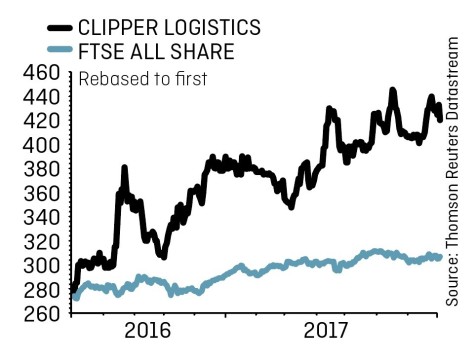

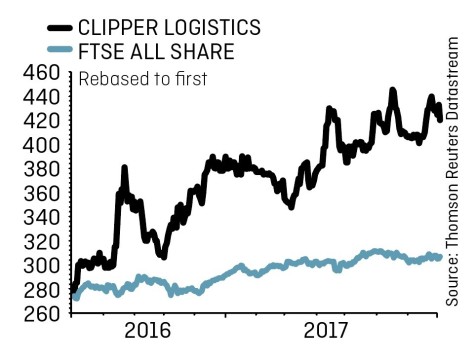

Clipper Logistics (CLG) 420p

Gain to date: 36.8%

Original entry point:

Buy at 307p, 1 September 2016

Full year numbers from Clipper Logistics (CLG) (28 Jul) initially supported another healthy advance in the shares although profit takers have swooped in the interim. Still, we remain in a healthy profit on our positive call on the stock.

Exposed to growth in online shopping, the company handles warehouses and delivery services for retailers. This includes sending out clothes ordered online and, probably more crucially, handling any returns.

Clients include ASOS (ASC:AIM), Tesco (TSCO), Asda and John Lewis. In the year to 30 April profit after tax was up 20.6% at £12.5m on revenue up 17.2% at £340.1m. On broker Cantor Fitzgerald’s reckoning the company trades at a 100% premium to the broad logistics and parcels sector. Although some premium is warranted it believes this is ‘difficult to justify’.

The shares are up more than four-fold on the 100p issue price from its 2014 IPO but appear to have stalled for now. A great company but this is reflected in the share price and with a lack of immediate catalysts it makes sense to book some profit.

‹ Previous2017-08-03Next ›

magazine

magazine