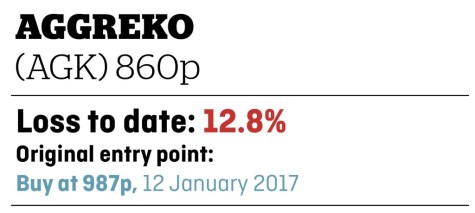

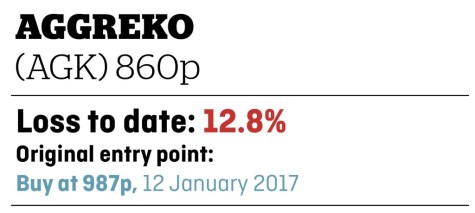

The temporary power solutions provider is enduring a torrid 2017, as reflected in a weak performance for the shares since we highlighted their appeal in January.

Our original hope was that Aggreko would enjoy a good recovery this year; sadly that’s not been the case.

The latest shock came on 21 November when it revealed the early termination of a contract in Japan, a trimmed order in Zimbabwe, continuing weakness in its Argentinian business and disappointing order intake.

The shares suffered an intraday fall of more than 10% on the third quarter statement as Aggreko observed its pipeline of potential contracts was ‘taking longer to convert than last year’.

Peel Hunt analyst Andrew Nussey puts the company’s woes down to ‘oil price volatility, emerging market uncertainty, new technology and unpredictable competitor behaviour’.

Panmure Gordon analyst Michael Donnelly is concerned that guidance for a return on capital employed (ROCE) of 20% cannot be maintained despite assurances from the company.

He notes consensus earnings estimates have fallen by 20% over the last 12 months on a ‘growing asset base’.

‹ Previous2017-11-30Next ›

magazine

magazine