Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Forever stocks for your ISA

The benefits of a stocks and shares ISA are best measured over the long term. Investors should look to get rich slowly through the power of compounding.

Compounding describes the process whereby investment returns themselves generate future gains. The value of an investment can increase exponentially because growth is earned on both the initial sum of money plus the accumulated wealth.

Imagine you invest £1,000 in a stock and it increases in value by 5% in year one to £1,050. If the stock rises by another 5% in year two, it will be worth £1,102.50. In the first year you earned £50 and in the second year you earned £52.50.

You can make compounding work even harder for you by reinvesting dividends - as that means you own more shares. You then receive more dividends next time, which you reinvest to get more shares, and so on.

If the dividend is at least sustained, or better still is growing, then the effects can be really powerful. To illustrate, the total return with dividends reinvested from reliable dividend growth stock Halma (HLMA) over the last 20 years is 2,390%.

The simple total return (just adding up all the capital gains and dividends) is 1,730%. Put another way, if you’d invested £1,000 in the stock in 2005 and reinvested your dividends you would be sitting on an investment worth nearly £25,000, nearly one-and-a-half times the £18,300 total if you hadn’t.

In this article we have identified six ‘forever’ stocks which can enable you to benefit from these compounding effects. Investments you can make today and slot in a tax wrapper for the long term with confidence they will continue to deliver over the decades. One of these names is Halma, discussed above, read on to discover more about why it, and the other five, warrant their ‘forever’ status.

Investment platforms will often let you reinvest dividends automatically.

With AJ Bell you can choose which dividends you want to be automatically reinvested rather than kept in cash. For each reinvested dividend, you’ll be charged £1.50.

You can turn on dividend reinvestment for one or more specific shares in your portfolio, or for every eligible share in your portfolio now and in the future.

Coca-Cola Company (KO:NYSE) $69.20

Beverage giant Coca-Cola Company (KO:NYSE) has proven its ability to grow profitability and sustainably over many decades. Yet, despite operating for 138 years the company has only scratched the surface of the global market opportunity.

Based on the company’s estimates it has a 14% volume share of developed markets and a mere 7% share in developing and emerging markets, which is a key focus area of Coke’s growth strategy.

In these markets, which comprise 80% of the world’s population, most potential drinkers do not consume any commercial beverages, which is a big virgin opportunity for Coke to exploit.

Long-term investor Warren Buffet once famously quipped that if someone offered him $1 billion dollars to compete with Coke, he would hand the money back.

This speaks to the strength of the ecosystem the company has built and the brand value. Coke’s franchise model means it has developed a huge network of partners which work on its behalf.

These include six million people serving the Coca-Cola network, 120,000 suppliers and 3,000 production lines. Today Coke sells more than just its namesake product.

From Costa Coffee to Sprite and Fanta through to Dasani water, the company has assembled 15 billion-dollar brands among the 200 in its portfolio. Coke is the number one global player in Water, Juice and International Sports Drink brands.

The capital light business model means the company generates high operating margins, returns on invested capital and strong free cashflow. In 2024 operating margins were 30% and return on invested capital was 23%, while free cash flow was just shy of $11 billion.

Strong cash flow allows Coke to outspend competitors on marketing and advertising and to invest in the business to increase durability, creating a flywheel effect.

Over the last six decades Coke has delivered a growth rate in earnings per share of between 8% and 9% a year. Looking forward the company is targeting 4% to 6% organic revenue growth and 7% to 9% comparable earnings growth, excluding currency effects.

Coke trades on a cyclically adjusted PE (price to earnings) ratio below its long-term average, which, given the quality and stability of the business, looks stingy. [MG]

Halma (HLMA) £26.60

Of all the companies named in this feature, technology firm Halma (HLMA) may be the least well-known, certainly for novice investors and possibly for even more experienced investors, despite it being a FTSE 100 stock.

Amersham-based Halma is a collection of world-class specialist technology and engineering businesses serving the safety, health and environmental industries across the globe.

Growth is driven by reinvesting in the existing businesses and by acquiring new businesses in niche markets with sustainable long-term demand and strong defensive ‘moats’.

Within the group, companies tend to have a high degree of autonomy, but from time-to-time Halma management will merge businesses to speed up penetration in certain markets.

Conversely, if the growth dynamics in a particular market start to look less attractive, they will sell businesses and look to reinvest the proceeds in other areas at a higher rate of return.

This focus on sustainably high returns means the company has better visibility than most firms and generates higher earnings growth than the market as a whole with much lower volatility, which has translated into a 100-fold increase in the share price over the last 50-odd years.

Despite this, the shares are cheap relative to their historic average valuation and offer attractive long-term returns, especially if dividends are reinvested in buying more shares.

In its most recent trading update, the company said it had made ‘good progress in the second half in varied trading conditions amidst an evolving economic and geopolitical backdrop’, allowing it to raise its margin guidance for the year to the end of March 2025.

Order intake was ahead of both revenue and the prior-year period, while the adjusted EBIT (earnings before interest and tax) margin benefitted from a better-than-expected performance across its three main business areas.

Thanks to a favourable product mix and good operational delivery, the company now expects its EBIT margin to be ‘modestly above’ its previous target of around 21% and is on track to deliver its 22nd consecutive year of record adjusted profit. [IC]

DISCLAIMER: Ian Conway owns shares in Halma.

Intertek (ITRK) £49.06

Like its Swiss and French peers SGS (SGSN:SWX) and Bureau Veritas’(BVI:EPA), Intertek (ITRK) is a leading player in the assurance and testing, inspection, and certification (TIC for short) industry.

It operates in various sectors such as food, chemicals, transport, and retail, benefiting from regulatory drivers which provide good visibility on future earnings. Its activities range from inspecting power stations and certifying vaccines to testing toys. With a shift towards outsourcing testing due to regulations, Intertek sees significant growth potential. It is these attributes which make it the sort of stock you could buy and tuck away for the long term.

In its 2023 annual report, Bureau Veritas estimated the annual TIC market at close to €300 billion or £250 billion, with 45% outsourced and 55% government-contracted or done internally.

Intertek’s push into assurance, which identifies and mitigates risks in the operations or supply chain of a business, is a key development. Fund manager Nick Train recently added Intertek to Finsbury Growth & Income Trust (FGT), noting the company’s 20% revenue from assurance puts it ahead of competitors.

Intertek has five divisions: Consumer Products, Corporate Assurance, Health and Safety, Industry and Infrastructure, and World of Energy. The latter, with experience in traditional and renewable energy sectors, is well-positioned for the energy transition.

Intertek’s profitability has increased due to substantial capacity investments. The company recently boosted its medium-term margin target from 17.5% to 18.5%, translating to strong EPS growth. Although concerns exist about the company’s Chinese business, which accounts for 18% of revenue, the risk is largely reflected in the valuation.

Intertek has a robust balance sheet, with borrowings projected to remain well within its targeted leverage range. The company generates ample cash for organic growth investments and potential acquisitions. It also continues to reward shareholders with a growing stream of dividends, which could be reinvested to benefit from long-term compounding effects. Based on consensus forecasts for 2025 it offers a 3.5% yield. Intertek is also trading at a discount to its long-run average price-to-earnings ratio at 18.2 times. [TS]

Microsoft (MSFT:NASDAQ) $387.68

Sometimes we can overlook what’s right in front of us, and although it may seem an obvious choice Microsoft (MSFT:NASDAQ) can genuinely be considered a ‘forever’ stock.

There can be few other companies whose products are so embedded in its clients’ processes and workflows, whether it is Word, Excel, Outlook, Teams, or more advanced products such as Azure, its cloud computing platform which offers analytics, storage, networking and so on.

Inevitably there has been a great deal of value placed on the firm’s role in developing AI (artificial intelligence) products, especially after it bought OpenAI, and chief executive Satya Nadella believes the emergent technology will have the same transformative effect on businesses as the launch of Excel.

However, the shift towards it becoming a major element of workflows will take time as companies themselves work out how it can add real value to their business rather than using AI for its own sake.

What matters more is the core of Microsoft’s business, which is the repeat sales it gets from straightforward products like 365 Commercial and 365 Consumer, server and cloud revenue, news and search advertising, and even non-core activities like LinkedIn and Xbox content and services.

In its second-quarter results published in January, Microsoft posted global revenue of almost $70 billion, an increase of 12% on the previous year, which for a firm of its size is truly impressive.

Just as impressive, operating income was just under $32 billion, up 17% on the previous year, representing a margin of 45%, a level which most companies can only dream of achieving.

The firm throws off so much cash from its operations that, having already returned $9 billion to investors during the first quarter in the form of dividends and share buybacks, it returned another $9.7 billion in the second quarter, and there is no reason to think this trend can’t continue. [IC]

Rightmove (RMV) 684.6p

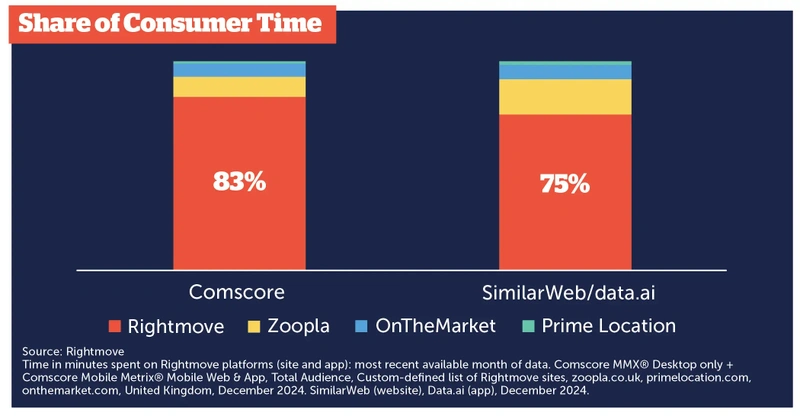

Online property portal Rightmove (RMV) stands out as a forever stock because it is the market leader in a UK property market with attractive supply and demand dynamics. In 2024, 80% of all consumer time spent on UK property portals (16.4 billion minutes) was on Rightmove. Last year, it was also the fourth busiest UK-based digital platform.

Being the market leader creates a virtuous circle for Rightmove. Its site has the most listings and is therefore the one which prospective property buyers will go to when looking for their next home. This reinforces its position as a must-have product for estate agencies and gives it significant pricing power when it comes to securing subscriptions from agencies. These strengths were evident in the company’s most recent full-year numbers. Rightmove reported a 7% rise in 2024 revenue to £389.9 million and returned£181.7 million of surplus cash through share buybacks and dividends.

The company is targeting 8-10% revenue growth for 2025 with a stable operating margin. The company operates a subscription-based model under which it is paid an annual fee by estate agents, lettings agents and housebuilders to list their properties on the site.

There is scope to grow ARPA (average revenue per advertiser) significantly from current levels by offering increased insights as the company ramps up its data analytics capabilities and, by doing so, offers more compelling insights to its clients. According to its last set of results ARPA rose £93 to £1,524 per month compared to £1,431 in 2023. Estate agency ARPA was £1,440, increasing by 6% and new homes developers’ ARPA of £1,987 increased by 9% compared to £1,825 in 2023.

It comes as no surprise with impressive numbers like these that the company recently attracted the attention of Australian rival REA Group (REA:ASX). The UK property portal rejected four offers from the outfit owned by Rupert Murdoch’s News Corp last October.

One worry for Rightmove is that to maintain its dominant market position it needs to keep an eye on the competition, with the stakes raised by US firm CoStar’s purchase of OnTheMarket in 2023, although its position looks pretty entrenched for now. [SG]

Tesco (TSCO) 321.5p

Stocks which are intended to be held forever or at least for a long period of time need a sustainable competitive edge, strong balance sheet and a clear growth strategy.

That is because over longer periods the share price follows the growth in the fundamentals of the business such as growth in free cash flow and earnings per share.

Grocer Tesco (TSCO) appears to have rediscovered its growth engine whereby it uses scale to drive down prices to drive more customers through the doors.

Tesco has halted the creeping share of German discounters Lidl and Aldi through its effective price match strategy while more restrictive planning permissions mean future growth is getting harder to achieve.

The Christmas and third quarter trading update (9 Jan) showed continued volume growth ahead of the market and value market share up 0.78% to 28.5%, the highest since 2016, representing 19 consecutive quarters of share gains.

The company said it is well placed to deliver long term growth by continuing to invest in customer offers, which, in turn drives volume momentum.

Management also confirmed it expects to deliver free cashflow within its medium-term range of £1.4 billion to £1.8 billion and an adjusted operating profit contribution from Tesco bank of around £120 million.

Management has a clear policy to utilise free cash flow to drive shareholder returns through share buybacks and dividends. Since launching its first buyback in 2021, the company has so far returned £2.4 billion to shareholders.

Fund manager and founder of Latitude Investment Management, Freddie Lait, has owned Tesco shares for many years, and believes Tesco can grow intrinsic value by a mid-teens percentage.

It may at first appear quite a stretch given the 3% to 4% growth rate in revenue, but there are other drivers at play.

While continuing to invest in price, there is scope for margin expansion through operating leverage which could see earnings growth of between 5% and 6%.

Utilising free cash flow to buy back shares which have been running at around 4% a year increases earnings growth to 10%. Finally, adding the dividend yield of 4.5% results in mid-teen’s growth.

That should be considered the base case and assumes no change in the PE (price to earnings) ratio of the shares. On a cyclically adjusted basis the shares at a big discount to their average ratio, giving further upside potential for patient shareholders. [MG]

DISCLAIMER: AJ Bell, referenced in this article, owns Shares magazine. The editor (Tom Sieber) and authors (Ian Conway, Martin Gamble and Sabuhi Gard) of this article own shares in AJ Bell.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine