Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Great value UK stocks: Where to find the biggest bargains

The fact the UK market is cheap relative to its international peers is hardly new news to anyone who has been investing for a few years, and the reason usually given is the UK doesn’t have the same exposure to growth stocks as markets like the US.

When the bulk of the gains in the S&P 500 over the last couple of years have been generated by just half a big tech dozen stocks, that argument does seem pretty valid, but it still doesn’t explain why the UK as a whole is so undervalued.

Thomas Moore, manager of investment trust abrdn Equity Income (AEI), believes the problem lies with low investor expectations: ‘The UK is one of the most lowly-valued markets in the world. Side by side, UK companies tend to trade at lower valuations than US companies of comparable quality.’

However, the flip side of the coin is low expectations can be an opportunity for investors who are willing to go against the flow, says Moore.

‘If expectations are high, there is a risk that everything has to go right to justify the valuation. Even a small miss can cause a major wobble. By contrast, there is a decent chance that expectations are low enough for UK companies that even a small improvement in their operations could drive a valuation re-rating.’

Alex Wright, manager of Fidelity Special Values (FSV), argues the better-than-anticipated performance of the UK economy, and corporate earnings which have proved resilient in a global context – giving companies the confidence to buy back their own shares or launch takeovers – will start to draw more investors to the market.

‘Given the relatively robust performance of UK companies, it has been a surprise that we have not started to see the valuation gap between the UK and other global markets close. For us, this demonstrates the strong opportunity for savvy investors willing to invest in the UK market today,’ adds Wright.

ARE FALLING RATES A TAILWIND?

Considering ‘value’ stocks outperformed ‘growth’ stocks as interest rates rose in 2022, the idea they will outperform as rates fall seems somewhat counter-intuitive.

Surely lower interest rates are better for long-duration ‘growth’ stocks, as a lower discount rate brings forward more of the earnings from future years?

Not so, says Simon Adler, global value equity manager at Schroders (SDR). ‘While many believe cheaper companies perform better when rates are high, history shows this is not the case and that value has worked across many different rate environments. Ultimately it is starting valuations that have the biggest impact on future returns, regardless of the level and direction of rates.’

Redwheel’s Ian Lance, manager of Temple Bar (TMPL), concurs, calling it ‘somewhat of a myth that value cannot perform when rates are coming down’.

‘If you take the three periods in the last 25 years when value did really well – 2000 to 2005, after the TMT (technology, media and telecom) bubble burst; 2008 to 2010 after the GFC (global financial crisis); and from 2020 to 2022 – they all occurred when rates were falling.’

Also, says Lance, what all three starting points had in common was “a market dislocation which increased the spread in valuations between the cheapest and most expensive parts of the market’.

‘With TMT it was “sell anything old economy no matter how cheap in order to buy tech as that’s where the growth is”; in the GFC it was “flight to quality” because some people thought the financial world was coming to an end; and during the pandemic it was “sell anything cyclical no matter how cheap as lockdown would lead to a perma-recession”. In all three cases, the unwind of these narratives led to spectacular gains for “value” stocks.’

And, as Simon Gergel, manager of UK equity income fund Merchants Trust (MRCH) points out, ‘value’ stocks ‘tend to be more economically sensitive and cyclical than the average company, as investors will often pay a premium for companies with steady and reliable cashflows and profits growth’.

Therefore, at a fundamental level, ‘value’ shares ‘may do better when interest rates fall, as lower borrowing costs should help support the economy, benefitting more cyclical businesses’.

However, says Gergel, ‘We don’t find the categorisation of “value” and “growth” shares particularly helpful. We prefer to think about individual companies and whether they are cheap compared to our assessment of their fundamental worth, or intrinsic value.

‘Some highly-priced shares may offer good value if the company’s prospects are strong, and many lowly-priced companies will not offer value. Buying a second-hand car for a low sticker price does not guarantee you are getting good value.’

WHAT IS ‘INTRINSIC VALUE’?

For abrdn’s Moore and his colleagues, understanding the drivers of a company’s cash flows – which are essential for the dividends they can expect to receive as shareholders – is fundamental to determining its ‘intrinsic value’.

‘We look to identify companies whose cash flows and dividends have not been properly factored into their share prices’, continues Moore.

‘One of our largest holdings, Imperial Brands (IMB), has a new management team who have focused on improving the delivery of cash flows by concentrating on core markets. This has resulted in a turnaround in its profitability, allowing both a generous dividend and a significant share buyback programme.

‘Added together, the dividend and buyback represent a mid-teens total distribution yield. At this pace, it would not be long before the entire market capitalisation of the company has been returned to shareholders.’

Gary Shannon and the team at Aurora Investment Trust (ARR) are also firm adherents to the concept of intrinsic value and use discounted cash flow models to measure what they believe companies could ultimately be worth.

Each model is unique to each business, and by using different assumptions and inputs the team can create a range of outcomes, including what they call a ‘stresses scenario’, and only if there is a substantial ‘margin of safety’ in the current valuation will they pull the trigger.

‘We invest in a way and build a portfolio that will deliver whatever happens, because it doesn’t rely on macro or global factors,’ says Shannon.

‘Cheap stocks today are as attractively priced as they have been over the last 50 years,’ comments Schroders’ Adler.

‘Very few areas of the equity market are at a discount to their own history, but the cheapest 20% of listed companies globally are trading at roughly 10 times normalised earnings compared to circa 12 times since 1970. History shows these levels of starting valuations are a good thing for subsequent returns.’

WHAT ARE THE MANAGERS BUYING?

Redwheel’s Lance sees the most value in cyclical sectors such as energy, financials, retail and media, and is encouraged the level of corporate takeovers and share buybacks this year, both of which have driven sizeable gains in some companies.

Aurora’s managers are bullish on UK housebuilders and own shares in both Barratt Redrow (BTRW) and Bellway (BWY).

‘With inflation continuing to moderate, and interest rates starting to decline, mortgage rates have lowered and there is an increase in demand for mortgages and house buying, so volumes and prices have started to rise.

‘None of these developments have changed our central expectations of what will happen, but they have removed downside risks. If the Government succeeds in raising new housebuilding output, it will increase the upside,’ observe the managers.

Merchant’s Gergel is finding interesting value opportunities within in a broad range of sectors, including cyclical industries like housebuilding and building materials, real estate and parts of retail, as well as more defensive industries like utilities, tobacco and healthcare.

Schroders’ Adler says he sees compelling ideas trading on big discounts ‘across consumer-facing businesses, health care and telecoms, where the market has become overly fearful on company prospects, allowing us to pick up companies for far less than their worth’.

One example is Molson-Corrs (TAP:NYSE), the US alcohol business with a global leading beverage franchise across several markets. ‘The firm trades on low double-digit normalised earnings and is backed by a strong balance sheet on top of a world-class brand with a loyal customer base,’ says Adler.

‘Elsewhere, we have large health care companies trading on big discounts as the market is worried about the patent pipelines, despite robust balance sheets, very healthy R&D (research and development) spend with proven track records of innovation.’

Asset Value Investors’ Joe Bauernfreund, manager of AVI Global Trust (AGT), says he looks for three main characteristics when assessing a business: ‘a durable franchise which is growing in value; deeply discounted valuations; and catalysts to unlock and grow value, which includes our own activism.’

‘As things stand, discounts across all parts of our universe are wide by historical standards and we have constructed a concentrated-yet-diverse portfolio of companies with idiosyncratic catalysts and events to drive returns.

‘We believe this stands us in good stead, whatever the weather, with our largest holdings in (Belgian car parts distributor) D’Ieteren (DIE:EBR), News Corp (NWS:NASDAQ) and Chrysalis (CHRY) indicative of this approach.’

LARGE-CAP VALUE PLAY

Rio Tinto – Price: £49.85 – Market cap: £84.6 billion

Poor sentiment around China has put a dent in Rio Tinto’s (RIO) share price in 2024 but we see long-term value in the mining giant.

The company is currently heavily dependent on iron ore for profit and revenue, with Chinese demand key here. However, it is expanding its copper footprint and this metal is likely to be in heavy demand thanks to the energy transition. Output from its Oyu Tolgoi copper mine in Mongolia is expected to hit half a million tonnes a year by 2028 – which would make it the fourth biggest copper mine anywhere in the world.

The company is also developing new ways of processing copper through its Nuton unit which can increase levels of copper extraction.

Current CEO Jakob Stausholm has been confronted with some material ESG (environmental, social and governance) challenges from the beginning of his tenure. His response means the company could be ahead of its peers in an area which is increasingly relevant thanks to the role miners have to play in the transition.

To quote Jefferies analyst Christopher LaFemina: ‘We believe that Rio is defensively positioned at this point, given its low production costs, strong balance sheet, and significant capital returns.’

Based on consensus forecasts Rio is on a 2025 price to earnings ratio of 9.6 times and offers a dividend yield of 6.1%. Given the generous dividends, investors are being paid to wait for the shares to return to their long-term average rating of around 12 times earnings. [TS]

MID-CAP VALUE PLAY

Inchcape (INCH) – Price: 786.5p – Market cap: £3.2 billion

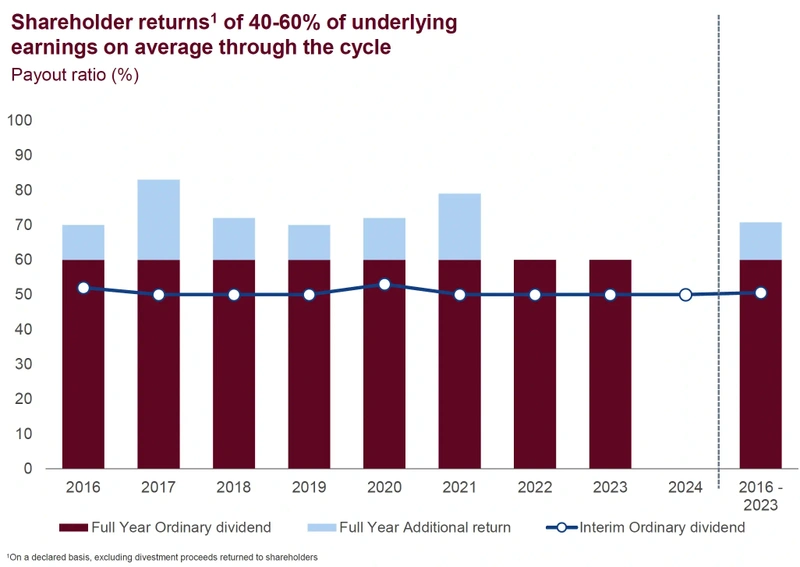

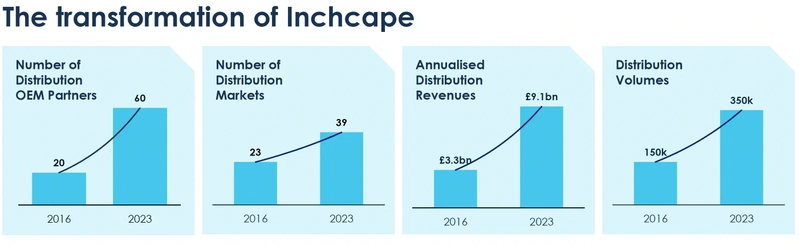

The stock market is undervaluing global automotive distributor Inchcape (INCH), whose stubborn PE (price to earnings) discount to historical valuation ranges and attractive 4.3% dividend yield imply significant re-rating scope.

Having recently sold its UK retail operations for £346 million to Group 1 Automotive, the FTSE 250 company is now a focused automotive distribution business with structurally better margins, higher returns, superior cash generation and a strengthened balance sheet to boot.

As a pure-play global vehicle distributor, the £3.2 billion cap is in pole position to profit from increased vehicle ownership, outsourcing by OEMs (original equipment manufacturers) as well as its weighting towards emerging markets offering faster growth and higher margins.

Exposure to developing regions does entail a greater risk of earnings instability, but operations in over 40 markets diversify this risk for the Duncan Tait-steered group.

Selling brands ranging from Toyota, Jaguar and Land Rover to Mercedes-Benz, Volkswagen, Porsche and Subaru, Inchcape has prudently guided for ‘moderated’ growth in the current calendar year, but cyclical upswings in key regions and territories and the likelihood of new distribution contract wins suggest there’s upside risk to forecasts.

Furthermore, cash generative Inchcape’s increased £150 million buyback should boost EPS (earnings per share) and the company has the firepower for further acquisitions in fragmented end-markets.

For the year to December 2024, analysts at Berenberg forecast a pre-tax profit of £470 million and EPS of 75p, revving up to £518 million and 87p respectively in 2025.

Those estimates place the shares on an undemanding forward PE of 10.5 times falling to just nine times on next year’s numbers. Inchcape is scheduled to motor in with a third quarter update on 24 October. [JC]

SMALL-CAP VALUE PLAY

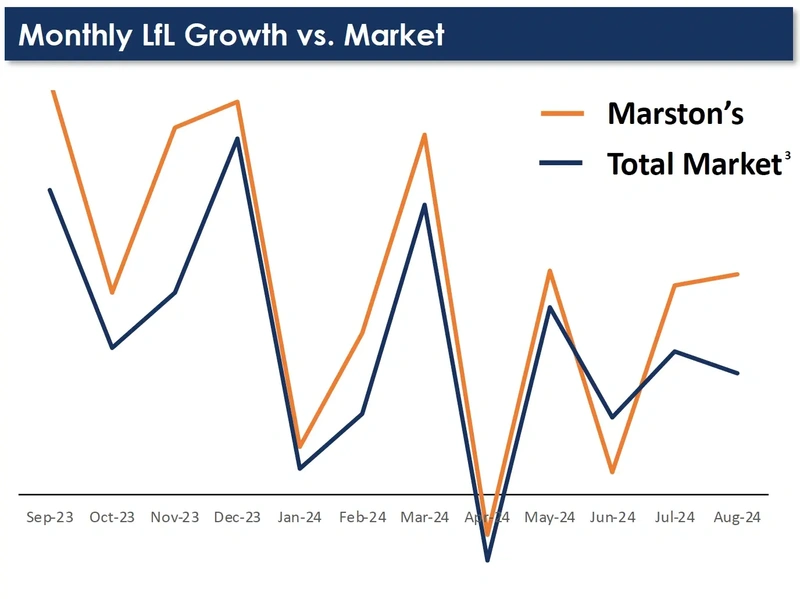

Marston’s (MARS) – Price: 43.2p – Market Cap: £283.9 million

Pubs group Marston’s (MARS) sits on a miserly five times consensus earnings forecasts for 2025 EPS (earnings per share) and trades on half book value, representing a great value opportunity for long-term, patient investors.

At an investor day on 16 October, management revealed plans to drive a high-margin, highly cash generative pure-play local pub business, capable of delivering over £50 million of annual free cash flow and margin expansion.

This represents a free cash flow yield of 17.6% which speaks to the value on offer.

The large £300 million reduction in net debt following Marston’s sale of its joint venture with Danish brewer Carlsberg (CARL-B:CPH) leaves it well placed to benefit from equity transfer.

That is, as debt is reduced, more of the underlying profit and cash flow is transferred to shareholders from debt holders.

Shore Capital’s leisure analyst Greg Johnson points out Marton’s has no bank debt, while improved profitability means cash flow is now ‘comfortably’ above scheduled bond repayments.

This provides the company with increased balance sheet flexibility and optionality, supported by the potential for an upward revision to the year-end (30 September) property valuation. At the end of March, the estate was valued at £2.1 billion.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Feature

Great Ideas

Investment Trusts

News

- Why former stock market darling Fevertree Drinks has lost its fizz

- Baltic Classifieds is emulating Auto Trader and Rightmove in Eastern Europe

- What the narrowest corporate bond spreads in two decades mean for investors

- Budget likely to feature a raft of ‘stealth taxes’ to raise revenue

- The market is looking for Visa lawsuit clarity

magazine

magazine