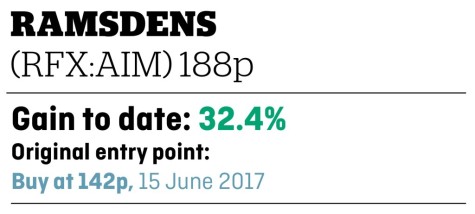

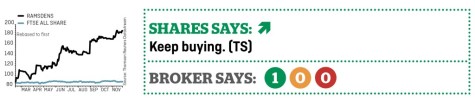

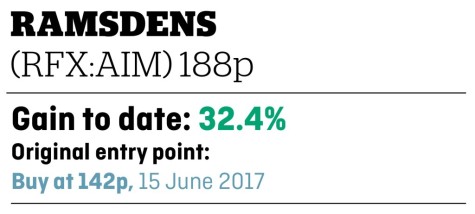

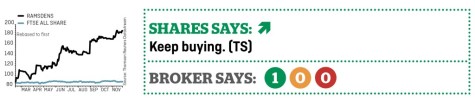

Our positive stance on pawnbroker Ramsdens (RFX:AIM) continues to pay off as the group has revealed a very strong set of first half results (27 Nov).

Particularly impressive was the contribution by its retail jewellery and foreign currency businesses where gross profit was up 30% and 35% respectively. For the wider group, pre-tax profit grew by 63% year-on-year to £5.2m.

Investment bank Liberum has subsequently upgraded its earnings per share (EPS) forecast by 6% to 16.2p for the year to March 2018 and its 2019 EPS by 2% to 16.4p.

The one fly in the ointment for analyst Justin Bates is the future direction of the gold price with assumptions for the precious metal trimmed by 6% for the 2019 financial year.

Since joining the stock market in February 2017 the market has rewarded Ramsden’s strong performance and future potential. The shares are now up by 118.6% on the 86p issue price and are also comfortably ahead of the levels we flagged them at in June.

Despite the stellar share price performance, the valuation does not look overly demanding at 11.6 times forward earnings. For comparison, rival H&T (HAT:AIM) is on an earnings multiple of 11.9.

‹ Previous2017-11-30Next ›

magazine

magazine