Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Why Alliance Witan is well positioned to outperform

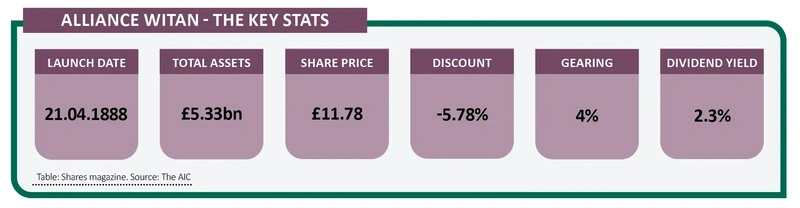

A big takeaway from 2024 was the big uptick in investment trust consolidation. It was a record year for mergers in the sector and the landmark deal was the combination between Alliance Trust and Witan to form Alliance Witan (ALW). Completed in October, the merger created a global sector giant with total assets of £5.8 billion, achieved economies of scale that have been passed on to shareholders through reduced ongoing charges and catapulted the enlarged company into the FTSE 100.

The first set of post-merger figures, annual 2024 results (7 March 2025) marked a transformative year for the Dundee-headquartered trust established back in 1888. So on results day,

Shares jumped at the chance to converse with Craig Baker, global chief investment officer at Alliance Witan’s investment manager WTW (Willis Towers Watson).

Topics on the menu were the merits of the mega-merger, recent performance and the outlook for a storied trust that has navigated the stock market ups and downs through two World Wars, the Great Depression and myriad financial crises.

DISTINCTIVE APPROACH

First, a primer on Alliance Witan. The trust aims to be a core investment that beats inflation over the long term through a combination of capital growth and rising dividends and is one of the Association of Investment Companies’ (AIC) feted ‘Dividend Heroes’ with 58 years of unbroken dividend growth under its belt.

Alliance Witan invests in global shares across sectors and industries through a distinctive multi-manager approach, blending the top stock selections of some of the globe’s best active managers into a diversified portfolio designed to outperform the market whilst dampening down risk.

Baker, who manages the trust in concert with colleagues Stuart Gray and Mark Davis, informs Shares that WTW has selected 11 elite managers, each with distinct yet complementary investment styles, who choose no more than 20 stocks each.

He stresses ‘everything has been running as a single trust’ since the end of October and that ‘a decent slug’ of Witan’s portfolio came across unchanged via a BlackRock-managed transition. Having added deep value manager ARGA for Jupiter in the first half of the year following star manager Ben Whitmore’s decision to leave Jupiter to set up his own business, there were two further changes to the manager line-up during the merger.

Alliance and Witan both had GQG Partners and Veritas in common already, but the merger also presented an opportunity to introduce growth manager Jennison Associates to the portfolio at a low cost.

‘Jennison is a manager that we have liked for a number of years,’ enthuses Baker. ‘We use them at WTW in some of our institutional portfolios, so here was an opportunity to bring across their portfolio in-specie.’ During the transition, value manager EdgePoint was also appointed, replacing Black Creek, while a small number of investment trusts and private equity holdings were inherited too; currently trading at prices well below what WTW deems to be intrinsic value, they’ll be held until attractive valuations are achieved. Beyond that, the combination did not lead to any change in the trust’s successful investment approach.

A CORE INVESTMENT

‘Clearly, being larger is helpful in terms of being a core investment for shareholders,’ says Baker. ‘Now, you’ve got a company with a lot more liquidity than before, both through size and FTSE 100 status. Alliance Witan is now of interest to more investors and with a combined entity you can spend more on the marketing required to ensure more retail investors are aware of everything that’s going on.’

The WTW guru adds that because the board has been able to keep the discount much lower than the rest of the sector, Alliance Witan looks ‘a pretty attractive proposition for investors who might not have invested historically’ and has increased appeal with wealth managers seeking larger trusts.

THE BEST OF THE BEST

Shares is hungry for more info on Alliance Witan’s underlying stock pickers, who run highly concentrated portfolios, typically 10 to 20 of their very best investment ideas, yet with markedly different yet complementary styles. ‘We’ve got 11 managers today, ‘says Baker, ‘and that’s 12 portfolios. Some of the managers are a bit more focused on the US, but high quality emerging market manager GQG runs two portfolios for us, one being a smaller pure emerging markets portfolio.’

When pressed on whether any key styles or exposures are absent from the trust, Baker’s reply is instant: ‘We are comfortable that we manage across multiple styles and one of our key jobs at WTW is to ensure stock selection drives everything in the portfolio. We balance the types of managers we choose, but also the weightings we give to each. We don’t think there’s anything missing because we’ve got a variety of managers that all think about the world very differently.’

Blending these best-in-class managers together means Alliance Witan looks similar to the MSCI All Country World Index from a top down perspective, but from a bottom up stock selection basis, the portfolio looks ‘very different to the index, so we feel we can significantly outperform but with almost all of that coming from stock selection’.

Baker points out that WTW undertakes thorough analysis to discern how much of Alliance Witan’s returns are coming from correctly calling company fundamentals versus returns from multiple expansion for those stocks, in other words is performance coming from earnings or sentiment.

‘The only bias that we do tend to end up with in the portfolio on an ongoing basis is a small bias away from large and mega cap,’ continues Baker. ‘But no real value, growth, momentum type biases. We ensure we’ve got managers in all those styles so that they balance each other out.’

What would be the impact if WTW had to change one of the underlying managers tomorrow, Shares wonders aloud? With an enviable book of fund manager contacts, Baker says there are between 10 to 15 elite managers sitting on a deep bench that could replace them. ‘The only reason they are not in this portfolio now is because we don’t need two similar types of managers in a particular area,’ he explains.

Investec is sticking with its ‘buy’ rating on Alliance Witan, which the broker notes has delivered a strong NAV total return of 82.7% over a five year period, ranking it 65th out of an extended peer group of 272 global open and closed ended funds. The trust ‘continues to trade in a relatively narrow discount range, an experience that contrasts starkly with the wider closed-end industry, which has endured a brutal de-rating and elevated and damaging discount volatility in recent years.’

In contrast, Stifel retains a ‘neutral’ rating on Alliance Witan: ‘In our view, the trust’s multi-manager approach offers something different for investors - with it being good to have some choices in the sector in terms of investment management style. However, with the shares trading on a circa 5% discount, we doubt there is much scope for the discount to narrow significantly from here.’

A BOOST FROM BROADENING OUT

Alliance Witan’s 2024 results revealed NAV (net asset value) total returns of 13.3%, lagging the 19.6% return from the MSCI All Country World Index, in sterling terms, given the concentrated nature of a market focused on a few mega cap tech stocks where the portfolio was underweight, as well as a relative lack of exposure to US banks. Disappointingly, Alliance Witan also marginally underperformed its AIC Global Sector peers.

The investment managers concede that ‘not owning enough Nvidia (NVDA:NASDAQ) was painful’. Yet while recent performance has suffered from this market concentration, Alliance Witan remains ahead of the benchmark over three years and WTW will stick to running a portfolio diversified exposure by geography and style, whilst seeking to add value from stock picking by the underlying managers. Year-to-date, markets have seen a broadening out of stock market returns amid concerns over Trump’s tariffs, frothy US valuations, escalating geopolitical tensions and a Mag 7 sell-off following the release of DeepSeek’s lower cost AI model. And this broadening out of market leadership should benefit Alliance Witan, which is significantly underweight the Mag 7 and runs a diversified portfolio that looks quite different from the index.

‘The scenario where this portfolio does particularly well is where it’s a broad market of those companies producing the best fundamentals and that gets reflected in the share price,’ explains Baker. ‘We look at our portfolio and we’re really excited about it. We think there are hidden gems delivering terrific earnings and beating expectations, but it hasn’t really been reflected in the share price yet because investors have been focusing on a pretty narrow sector of the market.’

Having digested Witan, might other investment trust morsels be on the menu for Alliance Witan, asks Shares? ‘Ultimately, that’s a call for the board,’ says Baker, ‘but it is hard to see that there won’t be continued consolidation and I’m sure the board would look at other opportunities if they are in the best interests of shareholders from a cost perspective. But we are very comfortable that the size of the trust today makes it a very attractive proposition for end shareholders already.’

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine