Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Emerging markets: China plays catch-up and Indian consumer stocks rebound

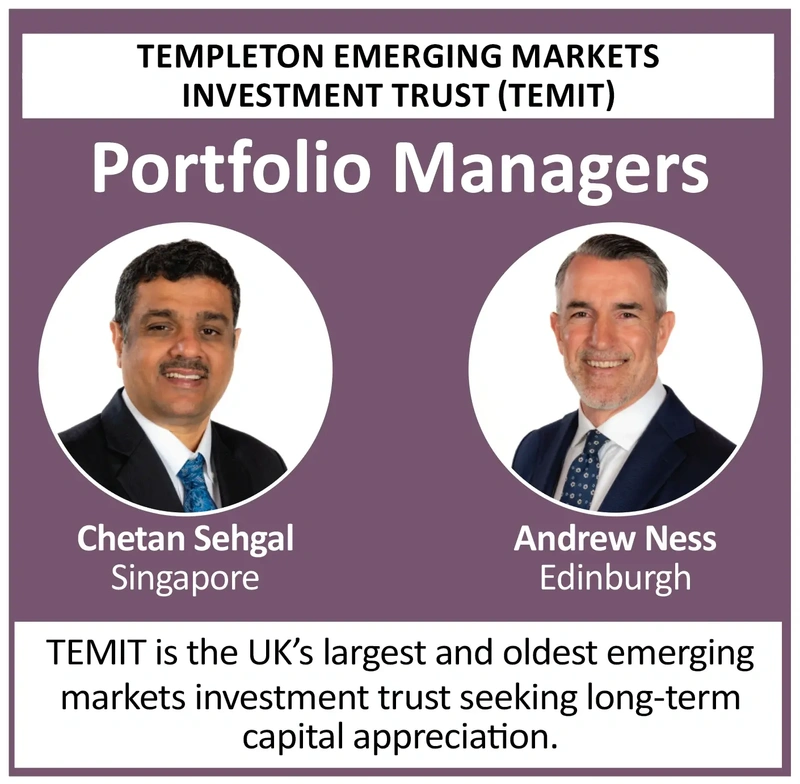

Three things the Templeton Emerging Markets Investment Trust team are thinking about today

magazine

magazine