Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Falling oil and share prices may be lulling investors into a false sense of security

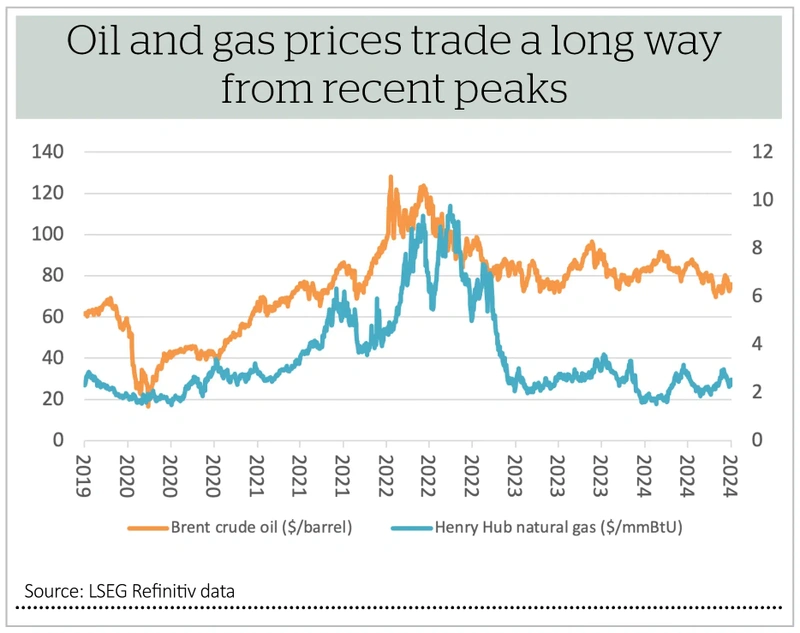

Equity markets are buoyant, fixed income markets seem more nervous judging by the way yields are rising (at least for government-issued in the developed West), and commodity prices continue to march to their own beat, with gold and silver surging, industrial metals largely flat and oil and gas remaining subdued.

The relative calm pervading hydrocarbon prices is in many ways surprising, given the ongoing war in Ukraine and Russia’s role as a top-three supplier worldwide together with heightened tensions in the Middle East.

There are clearly far more important, humanitarian issues at stake in both conflicts, but from the narrow perspective of financial markets investors must pay attention, too, especially because of oil and gas.

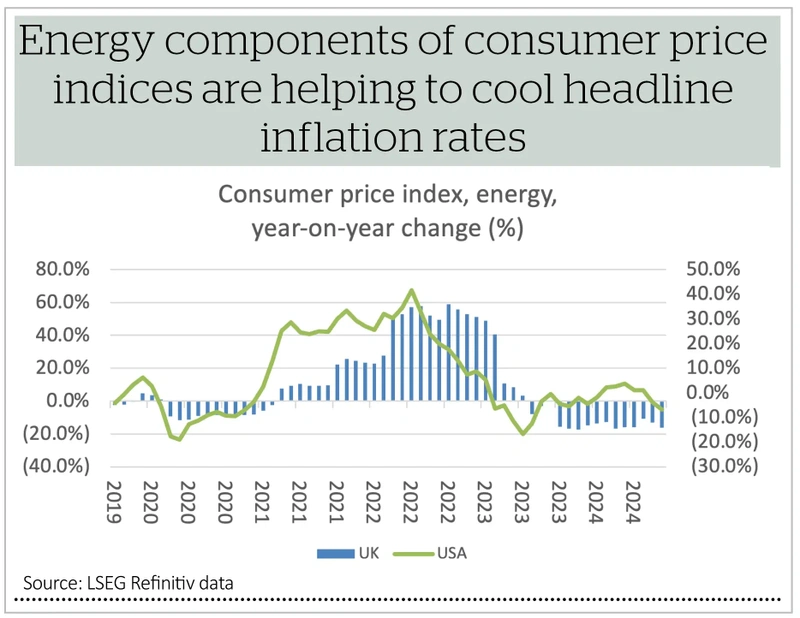

The equity markets’ preferred scenario of cooling inflation, a soft landing for Western economies and falling interest rates from central banks is playing out to perfection, such that the S&P 500 and NASDAQ Composite in the US, the DAX and MIB-30 in Europe, and even the benighted FTSE 100 trade at or very close to multi-year or even all-time highs.

Weakness in energy prices is a key part of this, as it is feeding into lower inflation meaning any resurgence in hydrocarbon prices could lead to an upset.

Therefore, as part of any risk management process, it is surely worth assessing the key sensitivities here.

THE BEAR CASE FOR PRICES

Near-term sentiment toward oil and gas prices remains broadly negative for three reasons.

The International Energy Agency (IEA) continues to assert that demand growth remains anaemic, thanks to China in particular. It argues demand will increase by less than one million barrels per day on average in 2024, a marked slowdown from the two-million-plus pace seen post-pandemic in 2022 and 2023. OPEC has also just cut its demand growth forecasts for this year and next, although it is more optimistic than the IEA with a forecast of 1.4 million barrels per day for 2024 and 1.6 million barrels per day for 2025.

The IEA also argues supply is plentiful, even allowing for tensions in the Middle East and output disruptions in Libya thanks to the febrile political situation there. OPEC+ continues to restrain capacity too, meaning there is scope for increased supply here. Meanwhile, American output continues to surge and stands near record highs of 13.2 million barrels per day, thanks to shale, so OPEC+ is not the only game in town.

Israel has promised not to target Iranian oil facilities in any attacks. The Kharg Island terminal is particularly important to the region as it ships 1.6 million barrels of oil per day or just under 1.5% of total global demand.

Overlaying of all of this is the long-term issue of the global transition toward more renewable sources of energy and away from hydrocarbons which should, in theory, dampen demand for oil in particular.

THE BULL CASE

Central bankers, politicians and consumers will doubtless all be hoping the previous prognosis proves correct and energy prices remain contained, as may environmental campaigners.

Only oil company executives and shareholders may be less pleased, and in the case of the latter they will note the S&P Global 1200 Energy sector is back down to just 3.8% of total S&P Global 1200 market capitalisation. Indeed, the energy sector’s entire market cap of $2.7 trillion is less than that of Apple (AAPL:NASDAQ), Nvidia (NVDA:NASDAQ) or Microsoft (MSFT:NASDAQ).

However, it could be unwise to write off oil just yet, also for three reasons.

Demand continues to grow – even if the IEA and OPEC expect less growth than before, the globe continues to rely heavily on hydrocarbons.

Even though we continue to consume more oil and gas, drilling activity remains subdued thanks to the pricing environment and the combination of political and public pressure. If demand does stay more robust for longer than expected, then supply may not be as adequate as we would like to hope.

The US Strategic Petroleum Reserve (SPR) is still diminished at 385 million barrels, way below its 714-million-barrel capacity, after the Biden administration’s liquidation of assets to try and cap fuel and gasoline prices for US consumers. At some stage it would make sense to top this back up, especially at a time when energy supply could be a matter of national security.

Moreover, the OVX index, which measures anticipated oil market volatility just as the VIX index does for stock markets, trades at 47, well above its historic average of 37. That suggests oil traders remain on a state of high alert, even if equity prices are not putting much, if anything, of a geopolitical premium on hydrocarbon prices. Let’s just hope this complacency doesn’t lead to shocks further down the road.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Ask Rachel

Editor's View

Feature

Great Ideas

My Portfolio

News

- Bloomsbury shares touch all-time high as sales of fantasy novels soar

- Kooth shares plummet after US pilot trial terminated

- Lloyds Bank shares tumble 10% on motor commissions court ruling

- Tesla stock makes largest one-day jump since 2011

- Trainline issues second profit upgrade in two months

- Budget 2024: AIM rallies as infrastructure and hospitality firms toast measures

magazine

magazine