Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

What to expect in 2025

Predicting what will happen to the global economy and markets over the next 12 months is hard enough at the best of times, but with Trump’s election victory on 5 November that job has become even more difficult.

As Deutsche Bank’s head of global economics and thematics Jim Reid put it, the outlook is no longer ‘business as usual’ which opens up a much wider range of potential outcomes for the global economy and financial markets.

Trump’s habit of making up policy on-the-hoof means we really are in unknown territory as far as a whole host of issues goes but in this article we aim to bring some clarity to the key themes which could dominate in 2025.

WILL BITCOIN GET TO $200,000 in 2025?

Cryptocurrencies grabbed investors’ attention once again in 2024 with poster child Bitcoin smashing through the $100,000 level for the first time on 5 December.

Bernstein has forecast the cryptocurrency could get to $200,000 in 2025 with the vocal support from US president Donald Trump and some of his key cabinet picks a major factor. The establishment of a national Bitcoin reserve could be a significant catalyst.

However, this asset class has proved unpredictable and volatile in the past so it would be dangerous to look at Bitcoin as a ‘one-way bet’.

Cryptocurrencies will push themselves further into the mainstream in 2025 as ‘investor sentiment toward crypto assets reach a turning point’ says Dovile Silenskyte, director, digital assets research at ETF provider WisdomTree.

‘This movement reflects growing confidence in the long-term potential of cryptocurrencies and a deeper recognition of crypto as a valuable tool for portfolio diversification,’ adds Silenskyte.

The FCA (Financial Conduct Authority) is looking at the regulation of the cryptocurrency market with around 12% of UK adults now owning crypto and 93% aware of it. Currently it is not possible for UK investors to buy exchange-traded funds tracking cryptocurrencies. [SG]

WILL THE REALITY LIVE UP TO TRUMP’S RHETORIC ON TARIFFS?

A big factor which will drive the direction of markets in 2025 is the extent to which Donald Trump’s rhetoric on tariffs translates into action – is it simply a negotiating stance or a genuine programme for government?

Taken at his word, the impact on the global economy could be dramatic but what Trump says and what he ends up doing could be two different things.

The problem for market sentiment is the threat of tariffs could hang over investors like a sword of Damocles with, as Deutsche Bank observes, Trump’s unpredictability resulting in a situation where we will only find out in real time how he balances different priorities in office.

There may be a measure of clarity after Trump’s inauguration, particularly if he delivers on a recent promise to introduce 25% tariffs on Mexico and Canada and increase tariffs on China by 10% on day one of his presidency.

This pledge came just after the unveiling of Scott Bessent as Treasury secretary pick for the new administration.

It had been hoped this selection signalled a greater measure of pragmatism on tariffs – Bessent commented earlier in 2024 that ‘the tariff gun will always be loaded and on the table but rarely discharged’.

On the campaign trail, Trump floated the idea of a 60% tariff on goods from China and a blanket tariff upwards of 10% on all imports into the US as part of a drive to boost domestic manufacturing and raise cash to support government spending elsewhere.

The devil may well be in the detail, with the specifics of tariff applications – countries, products, magnitude, and exclusion – significantly impacting corporate margins and stock valuations.

If tariffs are introduced on anything like the scale promised, they would likely prompt tit-for-tat responses from outside the US and put upward pressure on inflation.

Asset manager Pictet says: ‘Our assumption is that roughly 50% of what Donald Trump proposed during the election campaign will be implemented. The four key policy areas to monitor are: trade, taxation, immigration and deregulation. Their combined overall impact over the next four years should be inflationary although tax cuts and deregulation will boost sentiment and growth.

‘So far, the market has only priced in “Good Trump” i.e., deregulation and tax cuts. However, two big tail risks are underpriced: an all-out global trade war and a surge in bond yields due to concerns around the US deficit and/or the economy overheating.’

Similarly, Robeco argues: ‘We think Trump will mainly use the tariff threat as a bargaining chip and that it will be toned down in practice. Yet, when implemented, these tariffs still act as a tax on the domestic consumer (cooling consumption from above-trend levels). In addition, restrained immigration (we don’t envisage mass deportation) could also prompt higher inflation.’

Deutsche Bank’s economists currently expect core PCE inflation, the Federal Reserve’s preferred measure, to remain at or above 2.5% over the next two years.

This, in turn, is expected to lead the Fed to halt rate cuts: Deutsche Bank sees US rates at 4.375% by the end of 2025 and remaining above 4% through the whole of 2026, a striking prediction given the investment bank had seen rates dropping below 4% in 2024 this time last year. The consensus does expect a greater volume of cuts for now, as the chart shows.

This backdrop is likely to be supportive to the dollar, which has already enjoyed a big Trump-inspired rally. Swiss private bank Lombard Odier says: ‘The US dollar will likely emerge as a beneficiary of the new Trump administration and its policy priorities in 2025.’

That in turn could pressure on commodity prices although Lombard Odier thinks gold could be an exception. ‘Lower central bank rates reduce the opportunity cost of holding gold as a non-yielding asset. Central bank buying to diversify reserves from dollars, in part as a response to geopolitical developments, should also keep supporting gold prices. A stronger US dollar is a headwind for gold, but we do not think it will prevent individual investors increasing investment flows into gold.’

In terms of the impact of tariffs on Europe, asset manager Fidelity estimates a partial implementation of the tariffs floated by Republicans would knock as much as half a percentage point off German and Eurozone GDP. [TS]

WILL 'MADE IN AMERICA' POLICIES LIFT US SMALL CAPS

The Russell 2000 index of US smaller companies has already outperformed its large-cap S&P 500 counterpart since Trump’s election victory in anticipation of his policies, like tariffs on overseas goods and tax cuts, being supportive.

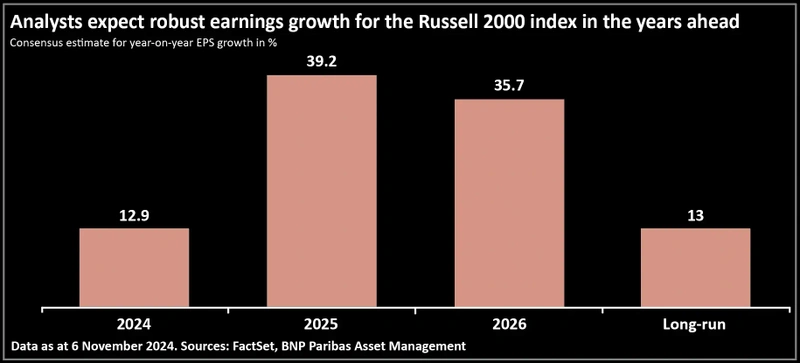

BNP Paribas note consensus forecasts are for this part of the market to deliver 30% earnings growth in 2025 and 2026 while also highlighting that valuations are low relative to those for their large-cap counterparts.

The investment bank comments: ‘For decades after China’s admission to the World Trade Organisation (WTO) in 2001, US companies were focused on outsourcing production to lower-cost nations to improve profits. Industrial production stagnated in the US, while it rose sharply in China.

‘We see potential for that trend to reverse in the coming years. During the pandemic, having supply chains and manufacturing far from home created difficulties for US firms and many are looking to ‘re-shore’ production.

‘Rising geopolitical tensions and protectionism are other catalysts, abetted by the financial support from the federal government’s CHIPS Act and the Infrastructure Investment and Jobs Act.

‘We believe a multi-year cycle of capital expenditure driven by re-shoring initiatives lies ahead. US small caps should benefit from this trend as they are more levered to domestic investment and economic cycles.’ [SG]

WILL THE AI THEME SHIFT IN 2025?

If it sounds like AI (artificial intelligence) has dominated the stock market conversation for ages, remember, it was only two years ago that OpenAI launched ChatGPT (November 2022). Back then you could have snapped up shares in AI chip poster child Nvidia (NVDA:NASDAQ) for less than $17. What a gift, yet they didn’t look like it then, trading on forward PE (price to earnings) of 44.

That led to some talk last year of an AI bubble, yet Nvidia’s earnings have ballooned 10-fold since full year 2023 (to January), if market forecasts are right for 2025, a measure of just how early on the AI journey we are, how quickly things can change, and how making the rights long-run calls can hand investors huge pay offs.

There have been other winners – Palantir (PLTR:NASDAQ) jumped 300% plus, beating even Nvidia’s 191% – but many investment experts, including Blue Whale Growth’s (BD6PG78) Stephen Yiu still believe the best returns next year will remain concentrated around infrastructure plays, such Nvidia, Broadcom (AVGO:NASDAQ), TSMC (2330:TPE) and Applied Materials (AMAT:NASDAQ), for example.

‘AI infrastructure is the foundation of future economic expansion,’ says Nigel Green of DeVere Financial Advisory, and so the likely leaders of market returns.

The challenge for 2025 is for AI to broaden out, something Morningstar analysts predict as GPU (graphics processing unit) capacity starts to catch-up with demand, allowing corporates greater freedom to embed AI tools into existing products and services.

‘Those companies that drive revenue and/or expand operating margins will not only provide earnings growth today but will help those companies to either dig or widen their economic moats to bolster returns on invested capital for years to come,’ says Morningstar’s Dan Kemp.

BlackRock expects the AI boom to continue to boost US stocks and economic growth next year as the theme broadens out, at odds with those that call US markets and tech stocks expensive.

It is hard to argue that the US is at the centre of AI innovation, a hegemony that restrictions on China and few European bleeding edge specialists are unlikely to challenge. Private markets could also play a crucial role through 2025 in funding innovation and development.

‘We stay risk-on and go further overweight US stocks as the AI theme broadens out,’ BlackRock says. [SF]

ARE US SHARES TOO CONCENTRATED AND EXPENSIVE?

US stocks outpaced the rest of the world again in 2024 with the S&P 500 index bursting through the 6,000 barrier thanks to the strong performance of AI boom beneficiaries and the prospect of lower interest rates. Federated Hermes has raised its year-end target from 6,000 to 7,000, though Morningstar cautions US valuations are ‘expensive based on our stock-level valuation models and top-down expected return estimates’.

Goldman Sachs Asset Management observes the US equity market is near its highest level of concentration in 100 years and warns investors this level of mega-cap market dominance is not sustainable: ‘With the performance of the S&P 500 index strongly dependent on the prospects of a small number of stocks, passive allocations to US large cap indices may pose risks to broader portfolios.’

Heading into 2025, skittish investors could look to regions outside the US to achieve better risk-adjusted returns, but Fidelity International’s Niamh Brodie-Machura believes US stocks will outperform the rest of the developed world on earnings. ‘A landmark Republican election victory is likely to reinforce American exceptionalism,’ says Brodie-Machura. ‘Even before November’s poll, we expected US corporate earnings to increase by 14% in 2025, beating most other regions and the global average in terms of growth, return-on-equity, and the level of net debt. The election has fanned optimism in the market that the coming year will prove pro-business, pro-growth, and pro-innovation.’ Nevertheless, the Fidelity sage stresses investors will have to be ‘more discerning in where they look this year’. [JC]

IS THE UK MARKET WELL-PLACED FOR 2025?

With a small manufacturing sector, the UK is less vulnerable to tariffs than other countries so the main drivers for the market next year are likely to be inflation and interest rates.

The Bank of England may cut rates more slowly than other central banks as the OBR (Office for Budget Responsibility) is forecasting a 0.5% rise in inflation to 2.6% as a result of Budget policies, with changes to employers’ NICs (national insurance contributions) in particular meaning the price of some goods and services will remain ‘sticky’.

Economic growth is seen accelerating to 2% in 2025 from 1% this year thanks to the large, sustained increase in spending, taxation and borrowing delivered in the Budget, before slowing to 1.5% in future years.

Net public borrowing is expected to increase by an average of £32 billion in each of the next five years, which the OBR described as ‘one of largest fiscal loosenings in recent decades’, as current and capital spending of roughly £70 billion is offset by tax policies which raise revenue by around £36 billion per year.

Real household disposable income is expected to rise by an above-average 1.25% in 2025 due to wage increases, before stalling for two years as wage growth slows and taxes increase.

This, together with falling interest and mortgage rates, paints a relatively positive picture for UK consumption, so discretionary spending on small-ticket items should remain fairly resilient next year.

Turning to forecasts for the market, Pictet Asset management’s chief strategist Luca Paolini believes the UK is a ‘cheap stagflation play’ where banks, utilities and small-caps should do well next year, and he is bullish on gilts and short-dated corporate bonds.

Analysts at Morningstar argue on a stock-level basis and a top-down basis investors will get better risk-adjusted returns from the UK than the US next year with small-caps offering greater value than large-caps.

Housebuilders top their list of sector calls, having been ‘through the wringer’ due to the pandemic: the team sees as much as 50% potential upside thanks to lower mortgage rates and supportive government policy. [IC]

DISCLAIMER: Steven Frazer, who contributed to this article, has a holding in Blue Whale Growth.

WILL INVESTMENT TRUST CONSOLIDATION CONTINUE AND WILL DISCOUNTS NARROW?

2024 proved to be a record year for M&A (mergers and acquisitions) across the investment trust sector against a backdrop of stubbornly-wide NAV (net asset value) discounts and increasing pressure on sub-scale funds. Consolidation is the dominant theme in investment trusts and is accelerating as boards heed shareholders including wealth managers who want larger, more liquid and cost-effective trusts that can hopefully deliver better returns.

With activists also sniffing around the sector, analysts believe this mergers trend is only set to continue in 2025, though negative consequences are that some good strategies will go to the wall next year in this process of creative destruction and choice for investors will be reduced.

Culling the supply of investment company shares, alongside consolidation, should help narrow discounts, which sat at a historically wide at 15.3% at the end of November 2024 but have narrowed over the last year as interest rate cuts got underway and the Trump trade boosted performance towards the end of 2024. Helpfully, the cost disclosure rules have been suspended, with new rules being implemented next year, which should hopefully help to narrow stubbornly wide discounts in 2025.

In terms of REITs (real estate investment trusts), the commercial real estate market has seen valuations stabilise and actually increase slightly in 2024, and experts expect this trend to continue in 2025 along with rising rents. The catalyst for a re-rating, however, lies with lower gilt yields which will depend on the speed with which the Bank of England reduces interest rates. [JC]

FROM CURRENCIES TO STOCKS AND COMMODITIES, SAXO BANK'S OUTRAGEOUS PREDICTIONS FOR 2025

Just to add some spice to our outlook feature, we always like to include Saxo Bank’s annual ‘outrageous predictions’, which are a series of events that, while they are pretty unlikely to happen, ‘would send shockwaves across financial markets’ if they did.

The first prediction, which is fairly outrageous but can’t be discounted, is that incoming president Donald Trump tanks the US dollar due a combination of tariffs, inflation and budget cuts.

As companies scramble to find alternatives means of payment, cryptocurrencies and gold soar even further against the dollar.

The only upside is for firms who have reshored production to the US and gain an advantage from the weak dollar.

While on the topic of currencies, Saxo predicts sterling will rise above the €1.27 level to recoup all its ‘Brexit discount’.

‘Fresh fiscal policy winds are blowing in the UK, where the new UK Labour government announced budget priorities ahead of 2025 that avoided the most growth-damaging types of tax hikes on income, while trimming the least productive public sector spending in moving to shrinking its deficits’, suggests the bank.

This encourages domestic demand and investment and sees UK markets post a ‘strong’ performance next year.

Meanwhile, the share price of Nvidia (NVDA:NASDAQ) could be ‘supercharged’ as availability improves for its Blackwell chip which is capable of driving a 25-fold increase in AI calculations per unit of energy consumed over the prior generation of chips.

With Nvidia becoming the most profitable company of all time, and its market value becoming double that of Apple, the company could attract regulatory scrutiny and attempts to break up its quasi-monopoly.

As climate change breeds more devastating weather events in the US, the bank predicts a large insurance company will fail for the first time as insured losses spiral to ‘many multiples’ of the $40 billion caused by Hurricane Katrina.

One US insurer, which has seriously underpriced policies in the affected region, finds it has insufficient reserves or reinsurance in place causing panic across the industry.

As the government moves to avoid contagion, Berkshire Hathaway (BRK.B:NYSE) sails serenely on and uses its surplus capital to gain market share.

Lastly, the bank sees OPEC collapsing as sales of gasoline and diesel decrease around the world and its multi-million barrel per day production cuts become an irrelevance.

‘With some members already cheating production quotas to grab what income they can and export demand falling, a majority quickly realise the jig is up.’

Amidst the in-fighting, key members leave the organisation and max out production to ensure market share, driving a large drop in oil prices, to the benefit of airlines and manufacturers but leading to the closure of expensive shale oil production in the US.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Feature

Great Ideas

Money Matters

News

- Can Chemring profit play catch-up after slow start to the year?

- Why Rolex seller Watches of Switzerland has clocked up a 40% gain in six months

- China eases monetary policy ahead of Trump 2.0 and global tariff war

- Budget impact on UK firms tops £1 billion as hiring slows

- Frasers shares down 30% year-to-date as Budget blues bite

magazine

magazine