Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Reassessing the Scottish Mortgage investment case

This is the first time for a long time that Scottish Mortgage (SMT) has underperformed its FTSE All-World Index benchmark over five years, the timeframe the trust’s Baillie Gifford manager believes is most useful.

It might not be the case as you read this feature, such are the daily ebbs and flows of share prices and indexes, but it was in mid-October 2024. The three-year performance is far uglier, the share price off around 40% versus a near 30% gain for its benchmark. It’s been a particularly testing time for shareholders spoiled by prolonged spells of scorching returns.

Over the past decade (to 30 September 2024), for example, the share price has produced total returns of 282%, while NAV (net asset value) has increased 348%, versus 211% for the benchmark. In the 10 years to November 2021, at £15 all-time highs, the stock was showing a 10-year capital return of more than 1,000%.

Even Baillie Gifford director Stewart Heggie can’t remember the trust’s five-year returns underperforming, and that’s including during his 15 years as a discretionary fund manager before joining Baillie Gifford in 2019. But Heggie stresses the unique conditions during the post-pandemic years, when the shift to work-from-home and online everything started to run out of puff, inflation turned ugly, and interest rates surged.

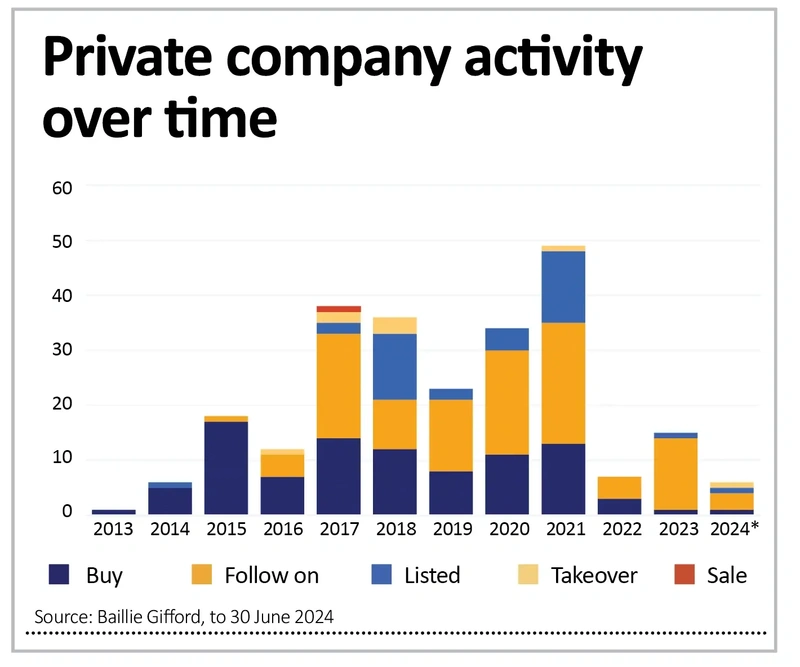

The trust has also suffered because it has a significant portfolio of private holdings, with a weak IPO market creating fewer opportunities to crystallise value.

INVESTMENT STRATEGY

Thousands of UK investors will be wondering, what now? To recap the trust’s pitch – Scottish Mortgage, run by Tom Slater and Lawrence Burns, aims to identify and back the world’s most exceptional growth companies, and, by doing so, deliver exceptional returns for shareholders over the long term. As with many things, it sounds simple yet is deceptively difficult to execute and investors must be willing to accept what might be called exceptional risk too.

But, the trust argues, it is an investment philosophy still capable of delivering ‘asymmetric’ returns, or in other words, has scope for unbounded upside versus capped downside.

In truth, share price performance is not always the best gauge over shorter-term spells, illustrated by the fact that many of the companies in which Scottish Mortgage owns its largest stakes have continued to post very decent operating metrics over the past three years.

The most obvious example is Nvidia (NVDA:NASDAQ). In June this was the trust’s largest single stake with a 9.4% weighting. Thanks to its pole position in AI (artificial intelligence) chips, it has seen revenues surge from $16.7 billion to nearly $61 billion between 2021 and 2024 (to 31 Jan), startling growth.

Operating profit and earnings have increased by 631% and 592% respectively, margins and returns on capital have continued to rise (albeit, not in straight lines) and free cash flows have surged 10-fold.

Yes, but Nvidia is an outlier, you might argue. However, it is just such outliers that are bread and butter to Scottish Mortgage. Nvidia’s stock has risen from $13 to $135 since the start of 2021. The trust first started buying Nvidia back in 2016 when the stock traded at around $1. Scottish Mortgage calculates its total return (to 30 September) at 8,591%.

Of course, yesterday’s profits offer little guidance to future returns, which in part explains why Scottish Mortgage has been aggressively recycling its Nvidia profits into new ideas, such as Latin American banking business Nu Holdings (NU:NYSE) and Hermès (RMS:EPA), the French luxury brand.

Nu Holdings, commonly known as Nubank, is a digital banking powerhouse, the trust describes, that has shaken up the traditional banking scene in Latin America. Hundreds of millions of people in Latin America are under- or un-banked. Nubank, led by its founder and chief executive David Vélez, is using technology to help change that.

Hermès is a luxury leading light, says Scottish Mortgage, with exceptional craftsmanship and timeless elegance. ‘This iconic brand, known for its exquisite leather goods, silk scarves and high-end jewellery, still has exceptional growth potential by captivating the hearts of the newly affluent and aspirational,’ the trust says.

As of 30 September 2024, Scottish Mortgage’s Nvidia stake was down to 4.1% of funds, still its fifth largest but far lighter than three months ago. The application of active management may help ease any investor concerns that Scottish Mortgage is merely resting on its laurels.

WHAT COULD SPARK THE STOCK

So far, 2024 has been a year of volatile performance, taking in peaks of more than 900p, and lows below 750p. At roughly 850p, as we write, the stock is about 8% higher than where it began 2024.

As we push through the final quarter of 2024, attention inevitably turns to what might enliven the share price through 2025 and beyond, and two clear reasons stand out: the discount and interest rates.

‘We now expect the Federal Funds target (upper) rate to fall to 4.5% by the end of this year, and to 3.5% by the end of 2025, and then to a neutral level of 3% by June 2026,’ said analysts at rating agency Fitch recently. They also admitted to being caught off guard by the Federal Reserve’s aggressive 50 basis point cut to 5% in September 2024.

With Scottish Mortgage’s focus on owning growth companies, the last couple of years have been a struggle. High interest rates act as a brake on these sorts of businesses as it raises the cost of capital, a vital source of growth funding. It also sees investors apply sharper discounts to tomorrow’s profits when so-called risk-free rates (government bonds) are more attractive.

But as rates come down, growth stocks should begin to become more popular with investors again, which will be good news for Scottish Mortgage.

A wider than usual discount also makes the shares in Scottish Mortgage appear more attractive, which should pull in new investment in the UK and, importantly, from abroad. Scottish Mortgage’s Stewart Heggie says the trust has been doing a lot of work with investors overseas, particularly in the US, an investment market seriously under tapped so far.

Scottish Mortgage shares are trading at a 13.7% discount to NAV (net asset value). In theory, this means investors can buy Scottish Mortgage stock for less than the trading value of its investee company stakes.

True, because of the perceived higher risks of the growth companies in which the trust invests, Scottish Mortgage shares typically trade at a discount, but the long-term average is significantly below what it is today.

The Scottish Mortgage team know this and have implemented measures to cut the discount. For example, the trust recently outlined plans to purchase ‘at least £1 billion’ worth of its own shares over the next two years, with that figure having already been exceeded and more to come as the trust tries to ‘facilitate trading around NAV in normal market conditions.’

So, there are a few reasons to think Scottish Mortgage shares will rise in the months and years ahead. It almost certainly won’t be a smooth run, volatility is inherent in the stock, yet this remains a clearly focused investment trust aiming to capture outlier returns amid market risk aversion from many of the largest investment themes around, such as AI, energy storage, digital commerce, and healthcare technology.

Shares believes this means share price performance will improve and could match the benchmark-beating returns of the past 10 years in the decade to come.

DISCLAIMER: The author of this article (Steven Frazer) owns a personal stake in Scottish Mortgage.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Feature

Great Ideas

Investment Trusts

News

- Why former stock market darling Fevertree Drinks has lost its fizz

- Baltic Classifieds is emulating Auto Trader and Rightmove in Eastern Europe

- What the narrowest corporate bond spreads in two decades mean for investors

- Budget likely to feature a raft of ‘stealth taxes’ to raise revenue

- The market is looking for Visa lawsuit clarity

magazine

magazine