Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Gold stakes its claim to be a glittering prize

This year’s record highs in the US, UK and German stock markets continue to make headlines, but another, much more unsung asset is also breaking new ground and that is gold, which is trading above $2,900 an ounce for the first time this week.

Gold’s 46% surge in the past year has even outpaced four of the so-called Magnificent Seven, despite markets’ ongoing fascination with technology stocks and all things AI-related, and apparent disinterest in the precious metal.

The $3,000 mark beckons. On past form, the metal may try and fail to pass that psychological threshold on more than one occasion before kicking on (assuming it makes the breakthrough at all) and this may give investors chance to think about why gold stands where it does and what needs to happen for its trajectory to continue – or change.

ALIVE AND KICKING

It still feels unfashionable to focus on gold, and it is easy to dismiss the case for including the precious metal in even the most balanced of portfolios.

As Warren Buffett succinctly put it in a speech, he gave at Harvard in 1998: ‘Gold gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.’

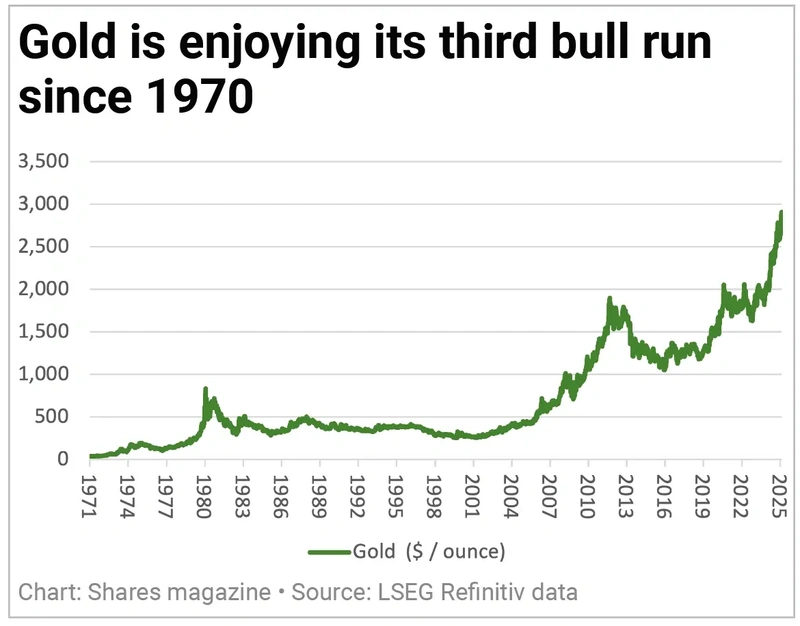

Yet, unusually, the market is shrugging off the Sage of Omaha’s words of wisdom and embracing gold instead in what seems to be the precious metal’s third major bull market since 1970.

The first came in the wake of president Richard M. Nixon’s decision to withdraw America from the gold standard in 1971. That move pulled down the curtain on the Bretton Woods monetary system that had prevailed since the end of the Second World War and ushered in a period of both unfettered government spending and inflation, the latter stoked in by two oil price shocks thanks to unrest in the Middle East. Central banks were slow to respond to inflation and the US Federal Reserve, for one, under Arthur Burns, cut interest rates too early and unleashed a second wave of inflation. The result was a surge in gold from $35 an ounce in 1971 to a peak above $700 in late 1980.

The second came in the early part of this millennium. Again, the narrative focused upon how central banks had lost control of the narrative, as they left interest rates too low for too long after the bursting of the technology, media and telecoms bubble in 2000. Free and easy money, and loose regulation, facilitated a frenzy in property and complex, real estate-related debt instruments that turned into a crushing bust. Western central banks had to cut interest rates to zero and launch both a range of unorthodox monetary policies and acronyms, including QE (quantitative easing). Investors looked for haven amid the bank bail-out and central bank balance sheet expansion and found it in gold, which romped from barely $250 an ounce in 2001 to a new high of almost $1,800 by early 2021.

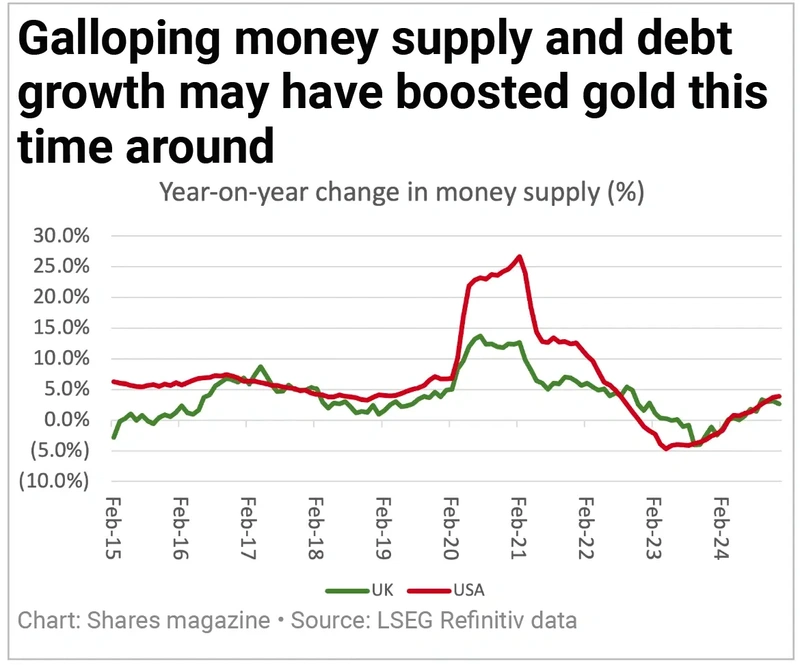

Now we have what looks like a third era in which gold is really starting to shine. The metal dipped below $1,200 an ounce in late 2018 but has since marched inexorably higher. Covid-19, and more QE, more interest rate cuts and above all more government deficit accumulation all combined to persuade investors to warm to gold once more, as supply of the metal grew so much more slowly than the supply of money. Inflation spiked, central banks looked to be behind the curve as they raised interest rates too slowly and fiscal incontinence sparked worries that the authorities would have to try and keep headline rates low to help government service their soaring debts, whether inflation was falling back toward the 2% target or not.

NEW GOLD DREAM

Which of the themes of inflation (or stagflation), money supply growth, government deficits or central banks being behind the policy curve is helping to drive gold higher this time is something that only investors can decide for themselves, but there do seem to be some uncanny parallels.

A further angle may be central bank buying. According to the World Gold Council, central banks added 1,045 tonnes to their reserves in 2024. Some have suggested this is a sign that some countries are looking to diversify away from the dollar and reduce their exposure, given how America has sought to use currency and trade sanctions against Russia and the latter against not only China, but would-be geopolitical allies such as Canada and Mexico.

Either way, that was the third year in a row when they gobbled up more than 1,000 tonnes of the precious metal and stories about how gold vaults have struggled to meet demand have begun to multiply.

Intriguingly, gold mining equities are not embracing the mood. The New York Stock Exchange ARCA Gold Bugs index is no higher now than it was in spring 2006, when the gold price was $550 an ounce, not more than $2,900. If – and it remains an ‘if’ ─ gold does keep going, perhaps miners will start to remind investors not to forget about them, given that statement from Barrick Gold (GOLD:NYSE) last week (12 February) that a 4% change in the gold price, up or down, equates to a $450 million swing in earnings before interest, taxes, depreciation and amortisation (EBITDA), or 9% of the miner’s profits, based on that metric.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Feature

Great Ideas

Investment Trusts

Money Matters

My Portfolio

News

- Airbnb shares enjoy record day after strong Q4 and growth initiative

- Strong regulatory tailwinds keep XPS Pensions in the ascendency

- Wood Group shares hit an all-time low after review and cash flow revelation

- Is the Rolls-Royce recovery complete?

- Market relaxed about outcome of crucial European poll for now

- UK and European defence stocks surge as governments mull security spending hike

magazine

magazine