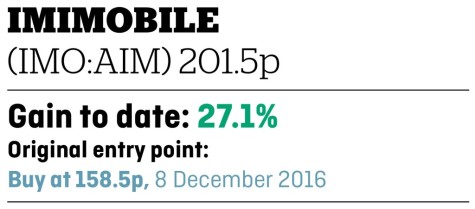

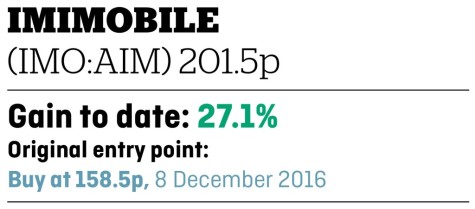

To maintain double-digit organic growth is no mean feat in the current economic environment and IMImobile (IMO:AIM) deserves credit.

The company’s software helps businesses to engage and communicate with their customers online.

It reported 12% organic revenue growth in its half year results to 30 September, with headline revenue jumping 48% to £53.1m, aided by the acquisition of Infracast.

That deal should enhance its position in the financial services space and create notable cross-selling opportunities. Cash generation was typically stronge at £5.7m. This could nudge the company a little closer to making a dividend decision in the not too distant future.

The one concern is pressure on profit margins, which continue to get squeezed. This is unwelcome, if not unsurprising, given ongoing demands to refresh and develop the product suite in what is still a fairly nascent industry.

Management remain very confident of hitting forecast full year earnings before interest, tax, depreciation and amortisation of £12.4m. That only implies 8% growth. We think there is a reasonable chance IMImobile can beat guidance.

‹ Previous2017-11-30Next ›

magazine

magazine