Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“With these fourth-quarter and full-year results, NatWest will doubtless be looking to put aside any lingering after-effects of last summer’s ruckus over Nigel Farage’s bank account and provide a strong narrative that can be used as a launchpad for a major share sale. Chancellor of the Exchequer Jeremy Hunt is looking to cut the government’s near-40% stake and in the process boost private investor involvement in UK-traded shares and revive a fairly moribund UK stock market (as well as rake in some cash, even if the government’s average purchase price was around 505p a share),” says AJ Bell investment director Russ Mould.

“NatWest operates in a highly competitive business (where established big players and fintech upstarts are snapping at each other’s heels). The trajectory of the UK economy is still uncertain, as the Office for Budget Responsibility’s new GDP growth forecasts are not exciting and the Bank of England continues to prevaricate on interest rates, having first bungled its call that inflation would be transitory and then jacked up headline borrowing costs at a rapid clip. Political, public and regulatory pressure could put a lid in net interest margins and a recession could increase bad loan losses, to further dent earnings in 2024 or 2025.

“On the other hand, the UK continues to dodge the dreaded recession, loan impairments are low by historic standards and the Bank of England is now expected to cut rates in 2024. NatWest also meets all regulatory requirements for capital adequacy with ease.

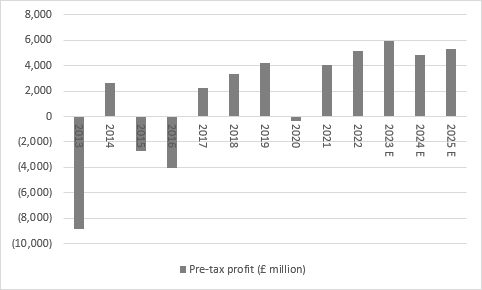

“It is possible to argue a lot of bad news is therefore already in the price, especially since the shares trade at a 19% discount to their last stated net asset value per share of 271p. A forward PE of less than five suggests investors have largely given up on hoping for growth (and analysts expect pre-tax income to slip in 2023 and then hover around the £5 billion mark reached in 2024 and 2025. That would represent little or no growth from 2022’s levels but such profits would be lightyears away from the still-heavy losses of a year ago and a dividend yield of nearly 8% could conceivably compensate for the pedestrian profit outlook.

Source: Company accounts, Marketscreener, analysts’ consensus forecasts

“In this context, investors will therefore be looking for ongoing reassurance over the outlook for earnings and dividends, both from the 2023 results and any guidance that chief executive Paul Thwaite feels able to offer for 2024.

- As already noted, pre-tax income is expected to advance to £6 billion in 2023 (from £5.1 billion in 2022) and then recede to £4.8 billion in 2024.

- NatWest is expected to pay a total ordinary dividend of 16.8p a share in 2023, up from 13.5p in 2022, although there is no expectation of a repeat of last year’s special dividend. In 2024, the shareholder distribution is expected to slip slightly to 16.1p a share, to reflect lower profitability.

Source: Company accounts, Marketscreener, NatWest investor relations website, analysts' consensus forecasts

- NatWest bought back some £1.8 billion of stock in 2023, including £1.2 billion from the government, and is seen following up with another £1 billion of cash returns via this mechanism in 2024. Add that to the £1.4 billion cash dividend and NatWest may therefore be returning £2.5 billion to investors in 2024, or 13% of its market capitalisation.

Source: Company accounts, Marketscreener, NatWest investor relations website, analysts' consensus forecasts

"Analysts and investors will then look to the quality of the 2023 numbers as well as the quantity, to judge how well set the bank is to make any guidance for 2024.

- In the third quarter of 2023, deposits fell 7.6% year-on-year to £436 billion and the loan book grew by 1.5% to £377 billion.

- In Q3, the net interest margin receded to 2.05%, although that was still more than a half-percentage point above the late 2021 low. Analysts expect another drop to 1.98% in Q4 and a figure of 2.00% for the whole of 2024.

Source: Company accounts, NatWest investor relations website, analysts’ consensus forecasts

- In Q3, the asset quality (or loan loss) ratio was a still-lowly 0.24%, as NatWest booked just £229 million of bad loan provisions. Analysts are looking for £235 million in Q4 to take the full-year total to £683 million, ahead of a jump to £1.1 billion in 2024.

- In Q3, litigation and conduct costs were £134 million and an additional £104 million are expected in Q4 to take the total to £346 million for 2023, the lowest mark since 2020 (when government and central bank support abounded). A small decrease is expected here in 2024.

Source: Company accounts, NatWest investor relations website, analysts' consensus forecasts

- Cost discipline is expected to remain good, with operating expenses coming in around £7.6 billion (52% cost-to-income ratio) and then growing only modestly in 2024 and 2025, while a Common Equity Tier 1 ratio of 13.4% helps the bank to reassure regulators and the public alike on its capital buffers and financial strength.”

Disclaimer: These articles are for information purposes only and are not a personal recommendation or advice.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Tue, 17/12/2024 - 10:20

- Thu, 07/11/2024 - 11:00

- Wed, 06/11/2024 - 12:06

- Mon, 21/10/2024 - 16:26

- Wed, 09/10/2024 - 10:17