

NEW PRODUCT LAUNCH

There aren’t a huge number of products to choose from in this category but global asset management firm Invesco recently launched the Invesco MSCI World Equal Weight UCITS ETF (MWEQ) which will track the MSCI World Equal Weighted Index.

The MSCI World Equal Weighted Index is constructed from the parent MSCI World Index by including the same constituent securities but equally weighting each company at each quarterly rebalance date rather than weighting securities by their float-adjusted market capitalisation.

The index comprises more than 1,400 stocks of large and mid-capitalisation companies across 23 developed markets.

Gary Buxton, head of EMEA (Europe, Middle East, and Africa) and APAC (Asia-Pacific) ETFs and indexed strategies at Invesco, says: ‘Our new ETF offers investors a sensible way to maintain broad exposure to global equity markets, but with reduced sensitivity to the performance of any individual company.

‘The MSCI World Equal Weighted Index is constructed from the parent MSCI World Index by including the same constituent securities but equally weighting each company at each quarterly rebalance date rather than weighting securities by their float-adjusted market capitalisation.’

SPREAD RISK AT THE STOCK LEVEL

Chris Mellor, head of EMEA equity ETF product management at Invesco told Shares: ‘Most investors instinctively think of an equal-weight approach as being a way to spread risk at the stock level.

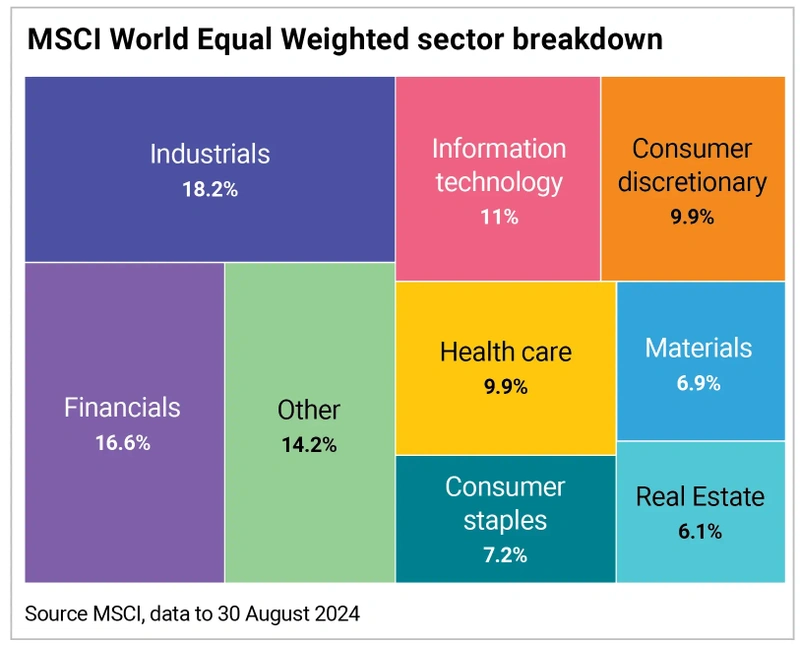

‘While that observation is completely valid, an ETF tracking the MSCI World Equal Weighted Index is also more balanced from a sector and geographic perspective. For instance, you end up with an allocation of around 42% to the US compared to over 70% in the standard index, and that allows you to capture increased exposure to Japan, the UK and other developed markets.’

The charges on Invesco’s new ETF are broadly in line with those of other equal-weight ETFs at 0.2% a year, the same as the iShares S&P 500 Equal Weight UCITS ETF (ISPE) and the Xtrackers S&P 500 Equal Weight ETF (XDWE).

Although an equal-weight ETF reduces exposure to single stock risk there are a few disadvantages.

Tom Bailey, head of ETF research at HANetf says there is the potential increased trading costs that rebalancing to equal weighting can incur. The MSCI World Equal Weighted Index has also underperformed over one-, three- and five-year periods compared to the MSCI World Index.

Over the past year, the MSCI World Equal Weighted Index has returned 18.2% compared to the MSCI World Index return of 25%. Over three years the former has returned 2.75% and the later 7.42% on an annualised basis.

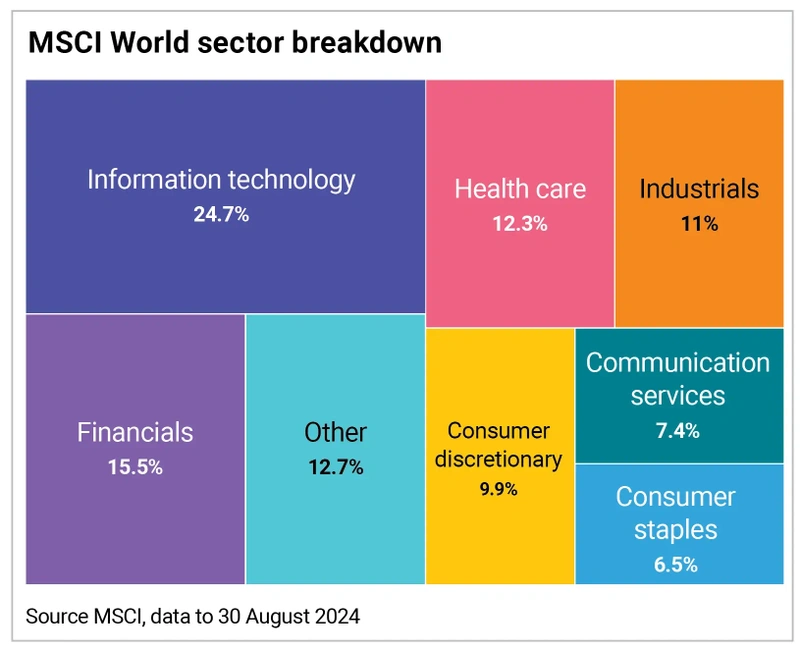

As Invesco’s Mellor observes, another key difference between the two indices is the country weightings. The US dominates the MSCI World, with a 71.6% weighting to the US, and only a 5.8% weighting to Japan. For the MSCI World Equal Weighted, US exposure is 42.5%, Japan represents 14.8% and 26.8% is accounted for by other countries. As the grahic shows the MSCI World Equal Weighted is also more diversified by sector.

Notably the dividend yield of the MSCI World Equal Weighted Index is 2.44% compared to 1.78% yield from the MSCI World and the former looks cheaper based on average valuation metrics, on a forecast price to earnings ratio of 15.7 times compared with 18.8 times for the traditional index.

Invesco’s Gary Buxton sees the demand for equal-weight ETFs will continue for the third quarter of 2024 as ‘questions over concentration are likely to persist’.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine