Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Green shoots are appearing among listed infrastructure and renewable trusts

Listed infrastructure and renewable trusts have had a torrid time over the last three years with average discounts to NAV (net asset value) drifting out to between 30% and 40%.

In our view the gloom and doom gone too far, with the headwinds impacting NAVs have starting to dissipate, opening the prospect of a strong recovery.

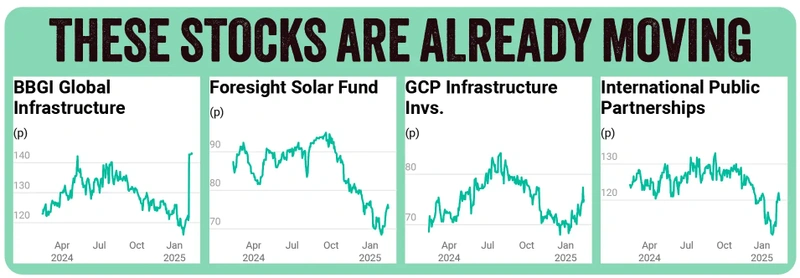

We have noticed some green shoots of broad share price strength since the start of the year, suggesting increasing investor interest.

On 6 February BBGI Global Infrastructure (BBGI) agreed to be taken over by Canadian group British Columbia Investment Management for a cash consideration of 147.5p per share.

BCI is one of the largest investors in Canada, managing a $250 billion portfolio of diversified public and private market investments on behalf of the British Columbia public pension fund and its institutional clients.

The key takeaway from the proposed transaction is the price agreed is not just a 21% premium to the prior closing price but, more significantly, a 3.4% premium to BBGI’s NAV.

This immediately dispelled investor scepticism and general uncertainty over the credibility of the quoted NAV and sent BBGI shares up 18% on the day, with a noticeable knock-on effect on share prices across the sector.

It is not just Shares which believes this represents a potential turnaround in fortunes and inflection point.

Panmure Liberum described the deal as: ‘A bolt from the blue which will reverberate around the industry. We go as far as to say that this is the most significant single news item in several years within renewable and infrastructure funds.’

Peel Hunt added; ‘We think this should reverberate positively across the wider infrastructure peer group, with core infrastructure trading on a weighted average discount of 25% and yield of 7.4%, core-plus infrastructure on a 20% discount and 4.1% yield, renewables on a 30% discount and 9.4% yield. We continue to see value across these sectors.’

In 2022, BBGI regularly traded at a premium to NAV, but the rapid rise in interest rates pushed up the cost of capital across the sector, and rising gilt yields provided an alternative income source for investors, draining capital from the sector.

A QUESTION OF SCALE

Another factor driving the widening of NAV discounts has been increasing consolidation within the fund and wealth management industry.

These larger pools of capital have bigger minimum investment allocations and liquidity requirements which means smaller trusts can fall out of the investable universe, encouraging the selling-down of existing positions which do not satisfy the investment size criteria.

A 2025 industry survey by broker Winterflood shines a light on this effect, showing a greater proportion of respondents preferring to invest in larger trusts.

In 2013, nearly all the clients surveyed were willing to invest in trusts with a market capitalisation below £200 million whereas today that proportion has fallen to just 46% of respondents.

Further, around two-thirds of respondents said they had a negative view on liquidity trends, up from just two fifths in 2022.

Another finding of the study is a ‘notable’ proportion of respondents think more trusts should actively pursue consolidation.

To be fair, there has been an uptick in corporate activity across the wider trust space, with Janus Henderson recently agreeing to merge Henderson International Income (HINT) into JPMorgan Global Growth & Income (JGGI).

Expected to conclude by July 2025, the transaction will create a company with net assets of roughly £3.4 billion, cementing JGGI’s position as the biggest beast by far in the Association of Investment Companies’ (AIC) Global Equity Income sector.

JPMorgan Asset Management will continue to manage the enlarged JGGI, whose shareholders will benefit from a significant fall in ongoing charges to 0.42% versus the current 0.77% on HINT.

The REIT sector has also seen consolidation activity, but the renewable and infrastructure players have thus far seemed either reluctant or unable to engage with each other to benefit from increased scale.

The huge variety of different structures operating across the sector may have created barriers which mean it is often impractical to merge funds.

Stifel summed up the situation as follows: ‘We think key issues for bidders assessing whether to make a “go” or “no-go” decision include shareholder bases, portfolio mix between PFI (Private Finance Initiative) /PPP (Public-Private Partnerships) & Utilities/Economic assets, debt structures and management termination terms.’

CAN HEADWINDS TURN INTO TAILWINDS?

With inflation heading lower and the Bank of England recently voting to cut rates further, the headwind from rising discount rates (which made the current value of longterm infrastructure assets lower) may finally be abating while the demand picture for infrastructure remains buoyant.

Philip Kent, lead adviser of GCP Infrastructure Investments (GCP) told investors at a recent AIC webinar: ‘The biggest challenge for our sector has been the macro environment, and we’re optimistic that it will turn in our favour in 2025.

‘We’re expecting more interest rate cuts in the UK, which will make the income characteristics of infrastructure more attractive versus traditional income assets.’

One of the attractive features of infrastructure funds is they possess stable, predictable cash flows which stretch decades into the future and are often linked to inflation, giving investors some protection from rising inflation.

It isn’t a perfect hedge, with BBGI for example estimating its inflation sensitivity is 0.43% per 1% increase in inflation, but on the other hand the longer cash flows stretch into the future the more the upside from lower interest rates.

Falling interest rates reduce the cost of capital, which in turn increases the theoretical value of assets held by infrastructure funds, boosting net asset value.

While inflation is expected to fall, it may prove sticky, or not reach the Bank of England’s 2% target as quickly as expected, a scenario which plays to the strengths of infrastructure funds with their inflation-linked contracts.

MORE INVESTMENT IS NEEDED

Infrastructure and renewable companies benefit from strong structural growth drivers such as increasingly urbanisation, the transition to net zero emissions and the digital revolution.

Many countries around the world need to upgrade their infrastructure: the OECD (Organisation for Economic Cooperation and Development) estimates £5 trillion of investment is required every year from now to 2030 to develop and support the world’s infrastructure needs.

Randall Sandstrom, chief executive and chief investment officer of Sequoia Economic Infrastructure Income (SEQI), comments: ‘There is currently a significant requirement for infrastructure developments, particularly in our core geographies of the US, UK and Europe.

‘However, there is a shortfall between the capital that traditional lenders can provide and the requirements of many infrastructure projects. SEQI fills this real and persistent funding gap.’

With regards to the UK’s green revolution, the government has promised to make Britain a clean energy superpower by 2030.

Michael Bonte-Friedheim, CEO and Founder of NextEnergy Group, which manages NextEnergy Solar Fund (NESF) explains what this means for the solar industry.

‘The UK government has mandated the delivery of 50 gigawatts by 2030 in its Clean Power 2030 plan. This is a threefold increase from current levels, driving the demand and necessity for strong operating portfolios such as NESF, which investors can leverage.’

SELF-HELP MEASURES

Investment trust managers have not been idle during the storm of the last three years: many have been proactively reshaping their balance sheets in the face of higher funding costs by paying down revolving credit facilities and recycling assets to prove net asset values they believe are conservatively struck.

For example, NextEnergy Solar has actively introduced a capital recycling programme, which has repeatedly proven the NAV is robust.

By reducing leverage and using the proceeds to buy back shares, it is also boosting NAV per share in the process.

David Bird, fund manager at Octopus Renewables Infrastructure (ORIT), has followed a similar strategy: ‘Since launching our capital recycling programme in 2023, ORIT has generated £161 million through three accretive investment exits, all of which have been realised at an uplift to carrying value.

‘So, while the shares trade at a discount to the value of the assets, these transactions provide validation of the underlying value, and this may be seen as an attractive entry point for those looking to invest in this asset class and make a positive impact with their capital too.’

Meanwhile, the board of Foresight Solar Fund (FSFL) has been buying back its own shares but admits buybacks alone won’t lead to a re-rating.

Given what it calls ‘the unprecedented market challenges’ facing the listed renewable infrastructure sector, it is ‘engaging with shareholders on a range of strategic options while continuing to deliver on our near-term objectives’.

ENHANCING RETURNS

Before the BBGI deal, the average discount to NAV across the infrastructure sector was 30% and across renewables the discount was closer to 40%.

The potential returns provided by the discount narrowing during a time when NAV is rising can result in significantly enhanced returns.

For example, a 30% discount which narrows to zero on a trust which grows NAV by 7% per year, provides a price return of 75% before reinvested dividend income is factored in.

An NAV of 100p and price at 70p = a 30% discount. 7% growth over three years = 1.07 x 1.07 x 1.07 = 1.2225 x 100p NAV = 122.5p.

So, if the price increases from 70p to 122.5p, the return is 122.5/70-1x100 = 75%

WHICH TRUSTS COULD BE M&A TARGETS?

The obvious question to ask is whether there any aspects of the BBGI takeover which provide clues to other potential targets?

While acknowledging it is something of a ‘mugs game’ to predict which funds could be taken over or taken private, Stifel identifies fund size, mix of assets, complexity of debt and management termination terms as key variables.

‘We think smaller funds may take the view they will be unable to grow though equity issuance for the foreseeable future and going private may offer scope for growth ─ one of BBGI’s rationales for delisting,’ observes Stifel.

Trusts in this category include Pantheon Infrastructure (PIN), Foresight Environmental (FGEN), Octopus Renewables, and Downing Renewables and Infrastructure (DORE).

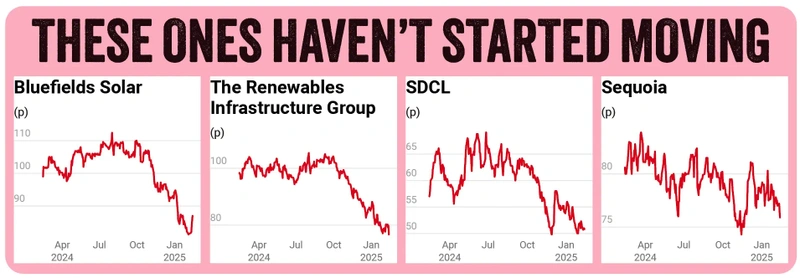

Interestingly, these trusts are among those which are up the least since 6 February, when the BBGI deal was announced, showing just how difficult it is to identify the next winner.

The second category identified by Stifel is those trusts which have large portfolios of operational assets and would be attractive to pension funds or institutions like BCI seeking ‘ready-made’ cash generative assets.

These include HICL Infrastructure (HICL), International Public Partnerships (INPP), Renewables Infrastructure (TRIG), Greencoat UK Wind (UKW) and Greencoat Renewables (GRP).

Investors appear to have found greater affinity with HICL and INPP, which are among the best performing trusts in recent weeks. Others gainers include Gore Street Energy (GSF) and GCP Infrastructure.

Interestingly, even though not all trusts have received a boost from the BBGI news, as a group renewables and infrastructure listed in the table have performed better than the mid-cap FTSE 250 index in recent weeks.

It still feels like early days in the recovery, and average discounts to NAVs remain historically wide, but with growing signs of stabilisation and double-digit dividend yields on offer, the potential rewards look more than interesting.

The fact many trusts are seeing positive share price move suggests the factors driving recent buying may have legs. It also means the current laggards may play catch-up, so this could be a lucrative hunting ground to consider.

Greencoat UK Wind and Sequoia Economic Infrastructure sit in this category, with the former identified by Stifel as a good fit for pension funds and corporates seeking cash generative assets.

Finally, we find it interesting that despite all the gloom surrounding the sector, UK asset manager Legal & General (LGEN) has just launched (13 February) a new infrastructure fund for institutional investors, to satisfy increased demand.

Ben Cherrington, Head of UK wholesale asset management at L&G, says: ‘With concentration risk challenges for equity portfolios and pressures on inflation and bond yields, we have seen demand increase for more tailored exposures to both equity and credit markets. We have also witnessed an increasing investor interest in listed infrastructure, given the desire for better diversification and liquidity.’

SHARES PICK

Greencoat UK Wind (UKW)

Price: 113.4p

Discount to NAV: 18.5%

Dividend Yield: 8.8%

This FTSE 250 company was one of the first to target renewable assets and is led by an experienced team of senior executives from Schroders Greencoat LLP, a leading European renewable investment manager.

The company is solely invested in operating offshore and onshore UK wind farms. The aim is to provide investors with a sustainable annual dividend per share that increases in line with the RPI (retail price index), while preserving the real value of the portfolio by reinvesting excess cashflow.

In its recent fourth-quarter update (29 January), the company said it would increase its target dividend for 2025 to 10.35p per share, in line with the 3.5% December 2024 RPI.

Net asset value total return has increased by nearly 80% since 2020, comfortably outperforming the FTSE All-Share index.

The company believes there is a significant market to grow into over the next few years and estimates the total value of UK assets in operation is around £100 billion.

Disclaimer: The editor of this story (Ian Conway) owns shares in NextEnergy Solar Fund and Sequoia Economic Income.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Feature

Great Ideas

Investment Trusts

Money Matters

My Portfolio

News

- Airbnb shares enjoy record day after strong Q4 and growth initiative

- Strong regulatory tailwinds keep XPS Pensions in the ascendency

- Wood Group shares hit an all-time low after review and cash flow revelation

- Is the Rolls-Royce recovery complete?

- Market relaxed about outcome of crucial European poll for now

- UK and European defence stocks surge as governments mull security spending hike

magazine

magazine