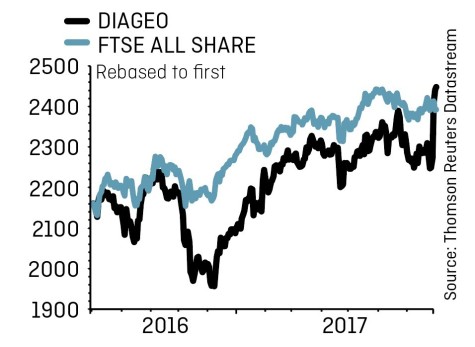

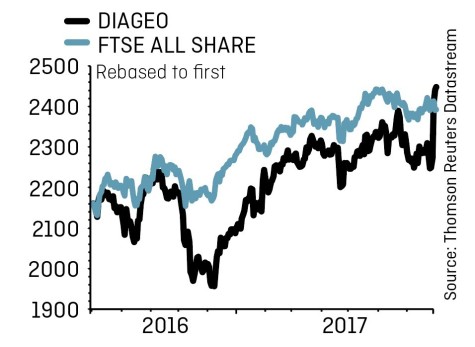

Diageo (DGE) £24.55

Gain to date: 13%

Original entry point:

Buy at £21.73, 12 Jan 2017

Our positive stance on alcoholic drinks giant Diageo (DGE) has been rewarded with a 13% share price advance so far. Investors’ thirst for the shares has been further stimulated by news (27 Jul) of record full year profits, an upgrade to its three-year margin improvement target and the launch of a palate-pleasing £1.5bn share buy-back.

In January, we flagged the top line growth and margin enhancement potential on offer at the world’s biggest spirits company, whose winning brands include Johnnie Walker whisky, Captain Morgan rum, Smirnoff vodka and Tanqueray gin.

Diageo’s sales and operating profits were up 15% to £12.1bn and 25% to £3.6bn respectively in the year to June, helped by currency movements but more importantly, reflecting robust organic growth. CEO Ivan Menezes said his charge ‘delivered consistent strong performance improvement across all regions’ and flagged ‘progress in our focus areas of US Spirits, scotch and India’.

Diageo is an ‘expensive defensive’ but we’re staying positive given wider macro-economic uncertainties. Diageo’s strong brands represent an economic moat, engendering loyalty among consumers, conferring pricing power upon the business and creating barriers to entry for rivals.

We’re in agreement with the bullish consensus, fans of Diageo’s brand strength, geographically diversified earnings and strong free cash flow generation.

‹ Previous2017-08-03Next ›

magazine

magazine