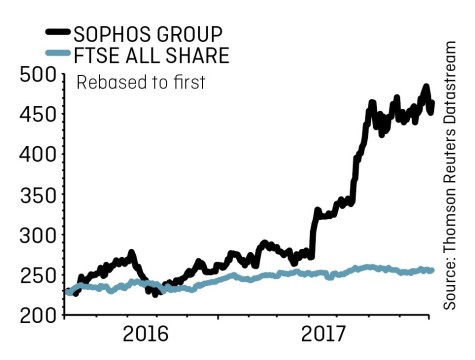

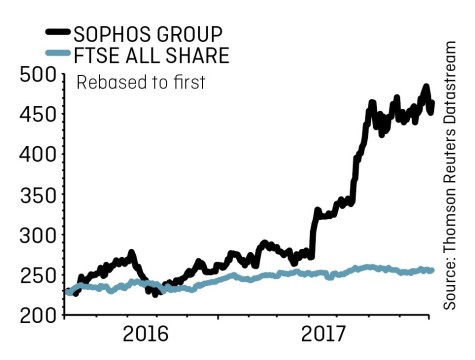

SOPHOS (SOPH) 460p

Gain to 27 July 2017*: 114.6%

Original entry point:

Buy at 220.7p, 28 Jul 2016

More robust trading through the first quarter for cyber security FTSE 250 Sophos (SOPH) makes it easier to understand why the share price has more than doubled in a year. End point security is the star, justifying previous investment and helping the company secure what Numis calls ‘an exceptionally large deal.’ This is presumably a response to soaring demand for tools to fight off ransomware hacking attacks, such as WannaCry and Petya.

Stripping some of the sheen off is a steep decline in adjusted operating profit to just $3.4m, and we would guess that this is partly down to front loading costs ahead of what should be a busy second half. That’s backed up by a hefty second half bias of contracts renewals, says Numis, even if billings growth of 16% shows a slowdown on the 25% this time last year.

We continue to like Sophos’ position in this high demand cyber security space, and believe there remains a long-term value creation opportunity in holding the shares.

That said, modest caution over the required growth to meet upgraded forecasts for the full year to 31 March 2018 makes it sensible to take some well-earned profit off the table.

*Date exited Great Ideas portfolio

This is a good time to cash in. (SF)

‹ Previous2017-08-03Next ›

magazine

magazine